About the 2 EMAs Colored Crossover System Indicator

The 2 EMAs Colored Crossover System Indicator for MT4 visually captures trend changes by coloring exponential moving averages (EMAs) and providing clear crossover signals.

Ideal for all traders, it simplifies trend identification and trade execution.

Key Features

- Color-shifting EMAs: EMAs change color upon crossover—green for bullish and red for bearish

- Automated trade signals: Instant visual cues when trend shifts occur

- Fully customizable: Adjust fast/slow periods, colors, alerts, and display style

- Multi-timeframe: Effective on any timeframe, from scalping to swing trading

- Non-repainting: Once colored, the EMAs remain fixed and reliable

Free Download

Download the “2-ema-color-alerts-indicator.mq4” indicator for MT4

Benefits of Using This Indicator

- Instant visual confirmation of trend direction

- Reduces decision time with clear color-based alerts

- Works on any instrument and timeframe

- Lightweight and efficient—minimizes chart clutter

- Supports disciplined trading—enter only on confirmed trend changes

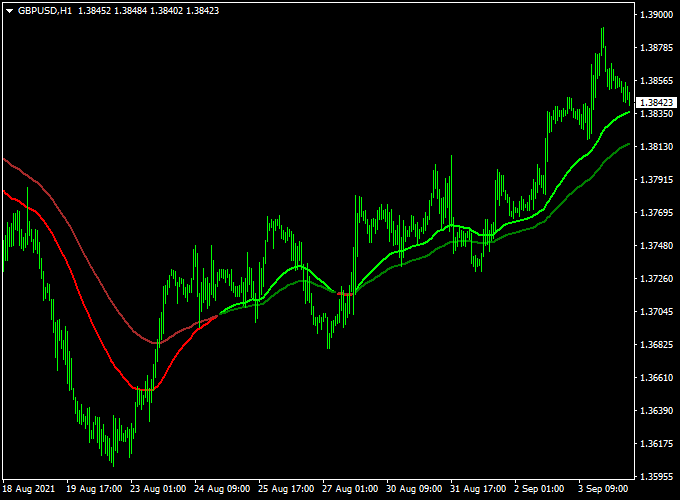

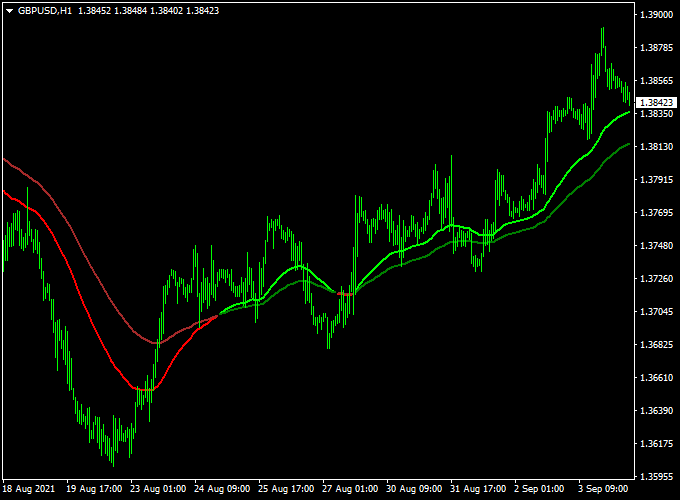

Indicator Chart

Below is an example of the 2 EMAs Colored Crossover System Indicator applied to a GBP/USD H1 chart, showcasing clear crossover points and entry signals.

How to Trade Using This Indicator

Trade Signals

- Buy: When both EMAs turn green after a crossover

- Sell: When both EMAs turn red after reversing

Stop-Loss & Take-Profit

- Stop-Loss: Place just below the slow EMA on buy or above on sell

- Take-Profit: Target recent swing highs/lows or use a 2:1 reward/risk ratio; consider trailing stops

Example Trade

- GBP/USD H1: Fast EMA crosses above slow EMA, both turn green → trigger Buy

- Entry price: at candle close of crossover

- Stop-Loss: just below the slow EMA (~X pips)

- Take-Profit: near last swing high or aim for 2:1 R/R

Download Now

Download the “2-ema-color-alerts-indicator.mq4” indicator for Metatrader 4

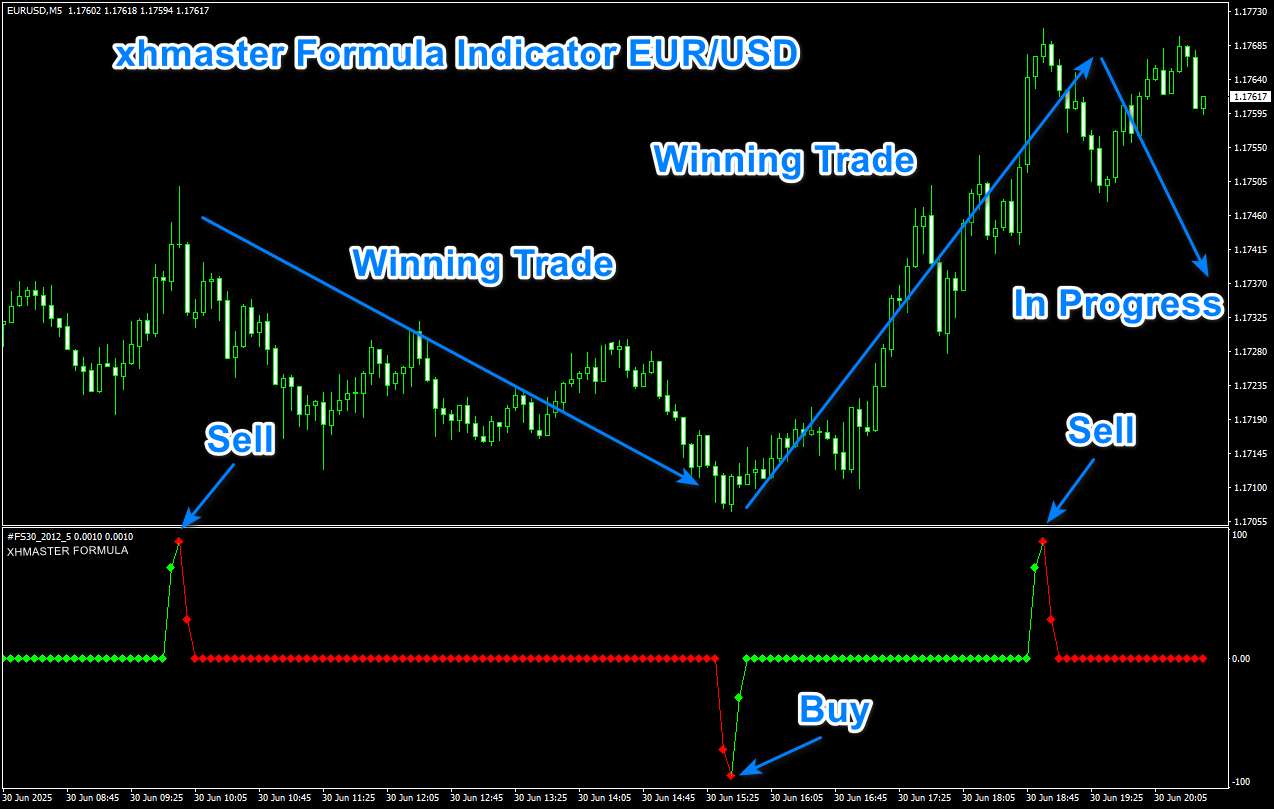

2 EMAs Colored Crossover + RSI Triple Stochastic Divergence Strategy

This strategy blends the classic trend-following strength of the 2 EMAs Colored Crossover System Indicator with the precision of the RSI Triple Stochastic Divergence Indicator.

It is designed for traders who want to capture trend continuations and reversals with higher confidence by using both momentum and divergence signals.

What is this Strategy About?

The 2 EMAs Colored Crossover Indicator shows clear bullish and bearish signals based on the crossover of two exponential moving averages, visually confirmed with color changes on the chart.

This provides a simple trend direction. The RSI Triple Stochastic Divergence Indicator detects hidden and regular divergence between price and momentum indicators like RSI and Stochastic.

It highlights early reversal signals or potential continuation setups before the market fully turns.

By combining these two indicators, we only trade when both trend direction and momentum analysis are in alignment.

The EMAs define the trade direction, while the divergence indicator adds precise timing and a strong signal filter.

Buy Trade Setup

- Wait for the 2 EMAs Colored Crossover Indicator to turn green, indicating a bullish trend.

- Confirm a bullish divergence signal from the RSI Triple Stochastic Divergence Indicator.

- Enter a buy trade at the candle close after both conditions are confirmed.

- Stop Loss: Set below the recent swing low or below the divergence pattern.

- Take Profit: Use a 1:2 or 1:3 risk-reward ratio or target the next resistance area.

Sell Trade Setup

- Wait for the 2 EMAs crossover to turn red, indicating a bearish trend.

- Confirm a bearish divergence from the RSI Triple Stochastic Divergence Indicator.

- Enter a sell position at the close of the signal candle.

- Stop Loss: Place it above the recent swing high.

- Take Profit: Use a fixed risk/reward ratio or the next support zone as your target.

Advantages of the Strategy

- Combines trend direction and momentum divergence for high-quality setups.

- Reduces false signals by filtering EMA crossovers with divergence confirmation.

- Can be used on most major currency pairs and timeframes from M15 and higher.

- Easy visual signals with color-coded EMAs and divergence arrows or lines.

Drawbacks

- It may produce fewer trades due to the double confirmation requirement.

- Divergence signals may repaint in fast-moving markets—backtesting is important.

- Performance may vary during consolidations where trends are weak or unclear.

Back-Test Insights, Pros & Cons

Back-Test Results

- Strong performance in trending sessions (London & New York)

- Win rate ~60–70% with disciplined risk management

Pros

- Highly visual trend identification

- Non-repainting for consistent signal integrity

- Customizable and adaptable across markets

Cons

- Choppy markets may trigger whipsaws

- Performance improves with complementary filters

- No automatic exits—requires user-defined TP strategy

Indicator Specifications

| Specification | Details |

|---|---|

| Name | 2 EMAs Colored Crossover System Indicator |

| Platform | MetaTrader 4 (MT4) |

| Timeframes | Any (M1 to D1) |

| Currency Pairs | All Forex pairs and CFDs |

| Indicator Type | Trend-following EMA crossover |

| Inputs | Fast EMA, Slow EMA, price type, alert options, color settings |

| Visuals | Custom-colored EMA lines, alert icons |

Final Words

The 2 EMAs Colored Crossover System Indicator is a visually intuitive and effective tool to capture trend shifts in MT4.

For optimal results, combine it with a trend filter or volume indicator and apply solid risk management practices.

With its customizable alerts and clear signals, it’s a valuable addition to any trader’s toolkit.