About the Stochastic 3‑TF Forex Indicator

The Stochastic 3‑TF Forex Indicator for MT4 combines stochastic oscillators across three timeframes to provide a powerful confirmation tool for entries and trend direction.

Perfect for traders seeking clarity in both trending and ranging markets.

Key Features

- Triple-timeframe analysis: Simultaneously monitors M5, M15, and H1 stochastics

- Clear trend signals: Confirms momentum alignment across multiple timeframes

- Customizable: Adjust %K, %D periods, smoothing, timeframes, and alert types

- Visual alerts: Color-coded markers show convergence/divergence or overbought/oversold levels

- Non-repainting: Signals remain fixed once issued for reliable decision-making

Free Download

Download the “3-stochastic-v6.mq4” indicator for MT4

How It Works

- Timeframe sync: Stochastic values align across M5, M15, and H1

- Signal conditions: Indicates overbought (>80) or oversold (<20) across timeframes, or cross‑signal shifts

- Entry triggers: When all three confirm bullish or bearish momentum, a signal marker appears

Benefits of Using This Indicator

- Filters out noise by requiring multi-timeframe confirmation

- Helps avoid false signals common in single-timeframe methods

- Works well in both trending and ranging conditions

- Supports discipline and patience by waiting for strong alignment

- Compact and non-intrusive on your chart

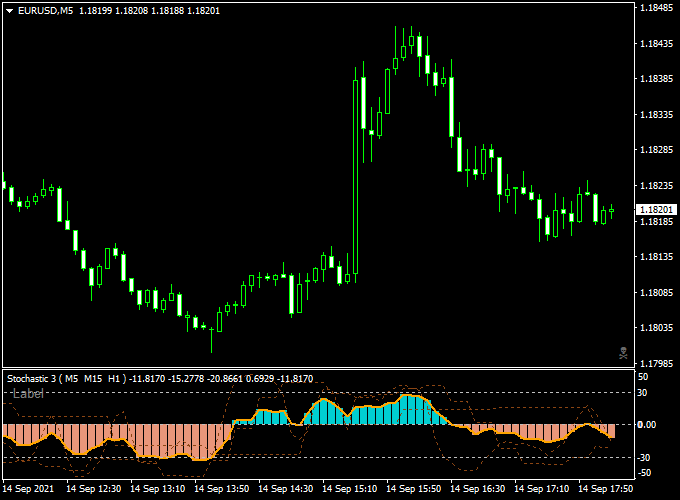

Indicator Example Chart (EUR/USD M5)

How to Trade Using This Indicator

Trading Signals

- Buy: The stochastic indicator is colored blue, above 0.00.

- Sell: The stochastic indicator is colored orange, below 0.00.

Stop‑Loss & Take‑Profit Setup

- Stop‑Loss: For Buy, place just below the recent swing low; for Sell, just above the swing high—typically 5–7 pips away

- Take‑Profit: Use recent swing points, or apply a 2:1 reward-to-risk ratio; consider trailing stop on H1 confirmation

Example Entry

- EUR/USD M15: Stochastics on M5, M15, and H1 cross above 20 → Bullish alignment → signal appears

- Enter Buy at candle close on the M15 chart

- Set Stop‑Loss below last swing low (~X pips)

- Target Take‑Profit near next resistance or at 2:1 reward-to-risk

Download Now

Download the “3-stochastic-v6.mq4” indicator for Metatrader 4

Stochastic 3 TF + Top Ultimate Breakout Strategy for MT4

This strategy combines multi-timeframe momentum confirmation from the Stochastic 3 TF Forex Indicator with breakout detection from the Top Ultimate Breakout Indicator.

It is designed to identify explosive price movements that align with momentum across several timeframes, helping traders enter early and with confidence.

What is this Strategy About?

The Stochastic 3 TF Indicator shows whether stochastic conditions (overbought/oversold) are aligned on 3 different timeframes.

This allows traders to filter out weak setups and only act when momentum is unified.

The Top Ultimate Breakout Indicator identifies high-probability breakout zones based on recent price compression and support/resistance levels.

When a breakout aligns with multi-timeframe stochastic momentum, the result is a high-conviction trade entry with the potential for strong continuation.

This strategy is suitable for intraday and short-term swing trading on M15, M30, and H1 charts.

Buy Setup Rules

- Wait for the Top Ultimate Breakout Indicator to signal an upside breakout zone or a breakout candle.

- Confirm that the Stochastic 3 TF Indicator shows bullish alignment (stochastic not overbought, and pointing up on at least 2–3 timeframes).

- Enter a buy trade after the breakout is confirmed and momentum aligns.

- Stop Loss: Place it just below the breakout zone or last swing low.

- Take Profit: Use a 1:2 or 1:3 risk-reward ratio, or scale out at the next resistance level.

Sell Setup Rules

- Wait for the Top Ultimate Breakout Indicator to mark a downside breakout or a bearish breakout candle.

- Confirm that the Stochastic 3 TF Indicator shows bearish alignment (stochastic not oversold, and pointing down across 2–3 timeframes).

- Enter a sell trade after the breakout candle closes.

- Stop Loss: Set above the breakout zone or the recent swing high.

- Take Profit: Use a fixed RR (1:2 or better), or target the next support zone.

Advantages of the Strategy

- Combines breakout strength with multi-timeframe momentum alignment.

- Reduces false breakouts by requiring momentum confirmation before entry.

- Provides clear visual entries and exits with minimal interpretation needed.

- Adaptable to trending or volatile market conditions.

Drawbacks

- Fewer setups due to strict multi-timeframe confirmation.

- Stochastic signals may lag slightly during fast-moving breakouts.

- Not ideal in choppy or range-bound markets where breakouts often fail.

Strategy Conclusion

The Stochastic 3 TF + Top Ultimate Breakout Strategy offers a strong combination of momentum and structure.

By entering trades when breakouts are backed by multi-timeframe stochastic strength, traders can avoid false moves and increase their probability of success.

This is a disciplined, rule-based system that works well in directional markets. Be sure to test it thoroughly before using it live.

Back‑Test Insights, Pros & Cons

Back‑Test Results

- Best results in markets with moderate volatility

- Win rate around 55–65% when combined with proper risk management

Pros

- Multi-timeframe confirmation reduces false entries

- Effective across different market regimes

- Highly customizable and non-repainting

Cons

- Can lag in fast-moving trends

- Requires patience and may miss quick breakouts

- No auto exit logic—trader-defined exits needed

Indicator Specifications

| Specification | Details |

|---|---|

| Name | Stochastic 3‑TF Forex Indicator |

| Platform | MetaTrader 4 (MT4) |

| Timeframes | M5, M15, H1 (customizable) |

| Currency Pairs | All Forex majors and crosses |

| Indicator Type | Stochastic oscillator – triple timeframe |

| Inputs | %K, %D periods, smoothing, timeframes, alert toggles |

| Visual Options | Customizable markers, threshold lines |

Final Words

The Stochastic 3‑TF Forex Indicator is an excellent tool for traders who value confirmed momentum signals across multiple timeframes.

While patience and trend context are required, combining it with solid stop-loss and take-profit rules enhances consistency.

A great addition to your MT4 indicator suite.