About the RSI MA EA Expert Advisor

The RSI MA EA MetaTrader 4 Forex Robot is a reliable algorithmic trading system that has been successfully operating since 2015.

This Expert Advisor combines the Moving Average trend with the Relative Strength Index (RSI) to identify overbought and oversold conditions in the market.

Unlike many automated systems, the RSI MA EA does not rely on fixed profit targets.

Instead, it exits trades based on early profit opportunities, aiming to maximize gains while minimizing unnecessary risk.

Free Download

Download the “MA-RSI-EA.mq4” MT4 robot

Key Features

RSI and MA-Based Trading Logic

The EA enters trades when the RSI indicates overbought or oversold conditions, and the price aligns with the Moving Average, ensuring trades are in the direction of the prevailing trend.

Multiple Timeframe Compatibility

The RSI MA EA operates across various timeframes, allowing traders to implement strategies ranging from scalping to long-term trading.

Customizable Input Parameters

Users can adjust settings such as lot size, Moving Average period, RSI period, and overbought/oversold levels to tailor the EA to their trading preferences.

Automated Trade Execution

The EA automatically executes trades based on the defined criteria, minimizing the need for manual intervention and ensuring timely entries and exits.

Strategy Tester Report

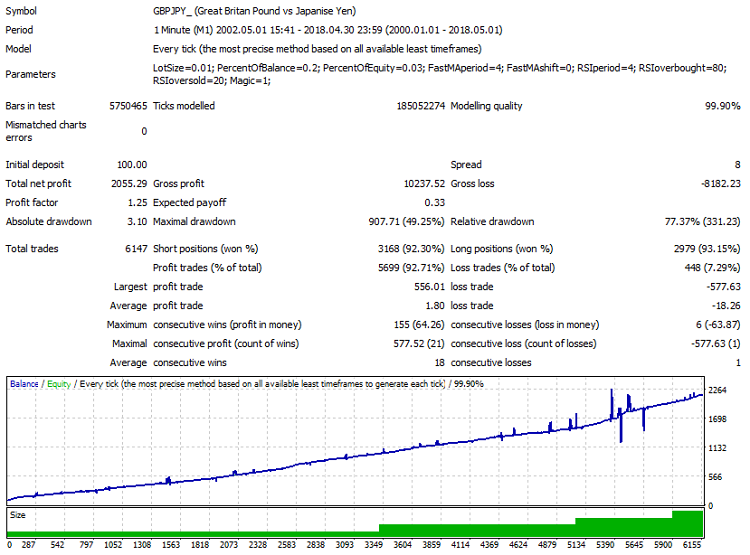

Find below the RSI MA EA forex robot strategy tester report for the GBP/JPY forex pair on the 1-minute chart.

Performance Highlights

The EA made a total profit of $2055.29 from a total of 6147 trades.

The largest winning trade generated $556.01 in profits, while the largest losing trade generated a loss of $577.63.

Statistics:

Bars in test: 5750465 ticks modelled

Initial deposit: $100.00

Total net profit: $2055.29

Total trades: 6147

Largest profit trade: $556.01

Largest loss trade: -$577.63

Consecutive wins: 18

Consecutive losses: 1

How the EA Works

- Monitors RSI for overbought (>70) and oversold (<30) conditions.

- Checks if the price is above or below the Moving Average.

- Enters a buy trade when RSI is below 30 and price is above the MA.

- Enters a sell trade when RSI is above 70 and price is below the MA.

- Exits trades based on predefined profit targets or opposite signals.

Download Now

Download the “MA-RSI-EA.ex4” Metatrader 4 robot

Parameters & Settings

- Lot Size: Define the trade volume per order.

- MA Period: Set the period for the Moving Average.

- RSI Period: Configure the period for the Relative Strength Index.

- RSI Overbought Level: Set the overbought threshold for RSI.

- RSI Oversold Level: Set the oversold threshold for RSI.

- Magic Number: Assign a unique identifier for the EA’s trades.

Recommended Trading Setup

- Use with major currency pairs like EUR/USD, GBP/USD, or USD/JPY.

- Test on a demo account before live trading.

- Monitor performance and adjust settings as needed.

- Ensure a stable internet connection and VPS for uninterrupted operation.

FAQ

Can I use the RSI MA EA on any currency pair?

Yes, the RSI MA EA is compatible with any currency pair, but it is recommended to test on major pairs for optimal performance.

Is the RSI MA EA suitable for all timeframes?

The EA supports multiple timeframes, allowing traders to adapt it to their preferred trading style, from scalping to long-term trading.

Can I customize the input parameters?

Yes, the RSI MA EA offers customizable settings, including lot size, MA period, RSI period, and overbought/oversold levels, to suit individual trading preferences.

Is there a risk of overtrading with this EA?

The EA is designed to trade based on specific conditions, reducing the likelihood of overtrading. However, proper risk management practices should always be followed.

Summary

The RSI MA EA for MetaTrader 4 is a versatile and automated trading solution that combines the Relative Strength Index and Moving Average indicators to identify optimal trading opportunities.

While it operates autonomously, regular monitoring and proper risk management are essential to maximize its potential.