About the Money Management Expert Advisor

The Money Management Metatrader 4 Forex Robot is an expert advisor that triggers buy/sell signal alerts using a money management strategy as its building block.

In essence, the forex robot uses a set of logic that is dependent on money management techniques.

It therefore relies on the effective manipulation of position sizes on varying trades to ensure an overall profit.

The expert advisor guarantees the modest and steady growth of position sizes alongside equity growth.

However, the Money Management EA has a default maximum lot (MaxLot) size value of 10, whereby positions can increase to.

Free Download

Download the “Tester_v0_15_.mq4” MT4 robot

Key Features

Risk-Based Position Sizing

The EA calculates trade size from a user-defined risk percentage of account equity, converting pip risk into lots automatically for each symbol.

Volatility Adjustment

Volatility-based multipliers increase or decrease lot sizes depending on recent market volatility to avoid oversized entries in thin or choppy markets.

Account Equity Protection

Equity stop rules can close all managed positions when drawdown limits are exceeded, protecting capital from catastrophic loss.

Broker Compatibility

Designed to operate with standard and ECN brokers, the EA respects min/max lot sizes, step increments, and spread limits before opening trades.

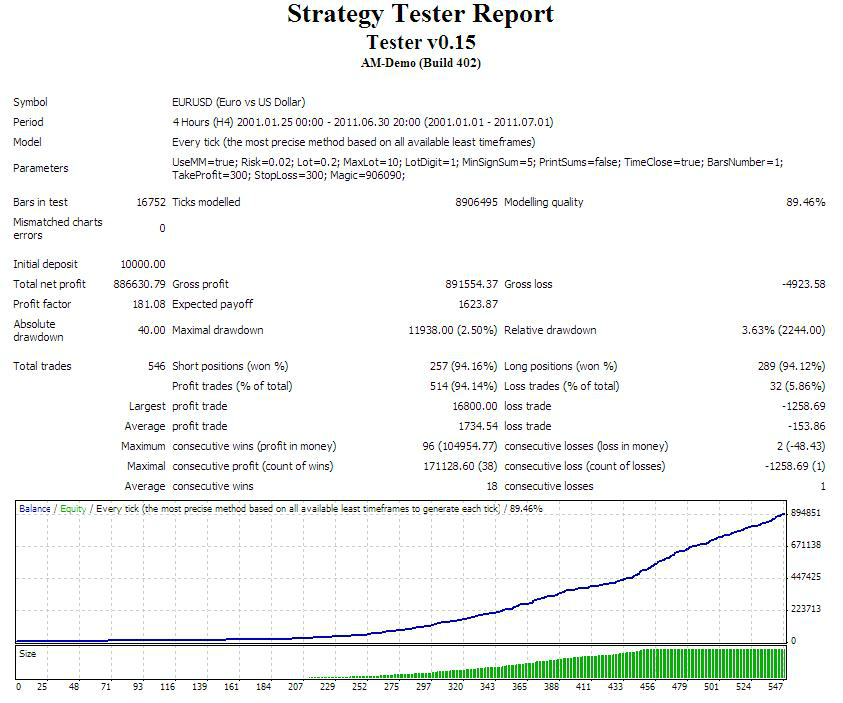

Strategy Tester Report

Find below the Money Management robot strategy tester report for the EUR/USD forex pair on the 4-Hour chart.

Overall Performance

The EA made a total profit of $8866630.79 from a total of 546 trades.

The largest winning trade generated $16800.00 in profits, while the largest losing trade generated a loss of $1258.69.

Statistics:

Bars in test: 16752 ticks modelled

Initial deposit: $10000.00

Total net profit: $8866630.79

Total trades: 546

Largest profit trade: $16800.00

Largest loss trade: -$1258.69

Consecutive wins: 18

Consecutive losses: 1

How the EA Works

- Listens for trade open requests from a master EA or monitors manual trade entries on the chart.

- Calculates the appropriate lot size using RiskPercent, stop-loss distance in pips, and current symbol tick value.

- Applies volatility multiplier based on ATR or user-selected volatility indicator.

- Checks broker constraints (MinLot, MaxLot, LotStep) and spread filters before sending orders.

- Monitors open positions and triggers equity protection or session-based closures when limits are hit.

Download Now

Download the “Tester_v0_15_.ex4” Metatrader 4 robot

Parameters & Settings

- RiskPercent — percentage of equity risked per trade.

- UseATR — enable ATR-based volatility adjustments.

- ATRPeriod — lookback period for volatility calculation.

- MaxEquityDrawdown — percent drawdown to stop trading and optionally close positions.

- MinLot, MaxLot, LotStep — broker-specific lot constraints.

- MaxConcurrentTrades — limit number of simultaneous trades per symbol/account.

- SpreadLimit — maximum spread allowed to open new trades.

Recommended Trading Setup

- Pairs: majors (EURUSD, GBPUSD, USDJPY) for predictable tick values and liquidity.

- Account Type: ECN or low-spread account for accurate price execution.

- Risk: 0.5%–1.5% per trade for conservative-moderate accounts; adjust per portfolio.

- Combine: Pair with an entry EA or manual trading plan — use this EA only for sizing and protection.

- Testing: Run the EA on demo for 30–90 days using the included .set to observe real-market behavior.

FAQ

Do I need programming knowledge to use this EA?

No — basic MT4 familiarity is enough. The download includes a settings file and a short guide to help you install and configure the EA.

Will it change my existing EA’s logic?

No — the Money Management EA only adjusts position sizing and risk controls. It does not change entry logic or modify stop/take settings unless configured to do so.

Can it manage multiple EAs or manual trades?

Yes — it can monitor multiple charts and manage lot sizing across EAs or manual positions, subject to your MaxConcurrentTrades setting.

What happens on large sudden market moves?

Equity protection rules can halt openings and close positions automatically if drawdown thresholds are exceeded to protect your account.

Is this suitable for small accounts?

Yes — use MinLot, LotStep, and RiskPercent to tailor sizing for small accounts. Always test on a demo first.

Summary

The Money Management EA is a focused MetaTrader 4 tool that brings professional position sizing, volatility-aware adjustments, and robust equity protection to your trading.

Use it to enforce discipline, remove emotional sizing decisions, and standardize risk across manual and automated strategies.

Download the free package, test in demo, and adapt the settings to match your risk appetite.