The AFL Winner forex indicator is an awesome short-term trend following trading oscillator that can be used for scalping and day trading on any time frame.

The AFL Winner indicator fluctuates between two extreme values, 0.00 and 105.

AFL follows the short-term trend and draws lime and red bars on a separate chart window.

- Green bars are said to be bullish and currency traders look for buy trade opportunities

- Red bars are said to be bearish and currency traders look for sell trade opportunities

For more profitable buy signals, wait for the green bars to reach oversold territory (near the 0.00 level).

Conversely, for more profitable sell signals, wait for the red bars to reach the overbought territory (near the 105 level).

Use together with a trend-following indicator to create a real forex trading system.

Free Download

Download the “afl-winner-indicator.mq4” MT4 indicator

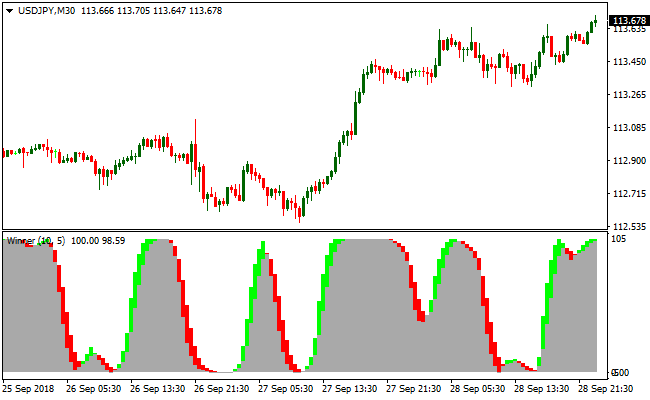

Indicator Chart (USD/JPY M30)

The USD/JPY 30-minute chart below displays the AFL Winner Metatrader 4 Forex indicator in action.

Basic Trading Signals

Signals from the AFL Winner MT4 forex indicator are easy to interpret and goes as follows:

Buy Signal: Open a long trade when the AFL Winner forex indicator changes color from red bars to lime bars and the overall trend is upward.

Sell Signal: Open a short trade when the AFL Winner forex indicator changes color from lime bars to red bars and the overall trend is downward.

Trade Exit: Close the open buy/sell trade when an opposite signal occurs, or use your own method of trade exit.

AFL Winner + Ultimate MA Forex Trend Strategy for MT4

This MT4 strategy uses the AFL Winner Indicator together with the Ultimate MA Indicator.

The AFL Winner provides clear buy and sell signals via its colored line: green for buy and red for sell.

The Ultimate MA shows the overall trend: price above the MA indicates a bullish trend, price below indicates a bearish trend.

By combining these two indicators, traders can enter trades that align with both trend direction and momentum signals.

This strategy works well on H1 and H4 timeframes and suits swing traders seeking reliable trend-following opportunities.

Buy Entry Rules

- Ensure the price is above the Ultimate MA line, indicating a bullish trend.

- Enter a buy trade when the AFL Winner line turns green.

- Place the stop loss a few pips below the most recent swing low or below the MA line.

- Set take profit at the next significant resistance level where price has previously reversed.

Sell Entry Rules

- Ensure the price is below the Ultimate MA line, indicating a bearish trend.

- Enter a sell trade when the AFL Winner line turns red.

- Place the stop loss a few pips above the most recent swing high or above the MA line.

- Set take profit at the next significant support level where price has previously reversed.

Advantages

- Reduces counter-trend trades by ensuring price aligns with the overall trend.

- Works well on H1 and H4 timeframes, capturing medium-term swing moves.

- Allows targeting natural market levels for take profit, improving trade management.

Drawbacks

- Profit targets may not always be reached if the trend loses momentum.

- Indicators alone do not account for fundamental news events, which can affect trades suddenly.

Example Case Study 1 – EURUSD H1

During an uptrend on EURUSD H1, the price remained above the Ultimate MA.

The AFL Winner line turned green, signaling a buy.

A long position was entered with a stop loss 8 pips below the recent swing low.

The trade moved upward and reached a strong resistance zone 64 pips above the entry.

The position was closed for a profit of 60 pips as price showed hesitation near resistance.

Example Case Study 2 – GBPUSD H4

On GBPUSD H4, the pair was trending downward below the MA.

The AFL Winner line turned red after a pullback, signaling a sell trade.

Stop loss was placed 10 pips above the recent swing high.

Price continued to decline and reached the next significant support level 93 pips below the entry.

The trade was closed at that support level for a profit of 89 pips.

Strategy Tips

- Use proper position sizing and risk management, especially if stop losses are wide.

- Target natural support and resistance levels for take profit rather than fixed pip amounts.

- If the MA flattens, skip trades even if AFL signals appear to avoid uncertain market conditions.

- Maintain a trading journal to record entries, exits, and pip gains for ongoing strategy refinement.

Download Now

Download the “afl-winner-indicator.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: Chart pattern indicator

Customization options: Variable (Period, Average) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Oscillator