About the Forex Laser Reversal Points Indicator

The Forex Laser Reversal Points indicator for MT4 is designed to identify potential trend reversals with precision.

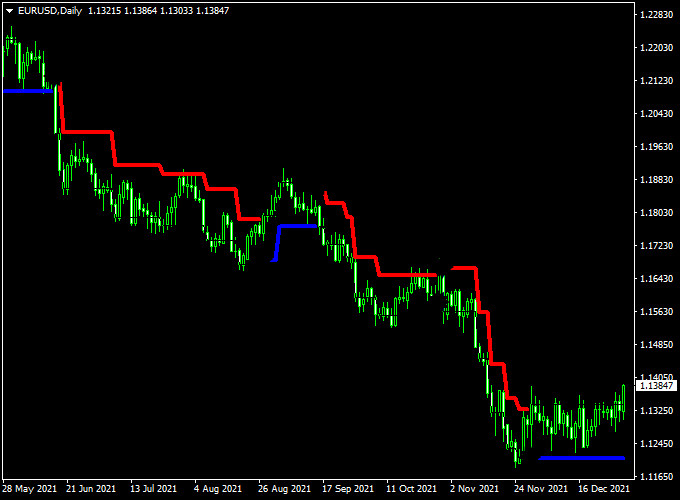

It draws blue and red signal lines on the chart, making it easy to see when market momentum shifts.

Traders can use it for both short-term scalping and longer-term swing trades.

The indicator works on all currency pairs and timeframes, helping users make informed entry and exit decisions.

It can also be combined with trend or momentum indicators for additional confirmation.

Free Download

Download the “Forex Laser Reversal Points.ex4” indicator for MT4

Key Features

- Blue signal line indicates potential bullish reversal

- Red signal line indicates potential bearish reversal

- Can be combined with other trend or momentum tools

- Provides clear entry and exit points without clutter

Indicator Chart

The chart shows the Forex Laser Reversal Points lines in action.

Blue lines highlight potential buying opportunities, while red lines suggest selling opportunities.

This allows traders to anticipate market reversals effectively.

Guide to Trade with Forex Laser Reversal Points

Buy Rules

- Enter a buy trade when the blue line appears

- Confirm trend or support if needed

- Close or reverse trade if a red line appears

Sell Rules

- Enter a sell trade when the red line appears

- Confirm trend or resistance if needed

- Close or reverse trade if a blue line appears

Stop Loss

- Set a stop just below the nearest swing low for buys

- Set a stop just above the nearest swing high for sells

- Tighten stops on lower timeframes

Take Profit

- Close trades when the opposite signal line appears

- Partial profits at nearby support or resistance

- Trail stop along the trend for bigger moves

Practical Tips

- Use on M5–H1 for best results

- Avoid low-volatility or choppy markets

- Keep position sizes small when testing new pairs

- Track recent swing highs and lows for stop and take profit levels

Day Trading Strategy: Forex Laser Reversal Points + Zero Lag MACD (MT4)

This strategy combines the Forex Laser Reversal Points Indicator and the Zero Lag MACD Indicator to identify high-probability trend reversals and confirm entry signals.

The Forex Laser Reversal Points Indicator shows trend direction with a blue line for bullish trends and a red line for bearish trends.

The Zero Lag MACD displays a histogram: above 0 indicates a buy signal, and below 0 a sell signal.

This strategy is designed for intraday trading on 15-minute to 1-hour charts.

Buy Entry Rules

- Confirm the trend is bullish with the blue line of the Forex Laser Reversal Points Indicator.

- Wait for the Zero Lag MACD histogram to be above 0 as a buy signal.

- Enter a buy trade at the close of the confirming candle.

- Set the stop loss below the most recent swing low or key support level.

- Set take profit at a 1:2 reward-to-risk ratio, or exit if the trend turns bearish (red line) or the MACD histogram moves below 0.

Sell Entry Rules

- Confirm the trend is bearish with the red line of the Forex Laser Reversal Points Indicator.

- Wait for the Zero Lag MACD histogram to be below 0 as a sell signal.

- Enter a sell trade at the close of the confirming candle.

- Set the stop loss above the most recent swing high or key resistance level.

- Set take profit at a 1:2 reward-to-risk ratio, or exit if the trend turns bullish (blue line) or the MACD histogram moves above 0.

Advantages

- Combines trend identification with momentum confirmation for higher probability trades.

- Non-repainting indicators provide reliable signals for intraday trading.

- Works across multiple currency pairs and timeframes.

- Helps traders avoid entering against the prevailing trend.

- Clear entry and exit rules improve discipline and reduce emotional decisions.

Drawbacks

- Trend reversals during economic news can trigger stop losses quickly.

- Multiple signals in quick succession may lead to overtrading.

- Signals may lag slightly in extremely fast-moving markets.

- Scalpers may find it less effective on very short timeframes due to delayed confirmation.

Case Study 1

On the AUD/USD 30-minute chart, the Forex Laser Reversal Points Indicator showed a blue bullish trend line.

The Zero Lag MACD histogram was above 0.

A buy trade was entered at 0.6730, with a stop loss at 0.6715 and a take profit at 0.6760.

The trade reached take profit within 2 hours, yielding a 30-pip gain.

Case Study 2

On the USD/JPY 1-hour chart, the Forex Laser Reversal Points Indicator showed a red bearish trend line.

The Zero Lag MACD histogram was below 0.

A sell trade was entered at 149.50, with a stop loss at 149.80 and a take profit at 148.90.

The trade reached take profit in 3 hours, capturing a 60-pip gain.

Strategy Tips

- Use currency pairs with tighter spreads like AUD/USD, USD/JPY, EUR/GBP, and NZD/USD.

- Combine with short-term support and resistance levels to filter false signals.

- Use trailing stops to lock in profits during strong intraday trends.

- Be patient: wait for clear confirmation from both indicators before entering a trade.

- Adjust stop loss and take profit levels according to market volatility for optimal risk-to-reward.

- Practice this strategy on a demo account to understand timing and execution before trading live.

Download Now

Download the “Forex Laser Reversal Points.ex4” indicator for Metatrader 4

FAQ

What type of trading is it best for?

It works well for scalping, day trading, and short-term swing trades.

Can it be used alone?

Yes, but combining with a trend or momentum indicator improves accuracy.

How do I know a signal is strong?

Signals near support or resistance levels or following a strong trend are more reliable.

Is it suitable for all market conditions?

It works best in trending markets. Avoid sideways or choppy price action.

Which timeframes give the best results?

M5, M15, and H1 are ideal, but it can be applied to higher timeframes for swing trades.

Summary

The Forex Laser Reversal Points indicator for MT4 highlights potential trend reversals with blue and red signal lines.

It works across all pairs and timeframes, helping traders enter and exit trades at key moments.

Beginner-friendly and versatile, it can be combined with other tools to improve accuracy.

By showing possible market turning points directly on the chart, it simplifies decision-making and supports better trading outcomes.