The Kaufman Efficiency Ratio forex MT4 indicator fluctuates between 0 and 1 indicator readings.

Kaufman is useful to detect overbought and oversold market conditions.

Use this indicator together with a trend-following technical analysis indicator to make a complete trading solution.

Free Download

Download the “kaufman-efficiency-ratio.mq4” MT4 indicator

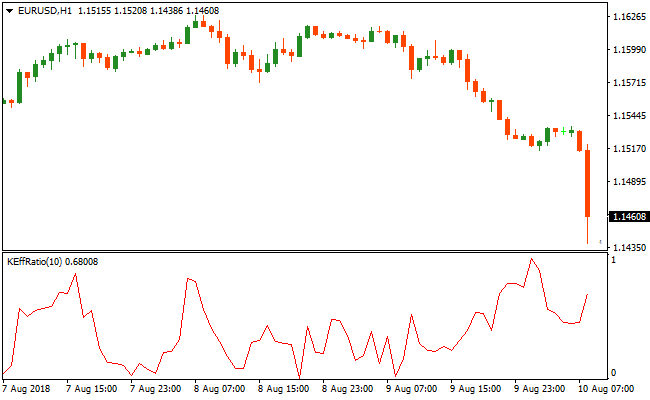

Indicator Chart (EUR/USD H1)

The EUR/USD H1 chart below displays the Kaufman Efficiency Ratio forex indicator in action.

Basic Trading Signals

Signals from the Kaufman forex indicator need to be used together with a trend-following indicator such as the 200 EMA:

Trend up (price above the 200 EMA)? Buy when the Kaufman indicator reaches 0 reading (oversold – buy on dips).

Trend down (price below the 200 EMA)? Sell when the Kaufman indicator reaches 1 reading (overbought – sell on rallies).

Kaufman Efficiency Ratio and VAR Moving Average MT4 Forex Strategy

This MT4 forex strategy combines the Kaufman Efficiency Ratio Indicator with the VAR Moving Average Indicator to create a trend-aligned mean-reversion strategy.

The VAR Moving Average uses green and red dotted lines to define the prevailing trend, while the Kaufman Efficiency Ratio identifies overbought and oversold conditions.

By entering trades when the trend aligns with an extreme reading, traders can capture profitable dips in an uptrend and rallies in a downtrend.

This strategy works well on M15 and H1 charts for major pairs like EURUSD, GBPUSD, and USDJPY.

It is suitable for day trading where price swings within the trend can provide multiple opportunities.

Buy Entry Rules

- The VAR Moving Average dotted line is green, indicating an uptrend.

- The Kaufman Efficiency Ratio reaches a reading of 0, signaling oversold conditions.

- Enter a buy trade at candle close when both conditions are met.

- Place the stop loss below the recent swing low or below the VAR Moving Average line.

- Exit the trade when the Kaufman Efficiency Ratio rises from the oversold region or when the dotted line turns red.

Sell Entry Rules

- The VAR Moving Average dotted line is red, indicating a downtrend.

- The Kaufman Efficiency Ratio reaches a reading of 1, signaling overbought conditions.

- Enter a sell trade at candle close when both conditions are met.

- Place the stop loss above the recent swing high or above the VAR Moving Average line.

- Exit the trade when the Kaufman Efficiency Ratio drops from the overbought region or when the dotted line turns green.

Advantages

- Combines trend direction and mean-reversion entries for higher probability trades.

- Visual signals make entries and exits easy to spot.

- Helps capture pullbacks and rallies within the prevailing trend.

- Works on multiple intraday timeframes including M15 and H1.

- Reduces risk of countertrend trades by requiring trend alignment.

- Suitable for day trading and swing trading sessions.

- Can be combined with support and resistance levels for additional precision.

Drawbacks

- Signals may lag slightly during rapid trend reversals.

- Requires monitoring of trend direction and Kaufman levels simultaneously.

- May produce fewer trades in flat or low-volatility periods.

- Patience is needed to wait for proper alignment of trend and indicator extremes.

Case Study 1

On EURUSD M15 during the London session, the VAR Moving Average showed a green dotted line indicating an uptrend.

The Kaufman Efficiency Ratio dropped to 0 after a minor pullback.

A buy trade was entered at candle close with a stop loss below the recent swing low.

Price rebounded strongly within the uptrend, and the trade was closed when the Kaufman ratio moved away from the oversold region, capturing 35 pips.

Case Study 2

On GBPAUD H1, the VAR Moving Average displayed a red dotted line showing a downtrend.

The Kaufman Efficiency Ratio reached 1 after a brief rally.

A sell trade was opened at candle close with the stop loss above the recent swing high.

Price declined steadily, and the position was exited when the ratio decreased from the overbought region, making 50 pips.

Strategy Tips

- Confirm the overall trend on higher timeframes before taking trades on lower timeframes.

- Use the Kaufman Efficiency Ratio extremes as entry signals, not as exit points alone.

- Combine with recent swing highs and lows to refine stop and exit placement.

- Avoid trading during low volatility periods to reduce false entries.

- Adjust position sizes according to volatility and trend strength.

- Be patient and wait for the perfect alignment of trend and oversold/overbought readings.

Download Now

Download the “kaufman-efficiency-ratio.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern

Customization options: Variable (ERperiod, histogram, shift) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Oscillator