About the RAVI Forex Oscillator Indicator

The RAVI Forex Oscillator indicator for MT4 is a momentum-based tool designed to highlight rapid shifts in market direction.

It focuses on short-term price behavior and helps traders react quickly when conditions change.

This makes it especially useful for scalpers and active day traders who rely on timely entries and exits.

The indicator is plotted in a separate chart window and uses a single oscillating line.

This line moves above and below a neutral reference level to reflect bullish or bearish momentum.

When momentum strengthens in one direction the oscillator responds immediately.

RAVI works best in active market sessions where price movement is consistent.

The simple design allows traders to stay focused on execution rather than interpretation.

Free Download

Download the “RAVI.mq4” indicator for MT4

Key Features

- A momentum-based oscillator focused on short-term price movement.

- Neutral level reference to identify bullish and bearish pressure.

- Well suited for scalping and intraday strategies.

- Single-line display for fast decision making.

- Compatible with all MT4 trading instruments.

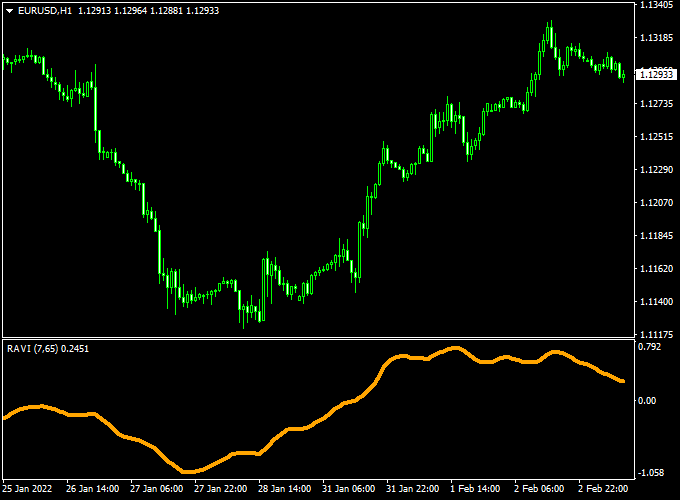

Indicator Chart

The RAVI Forex Oscillator indicator is displayed in a separate window below the main price chart.

The chart shows an orange line fluctuating around the neutral level.

Moves above the reference level reflect strengthening bullish momentum.

Moves below the level signal increasing bearish pressure and possible short-term continuation.

Guide to Trade with the RAVI Forex Oscillator Indicator

Buy Rules

- Monitor the oscillator as it approaches the neutral level from below.

- Wait for the line to move decisively into positive territory.

- Enter the buy trade after momentum confirms upward strength.

Sell Rules

- Watch the oscillator as it rises toward the neutral level from above.

- Wait for the line to turn lower and move into negative territory.

- Open the sell trade once bearish momentum is established.

Stop Loss

- Set the stop loss a few pips beyond the recent consolidation area.

- Adjust the stop size based on current market volatility.

Take Profit

- Target a fixed pip objective that matches the active trading session.

- Close the position when the oscillator returns toward the neutral level.

- Secure profits early if price momentum starts to fade.

Ravi Oscillator + Zero Lag MACD Forex Scalping Strategy

This scalping strategy combines the Ravi Forex Oscillator Indicator with the Zero Lag MACD Indicator to catch short-term price movements.

The Ravi Oscillator signals entries when the orange line crosses above 0.00 for buys and below 0.00 for sells.

The Zero Lag MACD confirms trend direction: a histogram above 0 indicates a bullish trend and below 0 indicates a bearish trend.

Combining both helps traders enter trades in alignment with the trend while spotting quick scalping opportunities.

This strategy works best on 5-minute and 15-minute charts during active trading sessions.

It is suitable for volatile pairs such as EUR/GBP, USD/JPY, and AUD/USD.

Buy Entry Rules

- Wait for the orange Ravi Oscillator line to cross back above the 0.00 level from below.

- Confirm that the Zero Lag MACD histogram is above 0, indicating a bullish trend.

- Enter a buy trade at the close of the confirmation candle.

- Set a stop loss 10–15 pips below the recent swing low or the last support level.

- Set take profit 15–25 pips or exit when the histogram turns negative or the oscillator crosses below 0.00.

Sell Entry Rules

- Wait for the orange Ravi Oscillator line to cross back below the 0.00 level from above.

- Confirm that the Zero Lag MACD histogram is below 0, indicating a bearish trend.

- Enter a sell trade at the close of the confirmation candle.

- Set a stop loss 10–15 pips above the recent swing high or the last resistance level.

- Set take profit 15–25 pips or exit when the histogram turns positive or the oscillator crosses above 0.00.

Advantages

- Combines momentum reversal signals with trend confirmation for higher-probability trades.

- Can be used on multiple currency pairs with reliable intraday volatility.

- Works well for both 5-minute and 15-minute scalping charts.

- Helps traders avoid entering trades against the main trend.

- Easy to interpret, even for traders new to oscillators and MACD.

Drawbacks

- Oscillator signals can produce false entries in choppy or range-bound markets.

- The MACD histogram may lag slightly, delaying confirmation in fast trends.

- Frequent small losses may occur if trades are not filtered properly by trend confirmation.

Example Case Study 1 – EUR/GBP

On the M5 chart, the orange Ravi Oscillator crossed above 0.00 at 0.8572, with the Zero Lag MACD histogram above 0.

A buy trade was entered at 0.8573, stop loss at 0.8560, and take profit at 0.8595.

The trade reached the target within 22 minutes, gaining +22 pips.

Example Case Study 2 – AUD/USD

On the M15 chart, the orange Ravi Oscillator crossed below 0.00 at 0.6785, with the Zero Lag MACD histogram below 0.

A sell trade was entered at 0.6783, stop loss at 0.6798, and take profit at 0.6765.

The trade hit the target within 35 minutes, yielding +18 pips.

Strategy Tips

- Only take trades when both the Ravi Oscillator and Zero Lag MACD confirm direction.

- Focus on high-volatility sessions to maximize scalping effectiveness.

- Consider using a trailing stop if the trade moves quickly in your favor.

- Backtest the strategy on different currency pairs to identify which respond best to oscillator and trend alignment.

- Maintain a trading journal to track entry timing and adjust pip targets based on volatility.

Download Now

Download the “RAVI.mq4” indicator for Metatrader 4

FAQ

What type of trader benefits most from the RAVI indicator?

RAVI is ideal for traders who focus on short-term opportunities.

Scalpers and day traders benefit most from its fast reaction.

Does RAVI work well in sideways markets?

The indicator performs best when price shows consistent movement.

Choppy conditions may reduce signal quality.

Can RAVI be combined with trend filters?

Yes, using a higher time frame trend filter can improve entry accuracy.

This helps align trades with broader market direction.

Does the indicator repaint signals?

Signals are based on live momentum changes.

Once a move is confirmed, the oscillator does not repaint past values.

Summary

The RAVI Forex Oscillator indicator for MT4 offers a direct way to trade short-term momentum.

Its neutral level logic helps traders identify shifts in buying and selling pressure.

The indicator suits active trading styles that require fast confirmation.

Its simple visual layout supports quick execution.

With disciplined risk control and proper market selection, RAVI can support consistent scalping and intraday trading performance.