About the SMA of RSX Forex Indicator

The SMA of RSX is a custom-built momentum trend oscillator for MT4, designed to help traders identify high-probability buy and sell signals.

The indicator appears in a separate chart window and oscillates between 0 and 100, with 50 as the neutral level.

Crosses above 50 indicate bullish momentum, while crosses below 50 indicate bearish momentum.

The indicator can be used for both trade entry and exit, or combined with other tools to confirm trend direction.

It provides clear signals that are easy to interpret and helps traders act quickly on market momentum without complicated calculations.

Free Download

Download the “Ma of Rsx.mq4” indicator for MT4

Key Features

- Oscillator displayed between 0 and 100 with a 50 neutral level.

- Signals momentum direction with easy-to-read crossovers.

- Can be used for both trade entry and exit.

- Suitable for beginners and advanced traders alike.

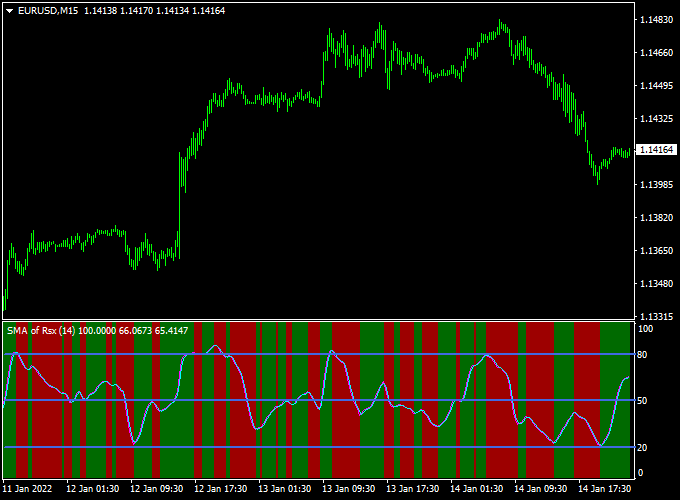

Indicator Chart

The SMA of RSX chart shows an oscillator with values between 0 and 100.

Crosses above the 50 level indicate buy signals, while crosses below indicate sell signals.

The chart provides a clear visual representation of momentum, helping traders time entries and exits effectively.

Guide to Trade with SMA of RSX

Buy Rules

- Open a buy trade when the oscillator crosses above the 50 level from below.

- Confirm bullish momentum with consecutive readings above 50 if desired.

Sell Rules

- Open a sell trade when the oscillator crosses below the 50 level from above.

- Confirm bearish momentum with consecutive readings below 50 if desired.

Stop Loss

- For buy trades, place a stop loss slightly below the 50-level crossover point or below the nearest minor support level.

- For sell trades, place a stop loss slightly above the 50-level crossover point or above the nearest minor resistance level.

Take Profit

- Close the trade when the oscillator crosses back across the 50 level in the opposite direction.

- Alternatively, set take profit near key support or resistance levels for the pair being traded.

- Use a trailing stop to capture extended momentum if the trend is strong.

Practical Tips

- Wait for full candle confirmation after a crossover before entering.

- Check higher time frames to align trades with the overall market trend.

SMA of RSX Indicator + SuperTrend MTF Forex Scalping Strategy for MT4

This scalping strategy combines the SMA of RSX Forex Indicator for MT4 with the SuperTrend MTF Forex Signal Indicator for MT4.

Together, they create a precise short-term setup ideal for traders who prefer fast-paced scalping on the M5 and M15 charts.

The SMA of RSX detects early momentum reversals, while the SuperTrend MTF confirms trend direction across multiple time frames.

This combination gives clear visual entries with stronger confirmation and less noise.

Why This Strategy Works

The SMA of RSX works as a momentum filter, signaling shifts in strength when its line crosses the 50 level.

The SuperTrend MTF verifies the overall market direction, allowing traders to enter only when both momentum and trend agree.

This multi-confirmation approach increases accuracy and minimizes false entries that occur during choppy periods.

Buy Entry Rules

- Wait for the SMA of RSX line to move back above the 50 level, showing bullish momentum.

- Confirm that the SuperTrend MTF line is green, indicating an active buy trend.

- Enter a buy trade at the open of the next candle after both signals align.

- Set the stop loss 10 to 15 pips below the latest swing low.

- Take profit after 15 to 25 pips or near the next resistance zone.

Sell Entry Rules

- Wait for the SMA of RSX line to fall back below the 50 level, confirming bearish momentum.

- Ensure that the SuperTrend MTF line is red, confirming a sell trend.

- Enter a sell trade at the open of the next candle after both signals align.

- Place the stop loss 10 to 15 pips above the latest swing high.

- Take profit after 15 to 25 pips or near the next support area.

Advantages

- Easy to follow visual signals suitable for beginners and experienced scalpers.

- Accurate trend confirmation using two independent tools.

- Works effectively on most major currency pairs.

- Provides quick trade setups with a good reward-to-risk ratio.

- Reduces false entries through momentum and trend alignment.

Drawbacks

- Less effective during sideways or low-volume markets.

- Requires quick execution and attention on lower timeframes.

- Can produce several signals in volatile sessions, increasing trading frequency.

Case Study 1 – EUR/USD M5

During the early London session, EUR/USD showed a clean bullish alignment.

The SMA of RSX crossed above 50, and the SuperTrend MTF switched to green.

A buy trade at 1.0865 with a stop loss at 1.0850 reached the 1.0890 target within 25 minutes, earning 25 pips.

The setup demonstrated how this combination captures quick, impulsive moves when momentum and trend align perfectly.

Case Study 2 – GBP/JPY M15

In the London–Tokyo overlap, GBP/JPY presented a bearish setup.

The SMA of RSX dropped below 50 while the SuperTrend MTF turned red.

A short entry was taken at 188.45 with a stop at 188.60 and a target at 188.10.

The trade hit the take profit level in under 20 minutes, yielding 35 pips.

This example shows how the method handles volatile pairs effectively.

Strategy Tips

- Use this method on high-liquidity pairs such as EUR/USD, GBP/USD, and USD/JPY.

- Trade only when both indicators clearly agree on direction.

- Avoid entering during news events or low-volume sessions.

- Consider using a trailing stop once the trade moves 15 pips in profit.

- Backtest the system on different timeframes to find your optimal setup.

Download Now

Download the “Ma of Rsx.mq4” indicator for Metatrader 4

FAQ

What time frames are best for this indicator?

It works on all time frames. Higher time frames give stronger signals with less noise, while lower time frames offer more frequent trades but may include false signals.

Does the oscillator repaint?

No. Once a bar closes, the value is fixed. Traders can rely on the signals for live trading without repainting issues.

Can I use it with other strategies?

Yes, the SMA of RSX can complement any trading strategy, helping confirm momentum and timing entries or exits.

Is it suitable for beginners?

Yes. Its simple 50-level crossover system makes it easy for new traders to interpret and act on momentum signals.

Can I trade multiple pairs at the same time?

Yes. The indicator works on any currency pair, allowing traders to monitor multiple markets and capture high-probability signals simultaneously.

Summary

The SMA of RSX MT4 indicator is a reliable momentum oscillator that helps traders identify trend direction and high-probability trade setups.

Crosses above and below the 50 level provide clear signals for entering and exiting trades.

Its simplicity makes it accessible for beginners, while advanced traders can integrate it into existing strategies for added confirmation.

By highlighting momentum shifts in a separate chart window, the SMA of RSX allows traders to make quick, informed decisions and capture profitable market moves efficiently.