About the SilverFox Expert Advisor

The Silverfox EA for Metatrader 4 is a very active Forex robot that opens between 20 and 60 trades a day.

The verified MyfxBook track record shows that the Silverfox EA made a +86.74% gain on the account.

In essence, the expert advisor takes advantage of small price fluctuations in trends using a proprietary trading strategy.

Silverfox is optimized to trade the EUR/USD pair, but should work for other currency pairs too.

The EA has a lot of parameters that can be easily customized. For example, you can choose between fixed lots and auto lots.

As always, please try the EA on a demo account first until you fully understand how it works and how it performs over an extended period of time.

Free Download

Download the “SilverFox.ex4” expert advisor

Key Features

High-Frequency Trading

Executes between 20 and 60 trades daily, taking advantage of short-lived opportunities.

Significant Verified Gain

Reported gain of +86.74% on MyfxBook, demonstrating solid performance in live or demo environments.

Trend-Based Micro Entries

Targets quick, small fluctuations in trending markets to build profits over volume.

Flexible Position Sizing

Choose between fixed lots or dynamic auto-lots for scalable trade sizing.

Customizable Trading Window

Adjust start and end times to focus on active trading sessions and avoid low liquidity periods.

Versatile Pair & Timeframe Compatibility

Primarily optimized for EUR/USD, but adaptable to other pairs and any timeframe as needed.

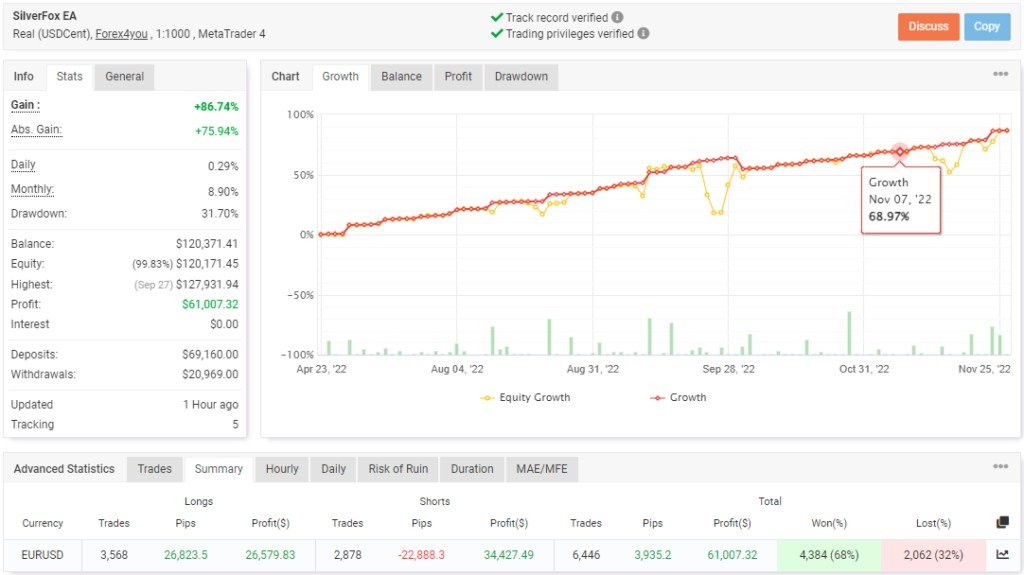

MyFXBook Trading Results

Find below the detailed MyfxBook verified track record for the Silverfox EA (click on the picture for full-size view).

Key Points

- Gain: +86.74%

- Monthly gain: 8.90%

- Profit: $61,007.32

The MyfxBook-verified account shows a +86.74% gain, underscored by high trade frequency and consistent trend exploitation.

Monthly gains aggregated to around 8.9%, yielding over $61,000 in profit across tested periods.

These results reflect a robust application of the strategy, though performance can vary; hence, demo testing is essential.

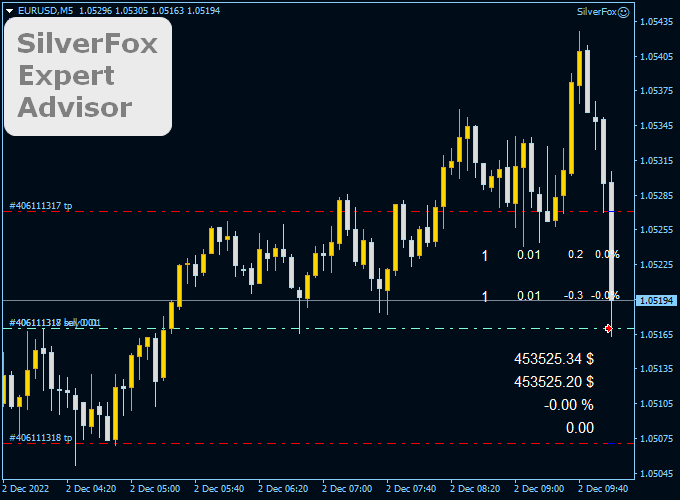

Trading Chart

The picture below shows the Silverfox EA attached to the Euro / U.S. Dollar 5-minute chart.

How the EA Works

- Monitors EUR/USD for trending micro-movements.

- Opens multiple trades per day—20 to 60—targeting small fluctuations.

- Uses either fixed or automatic lot sizing based on your input.

- Allows you to define trading hours to align with your session preferences.

- Adapts to any pair and timeframe, though optimized for EUR/USD.

Download Now

Download the “SilverFox.ex4” EA

Parameters & Settings

- Start of Trading Time

- End of Trading Time

- Friday Take Profit Closure

- Primary Timeframe / Secondary Timeframe

- Starting Lot Size

- Maximum Order Lot

- Take Profit & Stop Loss (TP/SL)

- Drawdown Lock Percentage

- Unique Magic Number

- Lot Mode (Fixed or Auto)

Recommended Trading Setup

- Symbol: EUR/USD (optimal liquidity and execution).

- Timeframe: Any, depending on your broker’s speed and spread—M1–H1 all viable.

- Account Type: Begin with a demo; then consider live once confident.

- Minimum Balance: Starting from $200 as a baseline for stability.

- Broker: Preferably low-latency with tight spreads on EUR/USD.

- VPS: Recommended for uninterrupted operation in fast markets.

- Risk Control: Start with conservative lot sizes until performance is proven.

FAQ

What gain did it achieve?

It recorded an 86.74% gain in a verified MyfxBook account with high trade frequency.

How many trades per day?

The EA can execute between 20 and 60 trades per day, depending on market conditions.

Can I use other currency pairs or timeframes?

Yes—while optimized for EUR/USD, the EA supports any pair or timeframe.

Should I demo test first?

Absolutely. Always test on demo to understand behavior before going live.

Summary

The SilverFox Expert Advisor (MT4) is an aggressive, high-frequency Forex robot targeting small, consistent gains on EUR/USD.

With a solid verified gain of +86.74%, flexible parameters, and wide adaptability, it’s suited to traders comfortable with active automation.

Download it for free, demo test thoroughly, and tailor the settings to match your broker and risk appetite before live deployment.