About the Pattern Recognition Indicator

The Pattern Recognition indicator for MT4 identifies key single candlestick patterns directly on your chart.

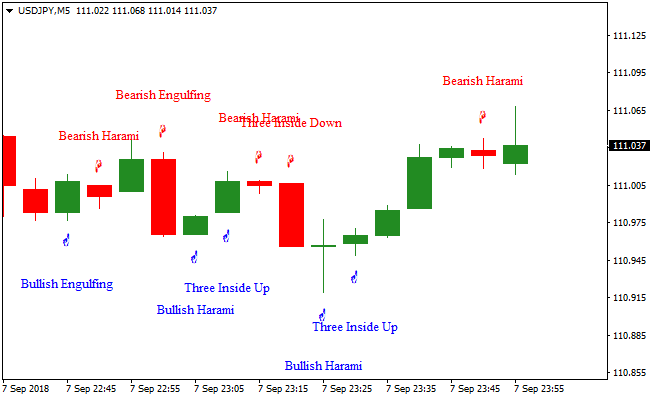

It highlights bullish and bearish formations such as Bearish Engulfing, Bullish Engulfing, Three Inside Up, Three Outside Down, Piercing Line, and Three White Soldiers.

Blue patterns indicate bullish setups, while red patterns signal bearish trends.

This indicator works purely on price action, making it suitable for traders who prefer analyzing the market without relying on lagging indicators.

By combining it with a trend-following tool, like the 50 SMA or 50 EMA, traders can filter signals and improve accuracy.

Follow the trend when trading the candlestick patterns for safer entries and exits.

All patterns can be enabled or disabled in the indicator’s input settings, giving full control over your chart setup.

Free Download

Download the “pattern-recognition.mq4” MT4 indicator

Key Features

- Automatically detects multiple candlestick patterns on any MT4 chart.

- Color-coded signals: blue for bullish, red for bearish.

- Works purely on price action, without any lagging data.

- Compatible with trend-following indicators for higher probability trades.

- Customizable pattern selection through input settings.

- Alerts traders when significant patterns appear on the chart.

Indicator Chart

The Pattern Recognition indicator chart shows identified candlestick patterns in real time.

Blue candlesticks mark bullish opportunities, while red candlesticks mark bearish reversals.

This chart helps traders quickly spot high-probability trade setups and follow the market direction in conjunction with a trend indicator.

Guide to Trade with Pattern Recognition

Buy Rules

- Identify a bullish candlestick pattern marked in blue.

- Confirm the price is above the 50 SMA or 50 EMA.

- Enter the trade at the close of the pattern candle.

- Avoid buying if a bearish pattern is forming or the trend is downward.

Sell Rules

- Identify a bearish candlestick pattern marked in red.

- Confirm the price is below the 50 SMA or 50 EMA.

- Enter the trade at the close of the pattern candle.

- Avoid selling if a bullish pattern is forming or the trend is upward.

Stop Loss

- Place a stop loss just below the lowest wick for bullish trades.

- Place a stop loss just above the highest wick for bearish trades.

- Adjust the stop according to recent support or resistance levels.

Take Profit

- Close all trades if the opposite candlestick pattern forms.

- Alternatively, target nearby support or resistance levels.

- Adjust targets based on trend strength and time frame.

- Trail stop loss to lock profits as the trend continues.

MT4 Strategy: Trading Pattern Recognition + PowerTrend Scalping Method

This MT4 scalping strategy combines the Trading Pattern Recognition Indicator and the PowerTrend Indicator to capture quick intraday moves.

The Trading Pattern Recognition indicator identifies candlestick patterns such as Bullish and Bearish Engulfing, Three White Soldiers, Three Black Crows, Harami, and Piercing Line.

The PowerTrend indicator shows a blue line for buy trends and a red line for sell trends, providing trend confirmation for pattern-based entries.

This method works best on M1, M5, and M15 charts for fast scalping.

By combining candlestick pattern signals with trend confirmation, traders can filter out low probability setups and enter trades aligned with the prevailing market direction.

The strategy is suitable for scalpers seeking multiple quick trades during high liquidity sessions.

Buy Entry Rules

- The PowerTrend indicator shows a blue line, confirming a bullish trend.

- A bullish candlestick pattern appears from the Trading Pattern Recognition indicator (e.g., Bullish Engulfing, Three White Soldiers, Piercing Line).

- Enter the trade immediately after pattern confirmation in line with the trend.

- Place a stop loss below the recent swing low or below the candlestick pattern low.

- Take profit when the PowerTrend line changes from blue to red or after a fast scalp of 5-12 pips.

Sell Entry Rules

- The PowerTrend indicator shows a red line, confirming a bearish trend.

- A bearish candlestick pattern appears from the Trading Pattern Recognition indicator (e.g., Bearish Engulfing, Three Black Crows, Cloud Cover).

- Enter the trade immediately after pattern confirmation in line with the trend.

- Place a stop loss above the recent swing high or above the candlestick pattern high.

- Take profit when the PowerTrend line changes from red to blue or after a fast scalp of 5-12 pips.

Advantages

- Combines candlestick pattern signals with trend confirmation for high probability entries.

- Clear visual alerts from both indicators make trading decisions fast and simple.

- Effective on multiple lower timeframes, ideal for scalping sessions.

- Helps traders stay in line with the trend and avoid counter-trend trades.

- Can generate multiple trades per session, increasing profit potential.

- Applicable across major and minor currency pairs with high volatility.

Drawbacks

- Requires quick execution and focus due to fast M1-M15 scalping setups.

- Not suitable for long-term trading or swing strategies.

- Frequent signals can lead to overtrading if discipline is not maintained.

Case Study 1: EURUSD M5

During the London session, EURUSD showed a blue PowerTrend line with a Bullish Engulfing pattern appearing on the chart.

A buy trade was executed with a stop below the pattern low.

The price quickly moved upward and the trade was closed after reaching a 11 pip target.

Combining the candlestick pattern with trend confirmation provided a reliable and fast scalp opportunity.

Case Study 2: GBPJPY M1

GBPJPY formed a red PowerTrend line and a Three Black Crows bearish candlestick pattern during the New York session.

A sell trade was taken with a stop above the pattern high.

Price moved downward steadily, and the trade was closed after achieving a 6 pip scalp.

Using both indicators together ensured the trade aligned with the short-term trend for a fast intraday move.

Strategy Tips

- Only take trades when candlestick patterns align with the PowerTrend line to reduce false signals.

- Place stop losses at logical levels near candlestick pattern extremes.

- Take profits quickly with small targets to maximize scalp efficiency.

- Avoid trading during major news releases to prevent unexpected spikes.

- Monitor multiple pairs carefully, but limit active trades to maintain focus.

Download Now

Download the “pattern-recognition.mq4” Metatrader 4 indicator

FAQ

Can I use this indicator alone?

While the Pattern Recognition indicator works on its own, combining it with a trend-following tool improves signal accuracy and reduces false entries.

Can I customize the patterns displayed?

Yes. You can enable or disable individual patterns in the indicator’s input menu, allowing you to focus on the setups you prefer.

How do I confirm trades?

Use a trend indicator like the 50 SMA or 50 EMA.

Trade bullish patterns only above the trend line and bearish patterns only below it for higher probability setups.

Summary

The Pattern Recognition indicator for MT4 helps traders identify high-probability candlestick patterns with minimal effort.

Its price-action-based signals and color-coded alerts make chart reading fast and efficient.

When paired with a trend-following indicator, it can improve entry timing and reduce risk.

Traders can customize which patterns to track, making it flexible for different strategies and timeframes.

Overall, it’s a practical tool for both novice and experienced traders looking to trade price action confidently.