About the MACD Cross Forex Signal Indicator

The MACD Cross Forex Signal Indicator for MT4 is designed to simplify trading by highlighting profitable MACD crossover points within a trading channel.

It allows traders to spot high-probability entries while keeping risk under control.

The indicator displays a colored trading channel and the MACD in a separate MT4 chart window.

It helps identify the direction of the underlying trend and provides clear signals when crossovers occur near key channel levels.

This makes it a practical tool for intraday and swing traders looking to align trades with the trend while avoiding noise from small market fluctuations.

Free Download

Download the “kg macd line.mq4” indicator for MT4

Key Features

- MACD crossover signals combined with a trading channel for higher accuracy

- Displays the MACD in a separate chart window for clear visualization

- Helps traders time entries with the underlying trend

- Improves trend-following trade setups and exit timing

- Easy to interpret, suitable for beginners and experienced traders

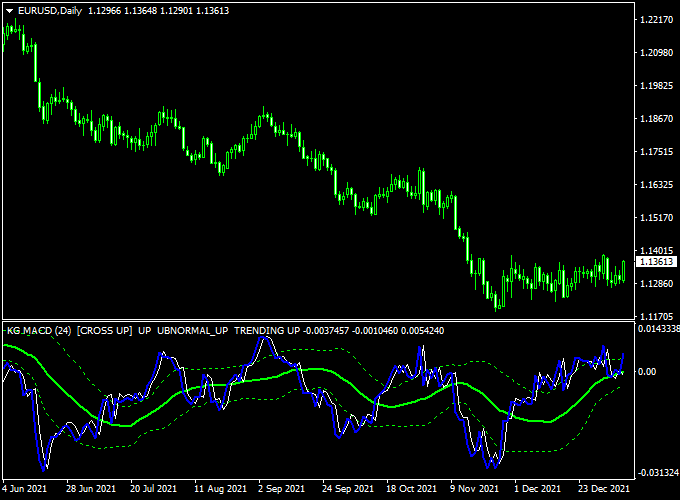

Indicator Chart

The chart shows the MACD Cross Forex Signal Indicator with a green dotted channel and the MACD signal line.

A crossover near the lower channel line indicates a potential buy, while a crossover near the upper channel line signals a potential sell.

Traders can use this setup to enter trades in line with the overall trend.

Guide to Trade with MACD Cross Forex Signal Indicator

Buy Rules

- Open a buy trade when the blue MACD line crosses the lower green dotted channel line bottom-up.

- Confirm that the underlying trend supports an upward move.

Sell Rules

- Open a sell trade when the blue MACD line crosses the upper green dotted channel line top-down.

- Ensure that the underlying trend confirms downward momentum.

Stop Loss

- For buy trades, place the stop loss just below the recent swing low or below the lower channel line.

- For sell trades, place the stop loss just above the recent swing high or above the upper channel line.

Take Profit

- Set the first target near the middle or opposite side of the trading channel.

- Partial exits can be taken at intermediate support/resistance levels.

Practical Tips

- Use this indicator in trending markets for more reliable signals.

- Check higher timeframes to confirm that the trend aligns with the crossover signal.

- Combine with other momentum indicators to filter false breakouts.

- Adjust the channel settings if needed to match market volatility and trading style.

MACD Cross + Coron MT4 Scalping Strategy

This scalping strategy uses the MACD Cross Forex Signal Indicator alongside the Coron MetaTrader 4 Indicator.

The MACD Cross Indicator provides precise entry signals when the blue signal line crosses key dotted levels, while the Coron Indicator identifies the overall trend using a green or red histogram.

Combining these indicators allows traders to scalp short-term moves with high accuracy on M1, M5, and M15 charts.

This strategy works best on major currency pairs with good liquidity, such as EUR/USD, GBP/USD, and USD/JPY.

Buy Entry Rules

- Ensure the Coron Indicator histogram is green, indicating a bullish trend.

- Wait for the MACD Cross blue signal line to cross back above the lower dotted green line.

- Enter a buy trade at the crossover point.

- Set a tight stop loss below the recent swing low or a nearby support level.

- Take profit at 10–20 pips for quick scalping or at the next minor resistance level.

Sell Entry Rules

- Ensure the Coron Indicator histogram is red, indicating a bearish trend.

- Wait for the MACD Cross blue signal line to cross back below the upper dotted green line.

- Enter a sell trade at the crossover point.

- Set a tight stop loss above the recent swing high or a nearby resistance level.

- Take profit at 10–20 pips for quick scalping or at the next minor support level.

Advantages

- Combines trend confirmation with precise entry signals for better accuracy.

- Works well for fast intraday scalping on multiple currency pairs.

- Clear visual cues make it beginner-friendly.

- Can be used on multiple timeframes to capture different scalping opportunities.

Drawbacks

- Signals can be late in highly volatile markets, potentially causing missed entries.

- Choppy or sideways markets may produce false signals, leading to small losses.

- Requires constant attention due to the fast pace of scalping trades.

- Stop losses can occasionally be triggered by short-term price spikes.

Case Study 1 – EUR/USD M5

During the London session, the Coron Indicator showed a green histogram, confirming a bullish trend.

The MACD Cross blue line crossed back above the lower dotted green line at 10:12.

A buy trade was opened at 1.1053 with a stop loss at 1.1045 and a take profit at 1.1065.

The trade reached the target in 15 minutes, securing 12 pips.

Case Study 2 – GBP/USD M1

On the GBP/USD M1 chart, the Coron histogram turned red, signaling a bearish trend.

The MACD Cross blue line crossed below the upper dotted green line at 09:34.

A sell trade was entered at 1.2985 with a stop loss at 1.2992 and a take profit at 1.2975.

The trade moved quickly in favor of the trend, reaching the take profit in under 10 minutes for a 10-pip gain.

Strategy Tips

- Trade only in the direction of the Coron trend histogram to filter out false signals.

- Focus on high liquidity pairs to ensure tighter spreads and faster execution.

- Use small timeframes (M1–M15) for scalping and adjust take profit according to volatility.

- Combine with support and resistance levels to improve trade exits and stop placement.

- Avoid trading during major news events to prevent sudden price spikes affecting stops.

- Consider using partial exits to lock in small profits quickly in fast markets.

Download Now

Download the “kg macd line.mq4” indicator for Metatrader 4

FAQ

Can the MACD Cross Forex Signal indicator be used for swing trading?

Yes, it works on both short-term and longer-term trades. Higher timeframes provide stronger signals for swing trades.

Which timeframes work best?

It works well on all timeframes. Lower timeframes suit intraday trades, while higher timeframes are ideal for swing trading.

Can I adjust the channel or MACD settings?

Yes, both the channel and MACD inputs are fully adjustable to fit your preferred trading style and market conditions.

Summary

The MACD Cross Forex Signal Indicator for MT4 combines MACD crossover analysis with a trading channel to deliver precise trend-based trade signals.

It simplifies entry timing while helping traders stay aligned with the underlying trend.

With proper stop losses, take profits, and trend confirmation, traders can improve accuracy and manage risk efficiently.

This indicator is suitable for both intraday and swing trading, providing a reliable tool for identifying high-probability trade setups.