About the Fox Pivot Indicator

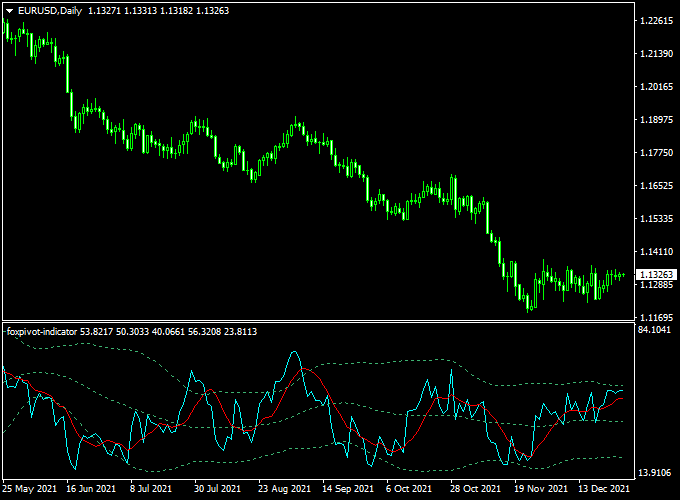

The Fox Pivot Indicator for MT4 is a channel-based oscillator that helps traders identify potential buy and sell opportunities.

It uses a signal line channel plotted around the Fox pivot to indicate market momentum and trend direction.

A buy signal occurs when both signal lines cross the middle pivot dotted line from below, suggesting upward momentum.

A sell signal occurs when both signal lines cross the middle pivot dotted line from above, suggesting downward momentum.

This approach provides clear signals for entering trades and managing positions.

Free Download

Download the “foxpivot-indicator.mq4” indicator for MT4

Key Features

- Channel-based Forex oscillator using Fox pivot

- Buy and sell signals generated by line crossings

- Plotted in a separate MT4 chart window

- Works on multiple currency pairs and timeframes

- Can be combined with trend filters or other indicators

Indicator Chart

The chart below shows the Fox Pivot Indicator applied to MT4.

Signal lines crossing the middle pivot line highlight potential buy and sell opportunities.

Traders can use this channel to confirm entries and align with the market trend.

Guide to Trade with the Fox Pivot Indicator

Buy Rules

- Wait for both signal lines to cross the middle pivot line from below

- Confirm overall trend supports upward movement

- Open a buy trade at the next candle open

Sell Rules

- Wait for both signal lines to cross the middle pivot line from above

- Confirm overall trend supports downward movement

- Open a sell trade at the next candle open

Stop Loss

- For buy trades, place the stop just below the recent swing low

- For sell trades, place the stop just above the recent swing high

- Consider slightly wider stops during choppy sessions

Take Profit

- Set profit targets near the next support (buy) or resistance (sell) levels

- Partial profits can be taken as the lines approach the channel edges

- Trail stops to lock in profits as the trend progresses

- Close fully if an opposite crossover occurs

Practical Tips

- Trade only when both lines cross the pivot clearly.

- Confirm the overall trend on a higher timeframe.

- Use support and resistance levels to set targets.

- Consider partial profits as price approaches channel edges.

Fox Pivot and Zero Lag Moving Average MT4 Scalping Strategy

This scalping strategy combines the dynamic Fox Pivot Indicator for MT4 with the fast-reacting Zero Lag Moving Average Indicator for MT4.

Together, they provide high-probability entry points with minimal lag, making it ideal for intraday traders who focus on quick price movements on M1, M5, and M15 timeframes.

The Fox Pivot identifies strong momentum shifts, while the Zero Lag MA confirms trend direction with reduced delay.

Buy Entry Rules

- Wait for both the blue and red Fox Pivot lines to cross above the zero line to confirm bullish momentum.

- Ensure price is trading above the Zero Lag Moving Average line to confirm a bullish bias.

- Enter a buy position once both conditions are met.

- Place a stop loss 8–12 pips below the recent swing low.

- Set your take profit at 15–25 pips depending on volatility.

Sell Entry Rules

- Wait for both the blue and red Fox Pivot lines to cross below the zero line to confirm bearish momentum.

- Ensure price is trading below the Zero Lag Moving Average line to confirm a bearish bias.

- Enter a sell position once both conditions are met.

- Place a stop loss 8–12 pips above the recent swing high.

- Set your take profit at 15–25 pips depending on volatility.

Advantages

- Combines two powerful indicators for higher accuracy.

- Reduces lag compared to traditional moving averages.

- Works well on multiple intraday timeframes.

- Clear and easy-to-follow entry and exit rules.

Drawbacks

- Requires strict stop loss management to avoid large drawdowns.

- Performance can vary between currency pairs depending on spread and volatility.

Case Study 1: USD/CHF M5

On USD/CHF M5, both Fox Pivot lines crossed above the zero line during a European session breakout.

At the same time, price was trading above the Zero Lag MA.

A long position was opened at 0.9035 with a 10-pip stop loss.

The trade quickly moved in favor, hitting a 22-pip take profit at 0.9057 within 20 minutes.

Case Study 2: AUD/USD M5

During the Asian session, both Fox Pivot lines crossed below the zero line on AUD/USD, while the price was also below the Zero Lag MA.

A short was entered at 0.6450 with a 10-pip stop loss.

Momentum accelerated, and the position reached a 20-pip take profit at 0.6430 in under 15 minutes.

Strategy Tips

- Stick to high liquidity sessions like London or New York for tighter spreads.

- Wait for both conditions to align to avoid premature entries.

- Consider trailing stops to lock in profits when volatility is high.

- Avoid trading major news releases to reduce whipsaw risk.

Download Now

Download the “foxpivot-indicator.mq4” indicator for Metatrader 4

FAQ

How do I know a signal is strong?

A strong signal occurs when both lines clearly cross the middle pivot without hesitation, ideally confirmed by the overall trend.

Can this indicator be combined with other tools?

Yes, pairing it with trend indicators, moving averages, or support/resistance levels can improve trade accuracy.

Which timeframe is best for this indicator?

M15 to H1 works well for intraday trades, while H1–H4 is suitable for swing trades.

Summary

The Fox Pivot Indicator for MT4 provides a clear channel-based oscillator to spot buy and sell opportunities.

Signal lines crossing the pivot help traders identify entry points and align with market trends.

With proper risk management and optional trend confirmation, this indicator can be a valuable tool for intraday and swing trading.