About the Power of EUR Indicator

The Power of EUR indicator for Metatrader 4 measures the relative strength of the Euro major currency in real time.

It shows whether the Euro is gaining or losing momentum against other currencies, giving traders a clear view of market direction.

When the indicator’s strength line is above the 0.00 level, the Euro is considered strong.

When it is below 0.00, the Euro is considered weak.

Traders can use this information to pair the Euro with weaker currencies on buys or stronger currencies on sells.

This indicator works on any time frame and on any Forex pair that includes the Euro.

It can be used as a standalone decision tool or combined with other technical analysis for entry confirmation.

Free Download

Download the “Power_of_EUR.ex4” Metatrader 4 indicator

Key Features

- Measures the relative strength of the Euro in real time.

- The zero line at 0.00 clearly separates strength and weakness.

- Helps match strong vs weak currency pairs.

- Works on all EUR-based Forex pairs.

- Suitable for all timeframes from scalping to swing trading.

- Can be combined with other analysis tools for confirmation.

- Easy to interpret, even for beginner traders.

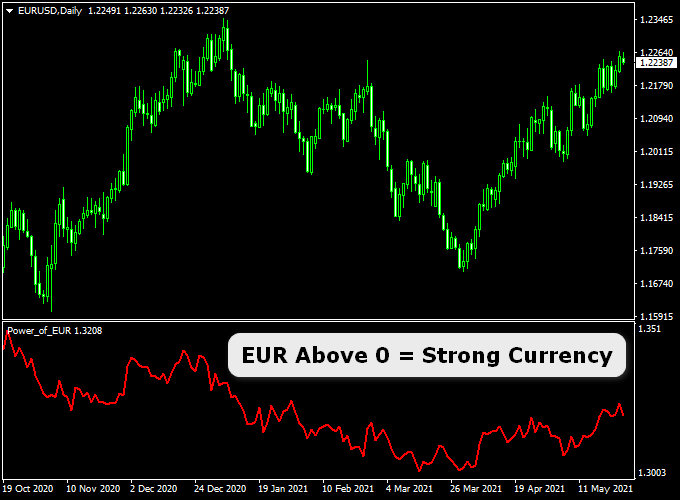

Indicator Chart

Example chart showing the Power of EUR indicator displayed in a separate window beneath the main price chart.

When the strength line crosses above 0.00, the Euro is gaining strength.

When it crosses below 0.00, the Euro is losing strength.

Guide to Trade with the Power of EUR Indicator

Buy Rules

- Wait for the Power of EUR line to cross above the 0.00 level.

- Ensure the counter currency shows relative weakness.

- Open a buy trade on the selected Euro pair once both conditions align.

Sell Rules

- Wait for the Power of EUR line to cross below the 0.00 level.

- Ensure the counter currency shows relative strength.

- Open a sell trade on the selected Euro pair once both conditions align.

Stop Loss

- Place the stop loss 3 pips above recent intraday resistance for sell signals.

- Place the stop loss 3 pips below recent intraday support for buy signals.

Take Profit

- Close the trade at a minimum reward-to-risk ratio of 2.5.

- Alternatively, use your own take profit method based on market structure.

Power of EUR + Zero Lag MACD Forex Scalping Strategy

This scalping strategy uses the Power of EUR Indicator for MT4 and the Zero Lag MACD Indicator for MT4.

The first indicator tracks the relative strength of the euro:

You open a buy trade when the Power of EUR crosses above the 0.00 level (indicating EUR strength vs the counter currency) and open a sell when it crosses below 0.00 (indicating EUR weakness).

The second indicator shows momentum: when its histogram is above zero, it signals bullish momentum, when below zero, it signals bearish momentum.

This dual-filter setup is ideal for fast scalps on M5 or M15 time frames, using pairs where the euro is paired with a weaker or stronger currency.

Buy Entry Rules

- The Power of EUR indicator crosses above the 0.00 level, showing euro strength versus the counter currency.

- The Zero Lag MACD histogram turns above zero, confirming bullish momentum.

- Check that the counter-currency in the pair is relatively weak (so the trade has a directional bias).

- For example, in EURAUD, when AUD shows weakness.

- Enter a buy trade when both conditions occur on the same or consecutive candles on the M5 or M15 chart.

- Set stop loss about 10-15 pips below the recent swing low (on M5) or 15-25 pips (on M15), depending on volatility.

- Set take profit target of 20-40 pips (M5) or 40-60 pips (M15)

- Or exit when either the Power of EUR crosses back below 0.00 or the Zero Lag MACD histogram drops below zero.

Sell Entry Rules

- The Power of EUR indicator crosses below the 0.00 level, indicating euro weakness versus the counter currency.

- The Zero Lag MACD histogram falls below zero, confirming bearish momentum.

- Ensure the counter-currency is relatively strong (so the pair has momentum in your direction), for example, EURCAD when CAD strength is evident.

- Enter a sell trade once both signals align on the M5 or M15 time frame.

- Set stop loss approximately 10-15 pips above the recent swing high (M5) or 15-25 pips (M15) per volatility.

- Set take profit target of 20-40 pips (M5) or 40-60 pips (M15)

- Or exit when the Power of EUR crosses above 0.00 or the MACD histogram turns above zero.

Advantages

- Combines currency-strength reading (Power of EUR) with momentum confirmation (Zero Lag MACD) for higher probability entries.

- Scalping setup promises quick trades and reduced overnight exposure; it fits active day traders.

- Clear visual signals: crossing zero for the strength meter and histogram above/below zero for MACD make it easy to scan charts.

- Suitable for major EUR pairs with high liquidity (e.g., EURJPY, EURAUD, EURCAD), which aids execution and tighter spreads.

Drawbacks

- The strategy requires the counter-currency to show clear strength or weakness. If both currencies move similarly, signals lose reliability.

- The Zero Lag MACD reduces lag but may still react late during fast market moves, occasionally causing late entries or exits.

Case Study 1: EURJPY M5 Setup

During the London session, the Power of EUR indicator crossed above 0.00, signalling euro strength.

At the same time, the EURJPY chart on M5 showed the Zero Lag MACD histogram crossing above zero.

The trader entered a buy at 157.20 with a stop loss at 157.05 (15 pip stop).

Price moved swiftly to 157.60, giving a 40-pip profit before the MACD histogram dropped back below zero and triggered the exit.

Case Study 2: EURCAD M15 Setup

In the New York session, the Power of EUR dropped below 0.00, indicating euro weakness, while CAD was showing strength via the strength meter on other pairs.

On EURCAD M15, the Zero Lag MACD histogram fell below zero.

The trader sold at 1.4200 with a stop loss at 1.4218 (18 pips).

Price declined to 1.4145 within the next 30 minutes, securing a 55-pip gain before the strength indicator crossed back up and the MACD histogram approached zero.

Strategy Tips

- Always confirm that the EUR’s strength or weakness on the Power of EUR indicator matches the general market sentiment.

- When possible, use additional confirmation, such as a simple moving average or a trendline, to verify trend direction before entering a scalp trade.

- Focus on currency pairs with strong volatility and tight spreads like EURJPY, EURUSD, and EURAUD. These pairs tend to deliver faster movements and cleaner setups.

- Monitor the first 2–3 candles after entry. If the price doesn’t move at least halfway to your target, close early to reduce the risk of a reversal.

- Use trailing stops once the trade moves in your favor by 20–25 pips. This locks in profits while allowing further gains if momentum continues.

- Avoid trading during the last hours of the New York session when liquidity drops and signals become less reliable.

- Check upcoming economic events such as ECB speeches or high-impact EUR data releases; avoid entering new trades shortly before them..

Download Now

Download the “Power_of_EUR.ex4” MT4 indicator

FAQ

Which currency pairs work best with this indicator?

Pairs that include the Euro, such as EUR/USD, EUR/GBP, EUR/JPY, and EUR/AUD, tend to show the clearest strength vs weakness relationships.

Is this indicator suitable for all time frames?

Yes. The Power of EUR indicator can be applied from M1 up through daily and weekly charts.

Lower time frames produce more frequent signals, while higher time frames provide stronger trends.

How should the Euro weakness or strength be confirmed?

While the indicator shows relative strength, many traders pair it with confirmation tools such as moving averages, price action patterns, or support and resistance.

Summary

The Power of EUR indicator for MT4 provides a clear measure of Euro strength and helps traders match the Euro against weak or strong currencies.

It simplifies pair selection and supports strength-based decision making.

The indicator works across all EUR pairs and time frames.

When paired with disciplined risk management and confirmation tools, it supports structured and consistent trading decisions.