About the Momentum Pinball Forex Indicator

The Momentum Pinball Forex Indicator for MT4 is a momentum-driven oscillator designed to identify overbought and oversold market conditions with accuracy.

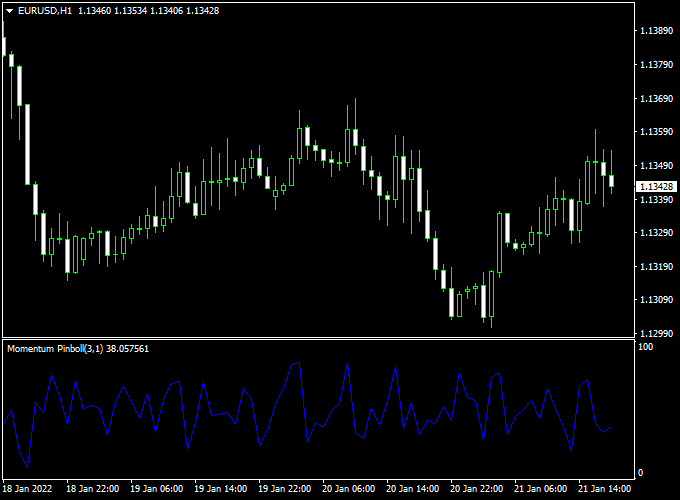

The indicator is displayed as a blue line in a separate MetaTrader 4 window and moves within a fixed range.

This makes it easy to monitor momentum behavior during active trading sessions.

Unlike indicators that rely heavily on lagging averages, Momentum Pinball focuses on momentum pressure.

This helps traders anticipate potential reversals when price movement becomes stretched.

When the indicator reaches the upper boundary, bullish momentum is considered exhausted.

When it reaches the lower boundary, bearish momentum may be losing strength.

This approach makes the indicator suitable for traders who specialize in reversal entries, range trading, and timing pullbacks within broader trends.

The Momentum Pinball indicator can be applied to all currency pairs and timeframes, making it flexible for scalpers, intraday traders, and swing traders.

Free Download

Download the “momentum-pinball-indicator.mq4” indicator for MT4

Key Features

- Momentum-based oscillator designed to detect market extremes.

- Fixed overbought and oversold levels at 100 and 0.

- Clean blue line display in a separate MT4 indicator window.

- Helps identify momentum exhaustion before potential reversals.

- Works across all timeframes and forex pairs.

- Pairs well with support, resistance, and trend analysis.

Indicator Chart

The chart illustrates the blue oscillator line reaching the 0 and 100 levels, highlighting possible buy and sell signals based on momentum conditions.

Guide to Trade with the Momentum Pinball Forex Indicator

Buy Rules

- Wait for the Momentum Pinball line to reach or touch the 0 level.

- Enter a buy trade when the line begins to turn upward.

- Prefer long entries aligned with a higher timeframe trend direction.

Sell Rules

- Wait for the Momentum Pinball line to reach or touch the 100 level.

- Enter a sell trade once the line starts to turn downward.

- Prefer short entries aligned with a higher timeframe trend direction.

Stop Loss

- Place the stop loss beyond the nearest swing high or swing low.

- Use a fixed pip stop when market swings are unclear.

- Keep risk consistent across all trades.

Take Profit

- Target the next support or resistance level.

- Exit the trade as the indicator approaches the opposite extreme.

Practical Tips

- Use the indicator during active trading sessions for stronger momentum signals.

- Combine the indicator with key support and resistance zones.

- Confirm entries with price rejection or candle patterns.

- Stick to one or two timeframes to maintain consistency.

Momentum Pinball + Super Forex Trend Scalping Strategy For MT4

The Momentum Pinball and Super Forex Trend indicators create a powerful combination for short-term traders looking to catch fast-moving opportunities in the forex market.

This MT4 strategy is ideal for scalpers and intraday traders who prefer precision entries and short holding times.

By merging momentum shifts with clear trend direction, traders can enter at moments of high probability and exit with steady profits.

The Momentum Pinball Forex Indicator helps identify when a currency pair is oversold (near 0) or overbought (near 100), signaling potential reversals or short-term continuation moves.

Meanwhile, the Super Forex Trend Indicator plots the dominant market trend, showing a bullish phase when the price is above its orange line and a bearish phase when below.

Combining these two tools allows traders to scalp in the direction of momentum and trend alignment, filtering out false signals and noise.

Why This Strategy Works

Momentum Pinball gives the earliest signal of a potential price burst, while the Super Forex Trend indicator confirms whether the overall direction supports that move.

The synergy of both ensures traders enter only when both momentum and trend agree.

This approach prevents premature entries during consolidation and improves consistency.

It works well on 1-minute to 15-minute charts for scalping major currency pairs like EUR/USD, GBP/USD, and USD/JPY.

Buy Entry Rules

- Wait for the Super Forex Trend indicator to show price above the orange line (bullish trend).

- Confirm that the Momentum Pinball indicator rises from the oversold area (near 0) and crosses above 50.

- Enter a buy position once both conditions align and the candle closes bullish.

- Place a stop loss 8 to 12 pips below the last swing low.

- Set a take profit target of 10 to 20 pips, or exit when Momentum Pinball approaches the 90–100 zone.

Sell Entry Rules

- Wait for the Super Forex Trend indicator to show price below the orange line (bearish trend).

- Confirm that the Momentum Pinball indicator drops from the overbought zone (near 100) and moves below 50.

- Enter a sell position once both conditions align and the candle closes bearish.

- Place a stop loss 8 to 12 pips above the last swing high.

- Set a take profit target of 10 to 20 pips, or exit when Momentum Pinball moves near the 10–0 zone.

Advantages

- Combines early momentum detection with reliable trend confirmation.

- Reduces false signals common in sideways markets.

- Simple to apply, even for beginner traders.

- Works on all major forex pairs and lower time frames.

- Scalable to different lot sizes or risk levels.

Drawbacks

- Less effective during high-impact news releases due to sudden volatility.

- Requires quick execution to capture short scalping moves.

- It may produce fewer signals in ranging conditions.

- Not ideal for long-term traders.

Example Case Study 1

On the EUR/USD 5-minute chart, the price moved above the orange trend line on the Super Forex Trend indicator around 1.0740.

The Momentum Pinball rose from 20 and crossed above 50, confirming bullish momentum.

A buy trade was entered at 1.0745 with a stop loss at 1.0733.

The trade reached a take profit of 1.0765 within 25 minutes, netting +20 pips.

Example Case Study 2

On the GBP/USD 1-minute chart, the Super Forex Trend indicator showed a bearish trend below the orange line near 1.2600.

The Momentum Pinball dropped from 90 to 40, confirming selling pressure.

A short trade was opened at 1.2598 with a stop loss at 1.2610.

The trade reached a take profit of 1.2583 in less than 10 minutes, producing a gain of +15 pips.

Strategy Tips

- Use this method only when both indicators agree on direction—momentum and trend must align.

- Avoid trading during major news announcements to reduce false spikes.

- Focus on liquid pairs with tight spreads for better results.

- If Momentum Pinball stays flat near mid-levels (40–60), wait for a clear breakout before trading.

- Combine with a trailing stop to protect profits during strong momentum bursts.

- Backtest on different sessions (London and New York) to find the best timing window for entries.

Download Now

Download the “momentum-pinball-indicator.mq4” indicator for Metatrader 4

FAQ

What market conditions suit this indicator best?

The Momentum Pinball indicator performs best in ranging or mildly trending markets where momentum extremes are respected.

Which settings should be adjusted?

The default settings work well for most traders, but minor adjustments can be made to suit faster or slower timeframes.

Summary

The Momentum Pinball Forex Indicator for MT4 is a practical tool for identifying momentum extremes and potential reversals.

Its fixed levels, clean display, and straightforward logic make it accessible for traders at all experience levels.

When applied with disciplined risk management and confirmation techniques, the indicator can improve trade timing and confidence.

It offers a focused approach to trading momentum without unnecessary complexity.