About the Taotra Trend Indicator

The Taotra Trend indicator is a trend-following trading tool built around a three moving average alignment system.

It uses a fast, middle, and slow moving average to define market direction and highlight potential entry points based on crossover logic.

The fast moving average reacts quickly to price changes, while the middle and slow averages help filter noise and confirm broader trend direction.

When all three averages align in the same direction, the indicator signals a potential trading opportunity.

The Taotra Trend indicator expands on traditional two-line crossover systems by adding an extra confirmation layer.

This approach works well for traders who want clearer trend validation and fewer false signals across different market conditions.

Free Download

Download the “taotra.ex4” MT4 indicator

Key Features

- Uses three moving averages for trend confirmation.

- Supports simple, exponential, smoothed, and linear weighted averages.

- Highlights bullish and bearish trend alignment clearly.

- Reduces noise compared to basic two-line crossover systems.

- Works well across multiple timeframes and currency pairs.

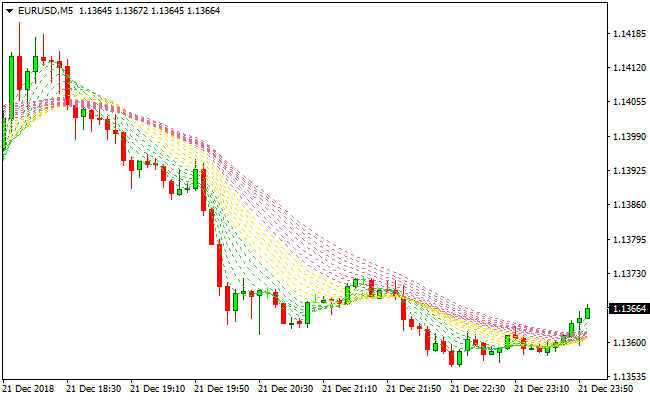

Indicator Chart

The chart displays the Taotra Trend indicator with three colored moving averages.

The alignment of the fast, middle, and slow averages shows trend direction and potential buy or sell setups.

Guide to Trade with Taotra Trend Indicator

Buy Rules

- Confirm that the fast moving average is above the middle moving average.

- Confirm that the middle moving average is above the slow moving average.

- Enter a buy trade once full bullish alignment is established.

- Trade only while the moving averages maintain their order.

Sell Rules

- Confirm that the fast moving average is below the middle moving average.

- Confirm that the middle moving average is below the slow moving average.

- Enter a sell trade once full bearish alignment is established.

- Trade only while the moving averages maintain their order.

Stop Loss

- Place the stop loss beyond the nearest recent price rejection area.

- Use the slow moving average as a dynamic risk boundary.

- Apply a fixed pip stop based on the active timeframe.

- Reduce exposure if moving average alignment weakens.

Take Profit

- Target previous swing zones in the direction of the trend.

- Scale out profits as price extends away from the averages.

- Trail profits while the moving averages remain aligned.

- Exit the trade when the fast average crosses back.

TAOTRA Trend + Parabolic SAR MT4 Forex Scalping Strategy

This strategy combines the TAOTRA Trend MT4 Indicator with the Parabolic SAR MT4 Indicator to scalp short-term moves.

TAOTRA Trend provides the overall direction: when its moving averages slope upward, we consider a bullish trend, and when they slope downward, a bearish trend.

The Parabolic SAR then gives precise timing for entries when price momentum shifts.

This setup works best on fast timeframes such as 1-minute (M1), 5-minute (M5), or 15-minute (M15) charts and is suitable for major, liquid Forex pairs like EURUSD, GBPUSD, USDJPY, or AUDUSD.

Buy Entry Rules (Long Scalps)

- TAOTRA Trend shows an upward trend (its MAs are sloping up).

- Parabolic SAR dots appear below the candlesticks (PSAR gives a bullish signal).

- Enter a buy trade at the close of the candle when PSAR flips below the price.

- Place a stop loss a few pips below the most recent PSAR dot or recent swing low.

- Take profit: target 8–15 pips or set a small fixed‑pip target depending on pair volatility.

Sell Entry Rules (Short Scalps)

- TAOTRA Trend shows a downward trend (its MAs are sloping down).

- Parabolic SAR dots appear above the candlesticks (PSAR gives a bearish signal).

- Enter a sell trade at the close of the candle when PSAR flips above the price.

- Place a stop loss a few pips above the most recent PSAR dot or recent swing high.

- Take profit: target 8–15 pips or use fixed‑pip profit depending on pair volatility.

Advantages

- Fast entries and exits, which are suitable for scalping with minimal time commitment.

- Trend‑filter from TAOTRA reduces trades against the main direction, lowering false signals.

- Parabolic SAR provides clear trigger timing, simplifying decision-making in fast markets.

- Fixed take‑profit target helps lock in small gains consistently when volatility is moderate.

Drawbacks

- Requires quick execution and discipline; slippage and spread costs may eat into profits on small targets.

- Not suitable during very choppy market periods because the trend filter may not be reliable if price whipsaws around the MAs.

Case Study 1 – EURUSD (5‑minute chart)

During a London session, TAOTRA Trend showed a clear uptrend.

PSAR dots flipped below the price at 1.10320.

A buy was entered at 1.10325, stop loss placed at 1.10280 (5 pips below PSAR), take profit set at 1.10440 (target 12–13 pips).

The market moved in favor quickly, and the trade closed for +13 pips within 20 minutes.

Case Study 2 – USDJPY (M5 chart)

On a volatile Asian session, the TAOTRA Trend sloped down.

PSAR flipped above price at 145.820.

A sell order was opened at 145.815, stop loss at 145.870 (5 pips above PSAR dot), take profit at 145.700 (target 11–12 pips).

The move was completed within 15 minutes, yielding about +11 pips.

Strategy Tips

- Prefer major currency pairs with tight spreads for scalping small pip targets.

- Trade during high-volatility sessions, such as London or New York open, for faster take profit.

- Avoid trading in quiet or consolidating periods. Skip trades if the TAOTRA slope is flat.

- Use small position size and proper risk management, risking only 0.5–1% per trade.

- Consider a volatility filter, for example, ATR, to avoid weak moves that may not reach TP.

- Monitor spread. Avoid trades when the spread is wide relative to the pip target.

- Use a fast broker to reduce slippage, which is important for short-term targets.

Download Now

Download the “taotra.ex4” Metatrader 4 indicator

FAQ

Why does this indicator use three moving averages?

The third moving average adds confirmation and helps filter out weak or short-lived crossovers.

Which moving average type works best?

Exponential and smoothed averages work well for faster trend response, while simple averages offer steadier signals.

Can this indicator be used as a standalone strategy?

Yes, it works well on higher timeframes where trends are more stable and easier to follow.

Does it perform well in sideways markets?

Like most trend-following tools, it performs better when the market is trending rather than ranging.

Summary

The Taotra Trend indicator provides a clear and disciplined way to trade trends using triple moving average alignment.

Its layered confirmation helps traders focus on stronger directional moves rather than short-term fluctuations.

The indicator works great for traders who prefer trend-based entries with visual confirmation.

Its flexibility in moving average types makes it adaptable to different trading styles and market conditions.