About the Day Pivot Point Buy Sell Signal Indicator

The Day Pivot Point Buy Sell Signal MT4 indicator is an intraday trading tool that generates buy and sell alerts based on daily pivot point calculations.

It is designed for traders who focus on short-term price reactions around key market levels.

This indicator analyzes price behavior relative to daily pivot points and identifies moments where price action supports a potential bullish or bearish move.

Once a valid setup forms, the indicator displays the most current trading signal directly on the activity chart, allowing traders to react without delay.

In addition to trade signals, the indicator provides useful account and session information on the chart, including server time, account name, account number, leverage, and balance.

For best performance, it is recommended to apply the indicator on timeframes between M5 and H1, where pivot-based reactions are most reliable.

Free Download

Download the “DayPivotPoint.mq4” MT4 indicator

Key Features

- Generates buy and sell signals based on daily pivot points.

- Displays the active trading signal directly on the chart.

- Optimized for intraday trading strategies.

- Recommended for M5 to H1 timeframes.

- Shows server time and account-related information.

- Works on all major and minor forex pairs.

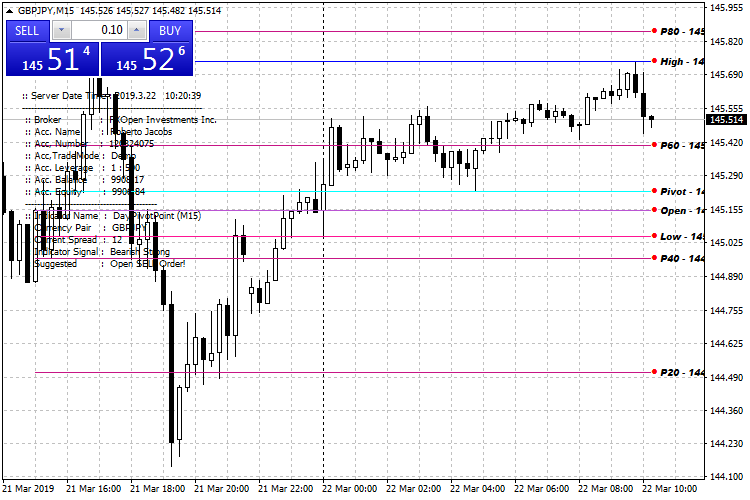

Indicator Chart

The Day Pivot Point Buy Sell Signal MT4 indicator displays pivot-based trade signals directly on the price chart.

Buy and sell alerts appear when price reacts around key pivot levels, helping traders identify potential intraday reversals or continuations.

Guide to Trade with Day Pivot Point Buy Sell Signal Indicator

Buy Rules

- Apply the indicator to a chart between M5 and H1.

- Wait for a buy signal to appear near a daily pivot or support level.

- Confirm that price is holding above the pivot zone.

- Open a buy order at the close of the signal candle.

Sell Rules

- Apply the indicator to a chart between M5 and H1.

- Wait for a sell signal to appear near a daily pivot or resistance level.

- Confirm that price is holding below the pivot zone.

- Open a sell order at the close of the signal candle.

Stop Loss

- Place the stop loss just beyond the next pivot level below the entry for buy trades.

- Place the stop loss just beyond the next pivot level above the entry for sell trades.

- Adjust the stop loss slightly to account for spread and short-term volatility.

Take Profit

- Set take profit at the next daily pivot level in the trade direction.

- For stronger moves, trail profits toward the following pivot zone.

- Close the trade early if price stalls or reverses near a pivot level.

MT4 Day Pivot Point and Simple Linear Regression Forex Strategy

This MT4 strategy combines the Day Pivot Point Buy Sell Signal MT4 Indicator with the Simple Linear Regression MT4 Indicator.

The Day Pivot Point indicator generates buy and sell alerts directly on the chart based on pivot levels, helping traders identify key support and resistance zones.

The Simple Linear Regression indicator identifies trend direction: an upsloping channel indicates a bullish trend, while a downsloping channel signals a bearish trend.

This strategy is suitable for intraday trading on M15, M30, or H1 charts.

Combining pivot point signals with trend confirmation allows traders to enter high-probability trades, capturing both trend-following and reversal opportunities.

The indicators’ visual alerts and channels make it easy to identify setups and manage trades effectively.

Buy Entry Rules

- The Simple Linear Regression channel must be upsloping, confirming a bullish trend.

- The Day Pivot Point indicator must generate a buy signal on the chart.

- Enter long at the close of the candle where the buy signal appears while the regression channel remains upward.

- Set a stop loss below the nearest support level or pivot point.

- Take profit at the next pivot resistance level or trail the stop below the regression channel to follow momentum.

Sell Entry Rules

- The Simple Linear Regression channel must be downsloping, confirming a bearish trend.

- The Day Pivot Point indicator must generate a sell signal on the chart.

- Enter short at the close of the candle where the sell signal appears while the regression channel remains downward.

- Set a stop loss above the nearest resistance level or pivot point.

- Take profit at the next pivot support level or trail the stop above the regression channel to secure gains.

Advantages

- Combines trend confirmation with pivot point alerts for higher probability trades.

- Dynamic take profit using regression channel allows capturing realistic intraday moves.

- Works well across multiple time frames and currency pairs.

- Helps traders avoid countertrend entries by confirming trend direction.

- Suitable for both trend-following and reversal trades.

Drawbacks

- Pivot point signals can be less reliable in low-volatility or sideways markets.

- The regression channel may lag during sudden market reversals, affecting entry timing.

- False pivot signals may occur during rapid price spikes or news events.

- Fewer trade opportunities may be available during quiet market hours.

Case Study 1

EURUSD M30 during the London session showed an upsloping regression channel, confirming a bullish trend.

The Day Pivot Point indicator generated a buy signal on the chart.

A long position was opened with a stop loss below the recent pivot support.

Price moved upward steadily, and the trade was closed at the next pivot resistance level, capturing a 42-pip gain.

Trend confirmation and pivot signal alignment ensured a high-probability intraday trade.

Case Study 2

GBPJPY M15 during the New York session displayed a downsloping regression channel, signaling a bearish trend.

The Day Pivot Point indicator generated a sell signal.

A short trade was entered with a stop loss above the recent pivot resistance.

Price declined consistently, and the trade was closed at the next pivot support, producing a 35-pip profit.

Using both indicators together minimized risk and captured the prevailing trend effectively.

Strategy Tips

- Focus on high liquidity sessions such as London and New York to ensure stronger pivot reactions.

- Wait for alignment between pivot point signals and regression channel direction before entering.

- Use higher time frames to confirm the overall trend and avoid countertrend trades.

- Move the stop loss to breakeven once the trade has gained halfway to the pivot-based target.

- Consider combining with volume analysis to confirm the strength of moves near pivot points.

- Focus on currency pairs with clear trends to maximize intraday trading opportunities.

Download Now

Download the “DayPivotPoint.mq4” Metatrader 4 indicator

FAQ

Why is this indicator best used on lower timeframes?

Pivot points are most effective for intraday trading, where price frequently reacts to these levels within short periods.

Does the indicator update signals throughout the trading day?

Yes, signals adjust based on current price action relative to the daily pivot levels.

Can this indicator be used during high-impact news sessions?

It is better suited for normal market conditions, as strong news events can push price beyond pivot levels without reaction.

What is the benefit of the account information displayed on the chart?

The on-chart account data helps traders monitor session timing and account status without switching screens.

Summary

The Day Pivot Point Buy Sell Signal MT4 indicator is a practical choice for traders who rely on intraday price reactions around key levels.

Using daily pivot points as the foundation for trade signals aligns well with short-term market behavior.

With direct on-chart alerts, recommended lower timeframe usage, and added account visibility, the indicator supports efficient decision-making during active trading sessions.

While experienced traders may combine it with session context or price action filters, it already provides a solid pivot-based framework for consistent intraday trading.