About the Power of GBP Indicator

The Power of GBP Indicator for MetaTrader 4 is designed to measure the real-time relative strength of the British Pound against other currencies.

It helps traders identify when GBP is strong or weak, making it easier to align trades with dominant market flows.

Instead of guessing direction, the indicator focuses on strength comparison, which is a core principle used by experienced forex traders.

The indicator plots the strength of the British Pound around the 0.00 level.

When GBP trades above this level, it signals strength. When it moves below, it signals weakness.

Traders then pair GBP with a currency showing opposite behavior.

This approach reduces noise and improves timing, especially on volatile GBP pairs.

The Power of GBP Indicator works on all timeframes and supports any forex pair that includes the British Pound.

It is often used alongside price action, support and resistance, or trend tools to confirm entries and manage risk more effectively.

Free Download

Download the “Power_of_GBP.ex4” Metatrader 4 indicator

Key Features

- Measures the real-time relative strength of the British Pound.

- Uses the 0.00 level to define strong and weak GBP conditions.

- Supports all GBP-related forex pairs.

- Works on any timeframe in MetaTrader 4.

- Helps filter trades by focusing on currency strength.

- Easy-to-read display suitable for discretionary trading.

Indicator Chart

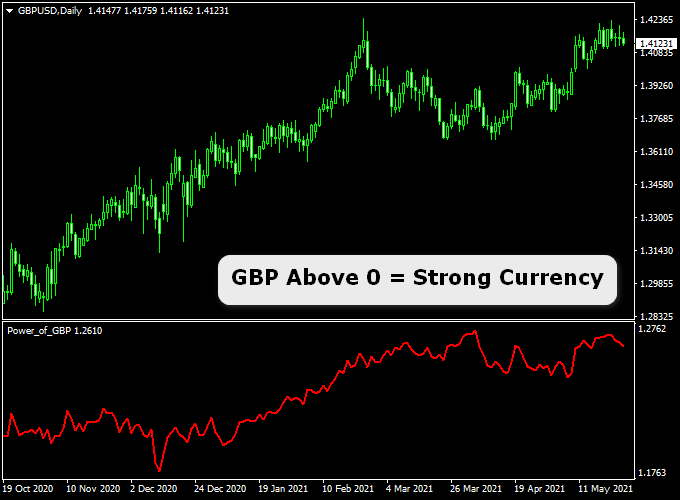

The chart below shows the Power of GBP Indicator applied to a GBP/USD chart.

The indicator highlights when GBP strength crosses above or below the 0.00 level, helping traders spot potential buy and sell opportunities.

These signals reflect shifts in trend direction and relative momentum between GBP and the counter currency.

Guide to Trade with the Power of GBP Indicator

Buy Rules

- Power of GBP crosses above the 0.00 level.

- The counter currency is relatively weak.

- Confirm the entry using trend or price action analysis.

Sell Rules

- Power of GBP crosses below the 0.00 level.

- The counter currency is relatively strong.

- Confirm the entry using trend or price action analysis.

Stop Loss

- Place the stop loss 2 pips below support for buy trades.

- Place the stop loss 2 pips above resistance for sell trades.

- Alternatively, apply a personal risk management method.

Take Profit

- Set take profit at a minimum reward-to-risk ratio of 2.5.

- Adjust targets based on support and resistance levels.

- Partial profit taking can be used to manage open risk.

Forex Day Trading Strategy for The GBP Currency Using 2 Indicators

This strategy combines the Power of GBP British Pound Indicator for MT4 with the Four Time Frames ASCTrend Indicator for MT4 to capture strong directional movements in GBP pairs during high-volatility market hours.

The Power of GBP tool measures the real-time strength of the British Pound across multiple pairs, while the ASCTrend indicator confirms multi-timeframe trend direction for precise entries.

Power of GBP Indicator: A buy setup forms when the GBP strength line crosses above the 0.00 level and the counter currency (USD, JPY, or EUR) is weak.

A sell setup occurs when the line crosses below 0.00 and the counter currency is strong.

Four Time Frames ASCTrend Indicator: When all four histograms turn blue, it confirms a strong buy trend; when all turn red, it confirms a strong sell trend.

Day Trading Strategy Rules

Buy Setup

- Wait for the Power of GBP indicator to cross above the 0.00 level, signaling GBP strength.

- Check the Four Time Frames ASCTrend indicator — all four histograms should be blue.

- Confirm that the price is trending upward on the M15 and H1 charts.

- Open a buy trade at the start of the next candle.

- Place your stop loss 25 pips below the nearest swing low.

- Target 40–70 pips depending on volatility, or use a 1.5–2.0 risk-reward ratio.

Sell Setup

- Wait for the Power of GBP indicator to cross below the 0.00 level, showing GBP weakness.

- Check the ASCTrend histograms — all four should be red.

- Confirm a bearish trend on both M15 and H1 charts.

- Enter a sell trade at the start of the next candle.

- Place your stop loss 25 pips above the recent swing high.

- Set your take profit at 40–70 pips or use a trailing stop after +40 pips gain.

Case Studies

Case 1: GBP/USD Morning Breakout

In a Tuesday London session, the Power of GBP crossed above the 0.00 level while USD was weak.

All four ASCTrend histograms turned blue, confirming a buy signal.

A buy entry at 1.2630 reached a target of 1.2690 (+60 pips) within two hours before a retracement started.

Case 2: GBP/JPY Late Session Pullback

Later that day, GBP/JPY showed a bearish crossover on the Power of GBP while JPY was strong.

The ASCTrend histograms are aligned in red.

A short at 191.80 dropped to 191.20 (+60 pips) by the end of the London session.

Advantages

- Combines currency strength (Power of GBP) with multi-timeframe trend confirmation (ASCTrend), increasing trade reliability.

- Works well on multiple GBP pairs like GBP/USD, GBP/JPY, and EUR/GBP.

- Helps traders follow the trend while reducing false entries during minor pullbacks.

- Suitable for day trading, providing structured setups for disciplined scalps and intraday trades.

Drawbacks

- The system can produce false signals during overlapping sessions with conflicting strength readings.

- Trend exhaustion may cause the ASCTrend histograms to lag slightly on reversals.

- GBP pairs are volatile — sudden spikes may hit tight stop losses.

- Requires discipline to avoid trades when both indicators are not aligned.

Strategy Tips

- Focus on London and New York sessions — GBP pairs move best during these hours.

- Always check for major news events (like UK CPI or BoE rate decisions) to avoid false spikes.

- Use the M5 and M15 charts for precise timing; confirm direction on H1.

- Combine the Power of GBP with correlated pairs such as EUR/GBP or GBP/JPY to spot divergence opportunities.

- Trail your stop loss once you secure 30+ pips profit to lock in gains.

Download Now

Download the “Power_of_GBP.ex4” MT4 indicator

FAQ

Which currency pairs work best with the Power of GBP Indicator?

The indicator performs best on GBP pairs such as GBP/USD, GBP/JPY, and EUR/GBP, where strength shifts are often more pronounced.

Can this indicator be used on lower timeframes?

Yes, it works on all timeframes. On lower timeframes, additional confirmation is recommended due to faster price movement.

Is it better used alone or with other tools?

The indicator is most effective when combined with trend direction, support and resistance, or momentum-based tools.

Summary

The Power of GBP Indicator for MT4 offers a focused way to trade the British Pound by analyzing real-time currency strength.

It helps traders avoid low-probability setups and concentrate on pairs with directional potential.

Its simplicity makes it easy to integrate into existing strategies, while its strength-based logic aligns well with professional trading approaches.

With proper confirmation and risk control, it can be a valuable addition to any GBP-focused trading plan.