About the Forex Price Sniper Oscillator Indicator

The Forex Price Sniper Oscillator Indicator for MT4 is a momentum-based oscillator designed to identify overbought and oversold conditions within existing trends.

Unlike traditional oscillators that perform poorly during strong market moves, this tool is optimized to work with trend direction rather than against it.

It helps traders time pullbacks and continuation entries with greater accuracy.

The indicator appears in a separate Metatrader 4 chart window and fluctuates between two fixed levels, 0 and 1.

A reading near 0 signals oversold conditions, while a reading near 1 highlights overbought price levels.

By combining these extremes with the prevailing trend, traders can focus on higher-probability setups instead of random reversals.

This makes the Price Sniper Oscillator especially useful for structured trend trading.

Free Download

Download the “forex-nn-indicator.mq4” indicator for MT4

Key Features

- Overbought and oversold oscillator designed for trend markets

- Fixed extreme levels at 0 and 1 for simple interpretation

- Displayed in a separate MT4 indicator window

- Helps time pullbacks within bullish and bearish trends

- Works well with trend confirmation tools

- Suitable for intraday and swing trading styles

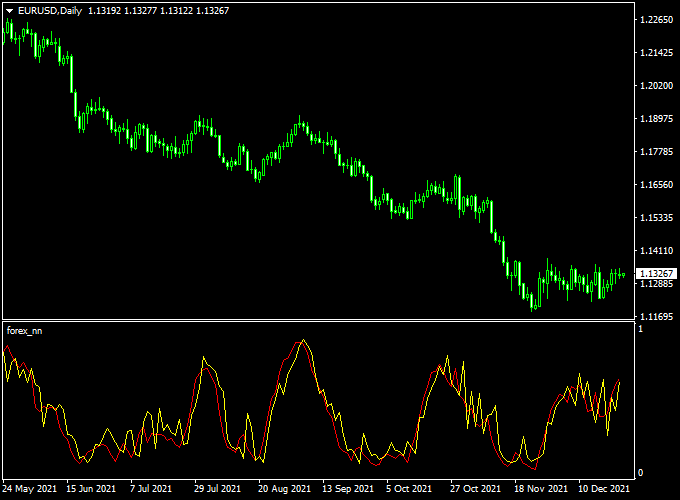

Indicator Chart

The chart below shows the Forex Price Sniper Oscillator Indicator plotted beneath the price chart.

When the oscillator drops toward the 0 level, it signals oversold conditions during an uptrend.

When it rises toward the 1 level, it highlights overbought conditions during a downtrend.

These zones help traders anticipate trend continuation moves.

Guide to Trade with the Forex Price Sniper Oscillator Indicator

Buy Rules

- Confirm the overall market trend is bullish

- Wait for the oscillator to reach or touch the 0 oversold level

- Enter a buy trade at the opening of the next candle

Sell Rules

- Confirm the overall market trend is bearish

- Wait for the oscillator to reach or touch the 1 overbought level

- Enter a sell trade at the opening of the next candle

Stop Loss

- Place the stop loss a few pips below the recent swing low for buy trades

- Place the stop loss a few pips above the recent swing high for sell trades

Take Profit

- Target recent highs or lows in the direction of the trend

- Use a fixed risk-to-reward ratio such as 1:2

- Exit trades early if the oscillator fails to react from the extreme level

Practical Tips

- Always define the trend using a higher timeframe before taking signals

- Avoid using the oscillator as a standalone reversal tool

- Best results are often seen on M15, M30, and H1 charts

- Ignore signals when price is moving sideways without direction

- Combine with a moving average or trend cloud for confirmation

- Focus on quality setups rather than frequent trades

Forex Price Sniper Oscillator + Trend Predictor MT4 Scalping Strategy

This MT4 scalping strategy combines the Forex Price Sniper Oscillator and the Trend Predictor V1.0 to identify precise entry and exit points for quick trades.

It works by using the momentum reading from the Sniper Oscillator along with the directional arrow signals from the Trend Predictor.

This combination helps traders catch short-term moves with high probability.

The strategy is ideal for scalpers and intraday traders who prefer the 1-minute to 15-minute time frames.

Buy Entry Rules

- Check the Forex Price Sniper Oscillator for an oversold condition at 0 or near 0, indicating a potential bullish reversal.

- Confirm that the Trend Predictor shows a blue arrow, signaling an upward trend.

- Enter a buy trade when both conditions align and the price shows upward momentum on the chart.

- Set a stop loss slightly below the most recent swing low to protect against sudden reversals.

- Set take profit based on 1:1.5 risk-to-reward ratio or use the next significant resistance level for scalping targets.

Sell Entry Rules

- Check the Forex Price Sniper Oscillator for an overbought condition at 1 or near 1 while the trend is downward.

- Confirm that the Trend Predictor shows a red arrow, signaling a bearish trend.

- Enter a sell trade when both conditions are met and the price shows downward momentum.

- Set a stop loss just above the most recent swing high.

- Set take profit based on a 1:1.5 risk-to-reward ratio or target the next support level.

Advantages

- Combines momentum and trend signals for higher accuracy.

- Easy to use, even for beginner scalpers.

- Works on multiple time frames, especially 1 to 15 minutes.

- Helps avoid false signals by requiring confirmation from both indicators.

- Provides clear entry, stop loss, and take profit levels.

Drawbacks

- Less effective during highly volatile news events.

- Requires constant monitoring for short-term scalping trades.

- Small pip gains per trade; suitable for scalpers only.

Case Study 1: EUR/USD 5-Minute Chart

The Forex Price Sniper Oscillator reached oversold at 0.

The Trend Predictor showed a blue arrow confirming upward momentum.

A buy trade was entered at 1.0950 with a stop loss at 1.0942.

The price moved quickly to 1.0965, hitting the take profit target for a gain of 15 pips within 10 minutes.

Case Study 2: GBP/USD 15-Minute Chart

The Forex Price Sniper Oscillator reached overbought near 1 while the trend was downward.

The Trend Predictor displayed a red arrow.

A sell trade was opened at 1.2870 with a stop loss at 1.2880.

The trade closed at 1.2852, capturing 18 pips in under 20 minutes, demonstrating the efficiency of this scalping combination.

Strategy Tips

- Focus on trades where the Sniper Oscillator is at extreme oversold or overbought levels.

- Always wait for confirmation from the Trend Predictor arrow before entering a trade.

- Scalping works best during active market sessions like London and New York.

- Use tight stop losses and quick take profits to reduce risk.

- Keep a trading journal to track wins and losses and refine entry points over time.

Download Now

Download the “forex-nn-indicator.mq4” indicator for Metatrader 4

FAQ

Is this indicator suitable for range markets?

No, it is designed to work best in trending conditions.

Range-bound markets can produce unreliable signals.

Does the oscillator repaint?

No, the oscillator values are calculated using closed candle data.

Once an extreme level is reached, the signal remains fixed.

Can it be used for scalping?

Yes, it can be used for scalping when combined with a clear trend filter.

Lower timeframes require tighter risk management.

Do I need another indicator with it?

A simple trend confirmation tool is recommended.

This helps filter out trades taken against the dominant direction.

Summary

The Forex Price Sniper Oscillator Indicator for MT4 offers traders a disciplined way to trade pullbacks within strong trends.

Its clear overbought and oversold levels make decision-making straightforward and consistent.

The indicator is easy to read and adapts well to different trading styles.

For best performance, it combines well with a trend-following indicator such as a moving average or cloud-based tool.

When paired with solid risk management, it can become a reliable component of a professional trend trading strategy.