About the MA Forex Profit System Indicator

The MA Forex Profit System is a free MT4 indicator designed to deliver clear buy and sell signals directly on your chart.

Each signal also comes with an estimated profit target in pips, allowing traders to quickly see potential gains.

The indicator calculates its signals based on moving averages and plots green lines for bullish entries and red lines for bearish entries.

It also provides a unique feature: a daily profit tracker showing how much you would have earned if you followed the signals for the current and previous trading day.

This gives traders a clear perspective on the system’s performance and helps with strategy planning.

Suitable for beginners and experienced traders alike, the indicator simplifies decision-making and makes trend-following more effective.

Free Download

Download the “Ma profit.mq4” indicator for MT4

Key Features

- Displays buy and sell signals directly on the main MT4 chart.

- Green lines indicate buy signals, red lines indicate sell signals.

- Includes profit target in pips for each trade signal.

- The daily profit tracker shows potential gains for the current and previous day.

- Easy to use and understand, ideal for beginners.

- Works on all currency pairs and time frames.

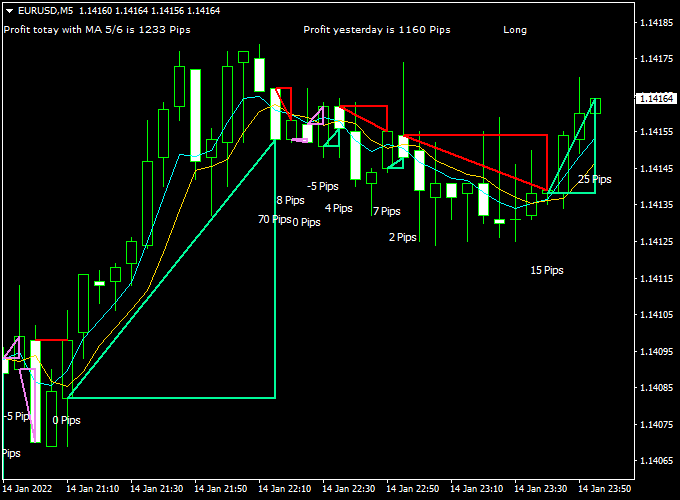

Indicator Chart

The chart shows green and red lines representing buy and sell signals.

The indicator also displays profit targets for each trade, giving traders a clear view of potential gains.

This visual setup allows for fast decision-making and easy tracking of both active and completed signals.

Guide to Trade with MA Forex Profit System

Buy Rules

- Enter a buy trade when a green line appears on the chart.

- Confirm with price moving above the recent swing low for added confidence.

- Consider checking the daily profit tracker to see previous performance.

Sell Rules

- Enter a sell trade when a red line appears on the chart.

- Confirm with price moving below the recent swing high for additional confidence.

- Use the profit tracker to evaluate recent bearish signals.

Stop Loss

- For buy trades, place a stop loss below the recent swing low or slightly below the green signal line.

- For sell trades, place a stop loss above the recent swing high or slightly above the red signal line.

- Optionally, adjust stops based on the average true range (ATR) to account for volatility.

Take Profit

- Close trades when the opposite signal appears (red line for buys, green line for sells).

- Alternatively, target the profit in pips displayed by the indicator for each signal.

- Consider trailing stops to lock in profits if the trend continues strongly.

Practical Tips

- Check the daily profit tracker to monitor the system’s consistency.

- Use smaller positions during volatile news events to manage risk.

- Always confirm the trend on higher time frames before entering trades on lower time frames.

MA Forex Profit System + AFIRMA MT4 Day Trading Strategy

This day trading strategy combines the trend clarity of the MA Forex Profit System Indicator for MT4 with the multi-timeframe trend confirmation of the AFIRMA Forex Trend Indicator for MT4.

The MA Profit System uses a thick green line to indicate buying conditions and a thick red line to indicate selling conditions.

AFIRMA plots a blue line for a bullish trend and a red line for a bearish trend.

Together, they give a clean, low-noise way to trade intraday moves with high-probability entries and defined risk.

This setup is best on 15-minute and 1-hour charts for day trading.

It also works on 5-minute charts for traders who prefer more frequent signals, but expect more noise.

The strategy is aimed at traders who want clear trend-based entries, disciplined stop placement, and targets that capture the day’s directional move.

Why this combination works

The MA Profit System provides a clear visual of the immediate market bias through its thick colored line.

AFIRMA adds confidence by confirming the trend across one or more higher timeframes.

When both indicators agree, you trade with the trend and momentum rather than against it.

This reduces false breakouts and improves risk-to-reward on intraday setups.

Buy Entry Rules

- Confirm the MA Forex Profit System shows a green thick line on the chart you trade, indicating buy bias.

- Check that the AFIRMA line is blue on the same chart and, if possible, on a higher timeframe (for example, H1 when trading M15).

- Enter a buy at the close of the candle that first confirms both green (MA) and blue (AFIRMA) alignment.

- Place stop loss below the recent swing low or below the MA thick line by a buffer of 8–15 pips for currencies, or appropriate ticks for metals.

- Target intraday resistance or a fixed target of 25–50 pips on 15-minute setups, or 50–120 pips on 1-hour setups, depending on volatility.

- If the price closes back below the MA thick line or AFIRMA flips red, exit the trade immediately.

Sell Entry Rules

- Confirm the MA Forex Profit System shows a red thick line, indicating a sell bias.

- Check AFIRMA is red on the trading timeframe and ideally red on the higher timeframe too.

- Enter a sell at the close of the candle that confirms both indicators are aligned bearish.

- Place stop loss above the recent swing high or above the MA line by 8–15 pips or an appropriate buffer.

- Set take profit at the next intraday support or a fixed target of 25–50 pips on M15, larger on H1.

- If AFIRMA or the MA thick line flips back to bullish conditions, close the position.

Advantages

- Clear visual signals reduce hesitation and speed decision-making.

- Dual confirmation cuts the number of false entries in choppy markets.

- Works on multiple timeframes so you can scale from scalping to larger intraday trades.

- Stop and exit rules are simple, making risk control straightforward.

- Suitable for both forex majors and liquid commodities such as gold.

Drawbacks

- Fewer signals when indicators disagree, which may feel slow for active traders.

- Indicator flips can lag at extremes, causing late entries in very sharp moves.

- Large news events can invalidate signals quickly and cause slippage.

- Fixed pip targets may need adjustment per pair and session volatility.

Case Study 1 – EUR/USD, 15-minute

During the London session, EUR/USD showed the MA thick line turning green as buyers regained control.

AFIRMA on the 15-minute chart turned blue, and AFIRMA on H1 was already blue, confirming alignment.

A buy entry was taken at the close of the confirming candle.

A stop was placed 12 pips below the recent swing low, and the initial target was set to 30 pips.

Price moved steadily and hit the target within a few hours while the indicators remained aligned.

The higher timeframe confirmation reduced the chance of a quick reversal.

Case Study 2 – Gold (XAU/USD), 1-hour

Gold formed a clear intraday downtrend after a risk-off move.

The MA thick line switched to red, and AFIRMA on the hourly chart turned red as well.

A sell trade was entered at candle close with a stop above the last swing high and a profit target equal to two times the stop distance.

The move extended as safe-haven flows pushed gold lower, and the trade closed near the target.

Using gold shows the method works on metals with wider swings; buffers and targets were expanded to account for larger volatility.

Strategy Tips

- Prefer trades where AFIRMA agrees on the trading timeframe and a higher timeframe for added confidence.

- Use wider buffers and larger targets on volatile pairs or metals like gold.

- Avoid taking signals immediately before high-impact news releases.

- Scale position size to account for intraday volatility and spread differences across pairs.

- Consider moving the stop to breakeven when half the target is reached to protect capital.

Download Now

Download the “Ma profit.mq4” indicator for Metatrader 4

FAQ

How does the MA Forex Profit System calculate its signals?

The indicator uses moving average crossovers and price action to determine potential buy and sell opportunities, plotting green and red lines directly on the chart.

Can I trade multiple signals in one day?

Yes. The indicator displays every signal for the current and previous day, allowing traders to manage multiple positions while monitoring potential profits.

Is the profit target guaranteed?

No. The profit target shows a suggested pip gain based on historical signals. Actual results depend on market conditions, spreads, and execution timing.

What pairs work best with this indicator?

It works on all currency pairs, but trending pairs often produce more accurate signals. Avoid using it on highly choppy or range-bound pairs without additional confirmation.

Summary

The MA Forex Profit System MT4 indicator delivers actionable buy and sell signals directly on your chart with clear green and red lines.

It includes a unique profit target and daily performance tracker, helping traders see potential gains instantly.

This makes it practical for both beginners and experienced traders who want a visual, easy-to-use trading system.

With proper stop loss placement and flexible take profit options, the indicator helps manage risk while capturing trend moves efficiently.

Overall, the MA Forex Profit System is a versatile, reliable tool for trend-following and high-probability trade setups on MT4.