The Reversal Stop Signal forex indicator for MT4 searches and displays possible trend reversal points in the currency trend.

It’s a great indicator used to find short-term trading opportunities. Scalpers and intraday traders can benefit from this indicator.

The Reversal Stop Signal forex indicator draws green and red bullets on the chart.

A green bullet suggests the short-term trend reverses from bearish to bullish.

On the contrary, a red bullet suggests the short-term trend reverses from bullish to bearish.

For more reliable scalping and intraday signals, use this Metatrader 4 indicator in agreement with a longer-term trend following indicator and trade in the direction of the underlying trend.

For instance, use together with 100 period exponential moving average.

Price above the 100 period exponential moving average? Trade the green bullets and ignore the red bullets.

Price below the 100 period exponential moving average? Trade the red bullets and ignore the green bullets.

Free Download

Download the “bb-stops-v2-indicator.mq4” MT4 indicator

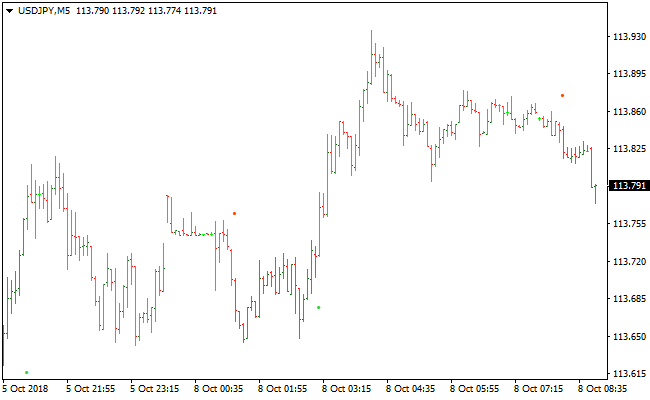

Indicator Chart (USD/JPY M5)

The USD/JPY 5-Minute chart below displays the Reversal Stop Signal Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the Reversal Stop Signal MT4 forex indicator are easy to interpret and go as follows:

Buy Signal: Open a short-term buy trade when the Reversal Stop Signal draws a green bullet on the chart. Confirm the overall bullish trend with a trend following indicator.

Sell Signal: Open a short-term sell trade when the Reversal Stop Signal draws a red bullet on the chart. Confirm the overall bearish trend with a trend following indicator.

Trade Exit: Use your own method of trade exit.

Reversal Stop Signal + Renko Boxes MT4 Trading Strategy

This MT4 strategy combines the precision of the Reversal Stop Signal indicator with the clear price structure delivered by the Renko Boxes indicator.

Both indicators complement each other, making this setup suitable for day traders and swing traders who prefer simple chart reading without unnecessary noise.

The Reversal Stop Signal plots green and red bullets that mark potential turning points.

The Renko Boxes show clean bullish and bearish momentum by painting blue boxes for upward movement and red boxes for downward movement.

Together, they help traders filter signals, confirm trend direction and execute trades with confidence.

This strategy works well on M15, M30 and H1 charts, but can also be applied on higher time frames for more conservative trading.

Buy Entry Rules

- The Reversal Stop Signal plots a green bullet on the chart.

- The Renko Boxes show a blue box at the same moment or one box after the signal.

- Wait for the candle to close to avoid early entries.

- Stop loss goes below the most recent swing low.

- Take profit at the next Renko structure level or after a fixed number of pips, such as 25 to 40 depending on volatility.

Sell Entry Rules

- The Reversal Stop Signal plots a red bullet on the chart.

- The Renko Boxes show a red box confirming bearish momentum.

- Wait for the candle to close before opening the trade.

- Stop loss goes above the latest swing high.

- Take profit at the next Renko barrier or after 25 to 40 pips.

Advantages

- Easy to read because both indicators give visual and direct signals.

- Works well in trending phases when Renko structures clearly expand.

- Can be applied on multiple time frames without changing the logic.

- Filters out weak signals because both indicators must agree before opening a trade.

Drawbacks

- Flat markets may produce small boxes and more false signals.

- Requires discipline to wait for candle close confirmation.

- Stop losses may be wide on higher time frames.

- Strong news releases can invalidate Renko box formations quickly.

Example Case Study 1

On EURUSD M30, the Reversal Stop Signal printed a green bullet after a short pullback.

The Renko Boxes immediately shifted to blue, showing renewed bullish strength.

A buy trade was opened at the close of the signal candle.

The stop loss was placed below the previous swing low and the take profit target was set slightly above the next Renko structure.

Price continued in the same direction and delivered a gain of about 38 pips before momentum slowed.

Example Case Study 2

On GBPJPY H1, a red bullet appeared during a strong bearish phase.

A new red Renko box formed shortly after, confirming the downward movement.

A sell position was placed at the close of the signal candle.

Within the next hours price produced several consecutive red Renko boxes and moved deeper into the trend.

The trade reached its target for a profit of roughly 52 pips before the market retraced.

Strategy Tips

- Wait for at least two consecutive Renko boxes in the same direction to strengthen the confirmation before entering a trade.

- Consider reducing position size when trading during low liquidity sessions because Renko structures may form more slowly.

- Trail the stop loss below each new swing for buys or above each new swing for sells to lock in profits during strong moves.

- If the first Renko box after a signal is very small, skip the trade and wait for a clearer push in the expected direction.

- Mark major support and resistance zones to avoid entering directly into heavy price barriers.

- Use only one trade per signal to avoid overexposure during ranging market conditions.

- Check the economic calendar and avoid entering new trades shortly before major announcements.

- Practice on a demo account first to understand how Renko price flow behaves on your chosen time frame.

Download Now

Download the “bb-stops-v2-indicator.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Time frame, Bands period, Bands deviation, Bands average type, Alerts?) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Trend Reversal