About the Pioneer EU Mart Killer EA

This EA combines trend-following and momentum-based trading with risk-management strategies.

It uses moving averages to track the trend direction, envelope bands to spot overbought or oversold zones, and Ichimoku elements to confirm momentum and key price levels.

The result is a responsive system that seeks to enter strong setups while shielding downside exposure.

Despite its aggressive name, it includes adjustable risk parameters to improve execution control.

Free Download

Download the “Pioneer EU Mart Killer.ex4” expert advisor

Key Features

Moving Average Trend Detection

Analyzes trend direction with dual moving averages, aligning entries with market momentum.

Envelope-Based Entry Zones

Targets overbought and oversold areas using envelope bands to time entry points.

Ichimoku Confirmation

Uses Ichimoku Kinko Hyo to validate momentum and key support/resistance levels.

High Trade Count, Strong Gains

Showed nearly 100% gain from 469 trades in backtesting, making it an active and aggressive strategy.

Controlled Drawdown

Maintained a drawdown near 19%, indicating a balance between return and risk.

Optimized for EUR/USD M5 & M15

Best-performance settings available for EUR/USD on 5- and 15-minute charts, with flexibility for other pairs.

Trading Results

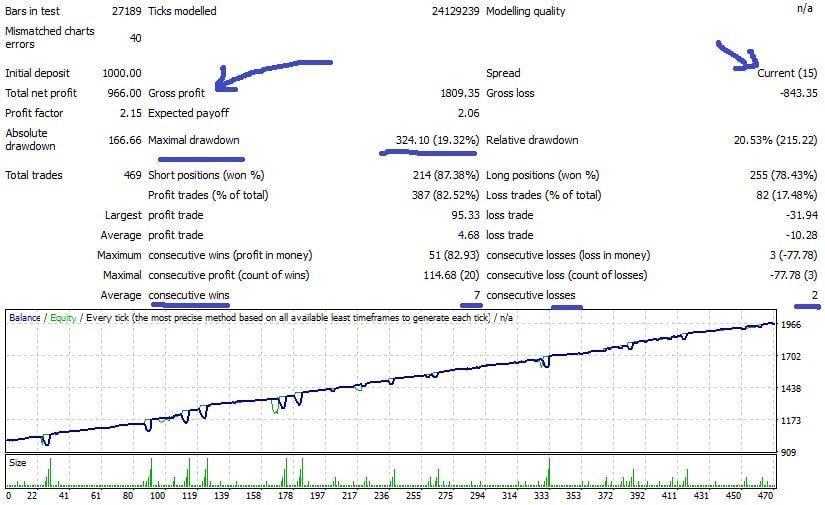

Find below the detailed strategy tester report for the Pioneer EU Mart Killer EA (click on the picture for full-size view).

Key Points

- Total net profit: $966

- Initial deposit: $1000

- Average consecutive wins: 7

- Average consecutive losses: 2

Backtest data shows the EA turned a $1,000 deposit into approximately $1,966, which is about a 97% return over 469 trades.

On average, it yielded 7 consecutive wins and 2 consecutive losses, with a relative drawdown near 19%.

This reflects strong trade frequency and a consistent risk–reward profile.

Trading Chart

The picture below shows the Pioneer EU Mart Killer EA attached to the Euro / U.S. Dollar 5-minute chart.

How the EA Works

- Calculates trend direction using two moving averages.

- Identifies overbought/oversold zones via envelope bands.

- Confirms momentum using Ichimoku elements like the Kumo and Tenkan/Senkou.

- Executes trades when all conditions align.

- Manages risk using stop loss, take profit, and trailing settings.

- Scalable to other pairs or timeframes with parameter adjustment.

Download Now

Download the “Pioneer EU Mart Killer.ex4” EA

Parameters & Settings

- Hedging (enabled/disabled)

- Maximum Orders

- Start Lot Size

- Take Profit (pips)

- Stop Loss (pips)

- Distance (entry threshold)

- Trailing Stop & Trailing Pips

- Magic Number (for managing instances)

Recommended Trading Setup

- Symbol: EUR/USD (preferred), others optionally.

- Timeframes: M5 or M15 for optimal performance.

- Account Type: Start on demo, then move to real accounts.

- Balance: At least $300 minimum recommended.

- Broker: Low-latency, tight-spread MT4 broker favored.

- VPS: Consider using VPS for reliable, uninterrupted operation.

- Risk Management: Adjust lot size and parameters conservatively at first.

FAQ

Which pair and timeframes work best?

EUR/USD performs best, especially on M5 and M15 charts, but you can test other pairs.

How high is the drawdown?

Backtests indicate around 19% relative drawdown during historical performance.

How many trades does it make?

In the sample backtest, it made 469 trades—showing it’s an active trading strategy.

Should I test it on demo first?

Absolutely. Start on a demo account until you understand how it behaves under live conditions.

Summary

The Pioneer EU Mart Killer EA (MT4) offers a powerful combination of moving averages, envelopes, and Ichimoku confirmation to capture trend-based opportunities on EUR/USD.

With nearly 100% gain over 469 trades and a manageable drawdown, it stands out as both aggressive and configurable.

Download it free and begin testing on a demo to find the right balance between performance and risk for your trading plan.