About the Vortex Oscillator

The Vortex Oscillator for MetaTrader 4 is a momentum-based technical indicator designed to identify potential buy and sell opportunities in trending and transitional markets.

It works by analyzing directional price movement and displaying the result as a histogram around a central zero level.

This makes it useful for spotting shifts in market pressure that often precede price continuation or reversals.

The indicator appears in a separate MT4 window and plots brown histogram bars that expand and contract based on directional strength.

When the bars move above or below the zero line, they highlight changes in bullish or bearish momentum. Traders often use this behavior to time entries, manage exits, or confirm signals from other tools.

The Vortex Oscillator can be traded on its own or combined with trend-following indicators, support and resistance levels, or price action.

Its simple output and responsive nature make it suitable for intraday trading as well as higher time frame analysis.

Free Download

Download the “Vortex_Oscillator.mq4” indicator for MT4

Key Features

- Displays momentum shifts using histogram bars in a separate MT4 window.

- Generates buy and sell signals based on zero level crossovers.

- Useful for both trade entries and trade exits.

- Works across all major forex pairs and time frames.

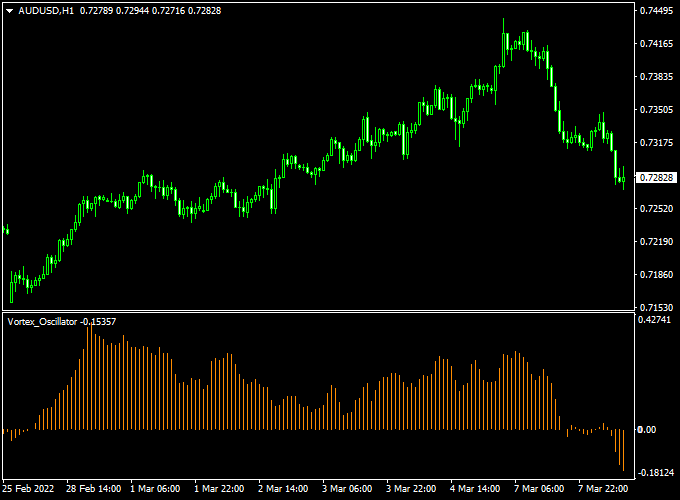

Indicator Chart

The chart below shows the Vortex Oscillator indicator plotted beneath price on an MT4 chart.

The histogram bars illustrate momentum direction, with moves above the zero line signaling bullish pressure and moves below the zero line signaling bearish pressure.

Guide to Trade with Vortex Oscillator

Buy Rules

- Wait for the Vortex Oscillator bars to move below the zero level.

- Enter a buy trade when the bars turn back above the zero level.

- Confirm the signal with price holding above recent support if possible.

Sell Rules

- Wait for the Vortex Oscillator bars to move above the zero level.

- Enter a sell trade when the bars turn back below the zero level.

- Confirm the signal with price holding below recent resistance if possible.

Stop Loss

- Set the stop loss a fixed number of pips beyond the signal candle low for buy trades.

- Set the stop loss a fixed number of pips beyond the signal candle high for sell trades.

Take Profit

- Use a risk-to-reward ratio of at least 1:2 based on the stop loss distance.

- Trail the take profit by closing the trade when the oscillator loses momentum near the zero level.

Vortex Oscillator + ZWinner Trend Forex Day Trading Strategy for MT4

This day trading strategy combines the Vortex Oscillator Indicator for MT4 with the ZWinner Trend Forex Indicator for MT4.

It is designed to identify high-probability intraday trends and capture medium-term moves on M15 and M30 charts.

The Vortex Oscillator detects momentum shifts, while the ZWinner Trend confirms the direction with a clear histogram signal.

This combination helps traders filter out false signals and enter trades in alignment with the prevailing trend.

Why This Strategy Works

The Vortex Oscillator reacts quickly to price movements, signaling when momentum is shifting.

A move back above zero signals bullish momentum, and below zero signals bearish momentum.

The ZWinner Trend provides trend confirmation: green histogram bars indicate a buy trend, while red bars indicate a sell trend.

When both indicators align, traders can enter positions with higher confidence.

Buy Entry Rules

- Wait until the Vortex Oscillator bars cross back above zero, signaling bullish momentum.

- Confirm that the ZWinner Trend histogram is green, indicating an uptrend.

- Enter a buy trade at the close of the confirmation candle.

- Place a stop loss below the most recent swing low or 20–30 pips, depending on pair volatility.

- Set take profit at 40–60 pips or when the ZWinner Trend histogram turns red.

Sell Entry Rules

- Wait until the Vortex Oscillator bars cross back below zero, signaling bearish momentum.

- Confirm that the ZWinner Trend histogram is red, indicating a downtrend.

- Enter a sell trade at the close of the confirmation candle.

- Place a stop loss above the most recent swing high or 20–30 pips, depending on the pair.

- Set take profit at 40–60 pips or when the ZWinner Trend histogram turns green.

Advantages

- Combines momentum and trend confirmation for higher-probability trades.

- Easy to read with histogram-based signals.

- Works well across multiple currency pairs with good volatility.

- Suitable for day traders seeking clear entry and exit points.

Drawbacks

- Not suitable for M1 chart short-term scalping; designed for medium intraday moves.

- Stop-loss levels may be hit during sudden news events before the trend resumes.

Case Study 1 – EUR/JPY M15 Chart

On the EUR/JPY M15 chart, the Vortex Oscillator crossed above zero near 142.10 during the London session.

The ZWinner Trend histogram confirmed a bullish trend with green bars.

A buy trade was executed at 142.15 with a stop loss at 141.90.

Price rose steadily to 142.70, yielding +55 pips within the session before the trend started to fade.

Case Study 2 – USD/CHF M30 Chart

During the New York session, USD/CHF showed the Vortex Oscillator dropping below zero near 0.9050.

The ZWinner Trend histogram turned red, confirming bearish momentum.

A sell trade was entered at 0.9048 with a stop loss at 0.9060.

The price declined to 0.9005, capturing 43 pips in profit before the oscillator signaled potential reversal.

Strategy Tips

- Trade during high-volume sessions such as London and New York for stronger momentum.

- Focus on major pairs with tight spreads like EUR/USD, GBP/USD, USD/JPY, and cross pairs like EUR/JPY and USD/CHF.

- Exit trades if the histogram shows early signs of trend reversal to protect profits.

- Combine with support and resistance levels to improve risk management and entry precision.

- Avoid trading during major news announcements to reduce whipsaw risk.

Download Now

Download the “Vortex_Oscillator.mq4” indicator for Metatrader 4

FAQ

Is the Vortex Oscillator better suited for trending or ranging markets?

The indicator performs best when the market is transitioning into a directional move.

Zero level crossovers tend to be more reliable when price shows follow-through after the signal.

Can I adjust the settings of the Vortex Oscillator?

Yes, the calculation period can be modified to make the histogram more responsive or smoother, depending on your trading style and preferred time frame.

What indicators work well with the Vortex Oscillator?

Traders often pair it with moving averages, trend filters, or support and resistance analysis to improve signal quality and reduce false entries.

Summary

The Vortex Oscillator for MT4 is a practical momentum tool that helps traders identify buy and sell opportunities through simple zero level signals.

Its histogram-based display makes momentum shifts easy to interpret without overloading the chart.

The indicator is easy to use, flexible across markets, and suitable for both new and experienced traders.

With thoughtful parameter tuning and confirmation from price behavior, it can become a reliable part of a consistent trading approach.