About the Simple Forex Major Range Breakout Indicator

The Simple Forex Major Range Breakout indicator for MT4 is designed to help traders capture strong price movements when the market escapes a defined range.

Instead of guessing breakout zones, the indicator calculates and plots two important price levels directly on the chart.

These levels are derived from higher time frame data to reflect broader market participation.

By relying on higher time frame calculations, the indicator focuses on meaningful breakout areas rather than short-term noise.

When price reaches these levels, traders can prepare for potential expansion in volatility.

This approach suits traders who prefer trading momentum rather than waiting for pullbacks.

The indicator is easy to interpret and works across all major currency pairs.

It performs well during active trading sessions when price is more likely to break out with strength.

Simple Forex Major Range Breakout can be used on its own or combined with trend confirmation tools.

Free Download

Download the “range breakout.mq4” indicator for MT4

Key Features

- Automatically plots major breakout levels on the chart.

- Uses higher time frame data for more reliable price zones.

- Designed for momentum and breakout trading strategies.

- Works on all currency pairs and most time frames.

- Helps traders avoid low-quality range-bound conditions.

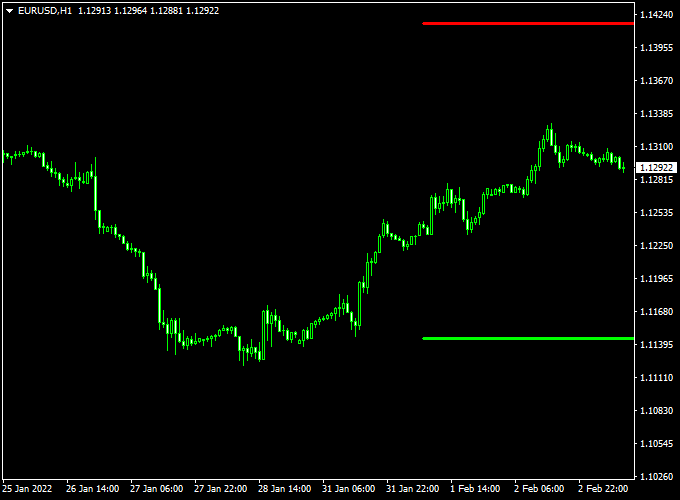

Indicator Chart

The Simple Forex Major Range Breakout indicator is displayed directly on the main MT4 chart.

The chart shows two horizontal price levels that define the upper and lower breakout zones.

When price moves beyond these levels, it signals potential expansion in the corresponding direction.

This visual layout allows traders to react quickly to breakout opportunities.

Guide to Trade with the Simple Forex Major Range Breakout Indicator

Buy Rules

- Wait for the price to approach the upper breakout level.

- Confirm that the price closes decisively beyond the marked level.

- Enter the buy trade after the breakout candle completes.

Sell Rules

- Observe price movement near the lower breakout zone.

- Look for a strong close below the breakout level.

- Open the sell trade once downside momentum is confirmed.

Stop Loss

- Place the stop loss back inside the previous range.

- Keep the stop beyond the breakout level to avoid false moves.

Take Profit

- Target a fixed pip objective based on recent volatility.

- Trail the stop loss as the price continues to expand.

- Exit the trade if price re-enters the breakout range.

Simple Major Range Breakout + Pure Pivot Points MT4 Day Trading Strategy

This day trading strategy combines the breakout signals of the Simple Forex Major Range Breakout Indicator with the trend confirmation of the Pure Pivot Points Forex Indicator.

The breakout indicator signals entries when the price crosses key range levels—above the red line for a buy and below the green line for a sell.

The pivot point indicator confirms trend direction: price above the pivot is bullish, and price below is bearish.

Using both ensures trades are taken in the direction of prevailing intraday momentum.

This strategy is best applied to M15 and M30 charts during high-volume trading sessions like London and New York.

It works well on major pairs such as EUR/USD, GBP/USD, and USD/JPY.

Buy Entry Rules

- Wait for the price to cross above the red price level line from the breakout indicator.

- Confirm that the price is above the current pivot point, indicating bullish momentum.

- Enter a buy trade at the close of the breakout candle.

- Set a stop loss below the breakout level or recent swing low.

- Set take profit based on risk-reward ratio (1:1.5 or 1:2) or exit if price closes below the pivot point.

Sell Entry Rules

- Wait for the price to cross below the green price level line from the breakout indicator.

- Confirm that the price is below the current pivot point, indicating bearish momentum.

- Enter a sell trade at the close of the breakout candle.

- Set a stop loss above the breakout level or recent swing high.

- Set take profit based on risk-reward ratio or exit if price closes above the pivot point.

Advantages

- Combines breakout entries with pivot point trend confirmation for higher probability trades.

- Clear visual indicators simplify entry and exit decisions.

- Works on multiple currency pairs with active intraday movement.

- Can be applied to both M15 and M30 charts, allowing flexibility in trading style.

- Helps filter false breakouts by confirming pivot point trend direction.

Drawbacks

- Breakouts can fail during low volatility or sideways markets, causing false entries.

- Pivot point may lag in sudden intraday reversals, leading to premature exits.

Example Case Study 1 – EUR/USD

On the M15 chart, price crossed above the red breakout line at 1.1095.

The pivot point was at 1.1088, confirming bullish momentum.

A buy trade was entered at 1.1096, stop loss at 1.1085, and take profit at 1.1115.

The trade hit the target within 30 minutes, gaining +19 pips.

Example Case Study 2 – GBP/USD

During the New York session, the price crossed below the green breakout line at 1.3120.

The pivot point was at 1.3125, confirming bearish momentum.

A sell trade was entered at 1.3118, stop loss at 1.3135, and take profit at 1.3095.

The trade reached the target within 45 minutes, yielding +23 pips.

Strategy Tips

- Enter trades only when the breakout level and pivot point trend confirm each other.

- Focus on high-liquidity sessions to improve breakout reliability.

- Use tight stop losses to protect against false breakouts.

- Consider trailing stops to lock in profits if the price moves strongly after the breakout.

- Adjust take profit targets according to pair volatility and intraday range.

Download Now

Download the “range breakout.mq4” indicator for Metatrader 4

FAQ

What market conditions suit this indicator best?

The indicator works best during periods of consolidation followed by expansion.

It is designed for markets preparing for strong directional moves.

Which time frames are recommended?

It can be applied to intraday and swing time frames.

M15 and above usually provide more stable breakout behavior.

Does the indicator repaint breakout levels?

The breakout levels are recalculated based on higher time frame data.

Once plotted, they remain stable until the next calculation cycle.

Can it be combined with trend filters?

Yes, combining it with a trend filter can help trade breakouts in the dominant direction.

This can improve overall trade quality.

Summary

The Simple Forex Major Range Breakout indicator for MT4 offers a focused approach to breakout trading.

It highlights key price levels and helps traders prepare for volatility expansion.

Its higher time frame logic supports more meaningful trade decisions.

The indicator encourages patience while waiting for price to commit beyond important zones.

With disciplined execution and solid risk management, this indicator can support consistent breakout trading across a wide range of market conditions.