The Orderbook V1.2 indicator for Metatrader 4, often referred to as the Depth of Market (DOM) or Market Depth Indicator, presents a visual representation of the supply and demand levels within the currency market at a given point in time.

In essence, it offers a window into the intentions of other traders.

Unlike traditional price charts that focus solely on historical price movements, the Order Book Indicator brings the future into the present by displaying pending orders—both buy and sell—alongside the current bid and ask prices.

Decoding Market Sentiment

Market sentiment is a driving force behind price movements.

Understanding whether the majority of traders are leaning towards buying or selling can offer invaluable insights.

The Order Book Indicator provides a snapshot of the distribution of pending buy and sell orders at various price levels around the current market price.

If there are significantly more buy orders (demand) than sell orders (supply), it suggests a potential upward price movement, and vice versa.

Key Points and Benefits

- Real-Time Insights: The Order Book Indicator updates in real-time, allowing currency traders to react swiftly to changing market conditions.

- Institutional Perspective: Large institutional traders often leave substantial orders in the order book. Observing these levels can offer insights into the actions of institutional players.

- Support and Resistance Identification: The indicator can help identify support and resistance levels based on the concentration of orders at specific price points.

- Entry and Exit Points: By gauging the intensity of orders at different levels, traders can make more informed decisions about potential entry and exit points.

- Confirmation Tool: The Order Book Indicator can complement other technical and fundamental analysis tools, acting as a confirmation or divergence signal.

Interpreting the Indicator

- Order Concentration: A high concentration of buy orders at a specific price level might indicate a strong support zone, while a cluster of sell orders might signal resistance.

- Order Imbalance: A significant imbalance between buy and sell orders can foreshadow a potential trend reversal or continuation.

- Order Fluctuations: Rapid changes in the order book can point to increased volatility and might hint at an impending price breakout.

Free Download

Download the “Order Book V1.2 .ex4” MT4 indicator

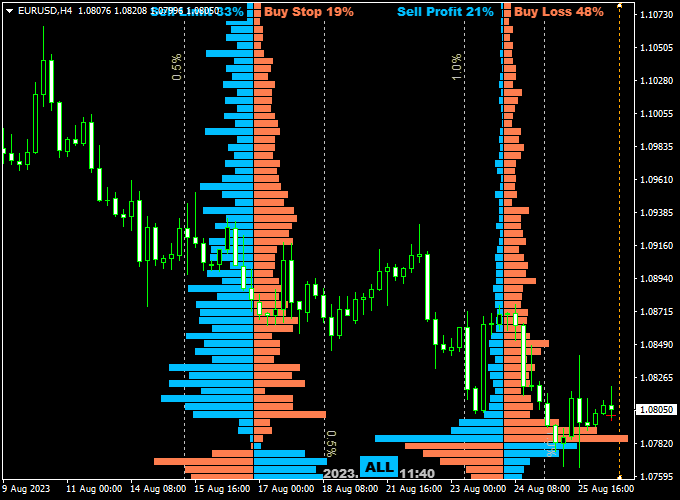

Indicator Example Chart

The chart presented below illustrates the Orderbook V1.2 indicator in action on the EUR/USD 4-hour time frame.

Simple Trading Strategy

While the Order Book indicator for Metatrader 4 can offer valuable insights, it should not be the sole basis for trading decisions.

Instead, it works best when integrated into a broader trading strategy that combines multiple indicators, technical analysis, and market news.

When used correctly, the Order Book Indicator can be a great asset in a trader’s arsenal, helping them navigate the complexities of the Forex market with greater confidence.

Download Now

Download the “Order Book V1.2 .ex4” MT4 indicator

Order Flow Strategy Using OrderBook v1.2 + RSI

This trading strategy leverages the OrderBook v1.2 Indicator to identify high-liquidity levels and potential turning points in price.

To increase accuracy, it adds the Relative Strength Index (RSI) as a secondary filter to confirm market exhaustion and improve entry timing.

Best Market Conditions

- Timeframes: M5, M15

- Pairs: EUR/USD, GBP/USD, USD/JPY

- Sessions: London, New York (for strong order flow)

Indicators Required

- Main Tool: OrderBook v1.2 Indicator

- Confirmation Tool: RSI (Relative Strength Index) with 14-period setting

Buy Trade Setup

- Monitor the OrderBook v1.2 for a visible liquidity zone below the current price, indicating strong buy interest.

- Check if RSI is below 30 and starting to curve upward, suggesting the market is oversold.

- Enter a buy trade once price touches the buy-side liquidity level and RSI confirms upward momentum.

- Set Stop Loss just below the liquidity zone or the most recent swing low.

- Set Take Profit at the next resistance zone or 15–25 pips above entry.

Sell Trade Setup

- Watch the OrderBook v1.2 for a visible liquidity zone above the current price, indicating strong sell interest.

- Confirm that RSI is above 70 and starting to move downward, indicating overbought conditions.

- Enter a sell trade once price touches the sell-side liquidity zone and RSI confirms the downward move.

- Set Stop Loss just above the liquidity zone or the nearest swing high.

- Set Take Profit at the next support level or 15–25 pips below entry.

Risk Management Tips

- Use proper position sizing: never risk more than 2% of your capital per trade.

- Skip trades if there’s no RSI confirmation, even if the liquidity zone is touched.

- Re-evaluate setups during major news events — order flow can become erratic.

Conclusion

The combination of OrderBook v1.2 and RSI provides a clear structure for identifying and trading around institutional order zones.

This strategy works well for traders who want to avoid false signals by confirming entries with momentum-based indicators.

Customizable Parameters & Settings

Colors, time (GMT), debug, and more.

Feel free to explore the indicator’s different parameters and settings to create your personalized indicator setup.

More Info About This Indicator

Currency Pairs: works on any currency pair and other trading instruments

Trading Platform: developed for Metatrader 4 (MT4)

Time Frames: works on any time frame

Indicator Type: Market depth

How to install the Order Book indicator in Metatrader 4?

- Copy and paste the Order Book V1.2 .ex4 indicator into the MQL4 indicators folder.

- You can access this folder from the top menu as follows:

- File > Open Data Folder > MQL4 > Indicators (paste here)

- Restart the trading platform

- Add the indicator to the chart