About the Klines MTF Price Levels Forex Indicator

The Klines MTF Price Levels Forex Indicator for MT4 is a price action tool that highlights key high and low levels across multiple timeframes.

It helps traders identify potential support and resistance zones with clarity and precision.

This indicator plots the high and low bars directly on the main MT4 chart for M15, M30, H1, and H4 timeframes.

These levels can guide trade entries, exits, stop loss placement, and take profit targets.

Because it relies on pure price action, the indicator does not lag behind market moves.

The multi-timeframe perspective allows traders to see the broader market structure at a glance.

It is ideal for those who want clear reference points without cluttering the chart with extra indicators.

Free Download

Download the “KLines.mq4” indicator for MT4

Key Features

- Displays high and low price levels from multiple timeframes

- Works on M15, M30, H1, and H4 charts

- Pure price action – no lagging signals

- Helps identify potential support and resistance zones

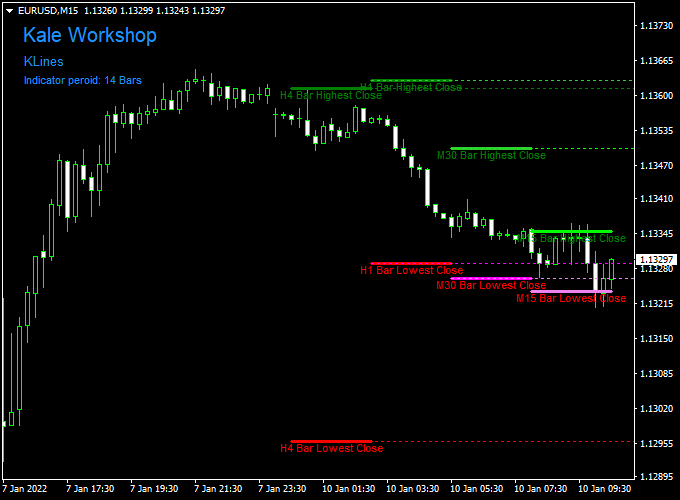

Indicator Chart

The chart shows the Klines MTF Price Levels indicator applied to an MT4 chart.

High and low levels from multiple timeframes appear as horizontal lines.

These levels help traders spot potential reversal points, breakout areas, and trend continuation zones.

Guide to Trade with Klines MTF Price Levels

Buy Rules

- Price approaches a support level from the indicator

- Confirm bullish candlestick formation near the level

- Enter a buy trade when price holds above support

Sell Rules

- Price approaches a resistance level from the indicator

- Confirm bearish candlestick formation near the level

- Enter a sell trade when price stays below resistance

Stop Loss

- Place the stop beyond the nearest support for buys

- Place the stop beyond the nearest resistance for sells

- Allow a few pips buffer to account for market noise

Take Profit

- Target the next level on a higher timeframe

- Close part of the trade at minor levels for early gains

- Exit fully if price shows reversal signals near a key level

Practical Tips

- Use multiple timeframes to identify strong levels

- Avoid trading when levels are too close together

- Combine with trend or momentum filters for better accuracy

- Use levels to fine-tune stop loss and take profit placement

MT4 Scalping Strategy: Klines MTF Price Levels + Free Forex Scalping Indicator

This MT4 scalping strategy combines the Klines MTF Price Levels Forex Indicator with the Free Forex Scalping Indicator.

The strategy is designed for traders looking to capture quick, high-probability trades on lower timeframes such as M1, M5, and M15.

By combining multi-timeframe support and resistance levels with precise buy and sell signals, it minimizes false entries and maximizes potential profits.

Buy Entry Rules

- Ensure the price is above the highest close line (green) of the Klines MTF Price Levels, indicating a bullish trend.

- Confirm a buy signal from the Free Forex Scalping Indicator (green histogram above 0).

- Enter a buy trade at the close of the candle, confirming the green histogram.

- Place the stop loss just below the most recent swing low or the lowest close line (red) of the Klines MTF Price Levels.

- Set the take profit at 1.5–2 times the stop loss distance or near the next significant resistance level.

Sell Entry Rules

- Ensure the price is below the lowest close line (red) of the Klines MTF Price Levels, indicating a bearish trend.

- Confirm a sell signal from the Free Forex Scalping Indicator (red histogram below 0).

- Enter a sell trade at the close of the candle confirming the red histogram.

- Place the stop loss just above the most recent swing high or the highest close line (green) of the Klines MTF Price Levels.

- Set the take profit at 1.5–2 times the stop loss distance or near the next significant support level.

Advantages

- Multi-timeframe analysis identifies strong support and resistance zones.

- Clear entry signals reduce indecision and increase confidence.

- Defined stop loss and take profit levels support disciplined risk management.

- Works well for quick trades on low timeframes.

- It can be applied to multiple currency pairs, especially majors.

Drawbacks

- Late signals may occur during fast price movements.

- Sideways or low-volatility markets may produce false signals.

- Scalping requires constant monitoring, which may not suit all traders.

- Broker spreads and execution speed can affect trade outcomes.

- Multiple horizontal levels on the chart may be visually cluttered for some traders.

Case Study 1: EUR/USD M5 Scalping Trade

The price was above the green line of the Klines MTF Price Levels, signaling a bullish trend.

The Free Forex Scalping Indicator showed a green histogram at 1.1050.

A buy trade was entered at 1.1050, with a stop loss at 1.1045 and a take profit at 1.1065.

The trade closed within 10 minutes, netting a 15-pip profit.

Case Study 2: GBP/USD M15 Scalping Trade

The price was below the red line of the Klines MTF Price Levels, signaling a bearish trend.

The Free Forex Scalping Indicator showed a red histogram at 1.3050.

A sell trade was entered at 1.3050, with a stop loss at 1.3060 and take profit at 1.3030.

The trade closed within 15 minutes, netting a 20-pip profit.

Strategy Tips

- Use M1, M5, or M15 timeframes for quick scalping opportunities.

- Focus on major currency pairs with high liquidity to minimize spreads and slippage.

- Always risk only a small percentage of your trading capital per trade.

Download Now

Download the “KLines.mq4” indicator for Metatrader 4

FAQ

Can I adjust which timeframes are plotted?

Yes. The indicator allows customization of which MTF levels are displayed to focus on preferred timeframes.

Does the indicator repaint or lag?

No. It works on closed candles and pure price action, so it does not repaint or lag.

Can this indicator be used for intraday and swing trading?

Yes. M15 and M30 are ideal for intraday trades, while H1 and H4 provide levels for swing trading.

Summary

The Klines MTF Price Levels Forex Indicator for MT4 provides a clear framework for trading with support and resistance from multiple timeframes.

Highlighting key highs and lows allows traders to plan entries, exits, and risk management with confidence.

It is simple to use, works on multiple timeframes, and does not lag behind the price.

The indicator can be combined with trend or momentum tools for improved confirmation and higher probability trades.