About the ZZ Semafor Indicator

The ZZ Semafor Forex indicator for MT4 is designed to highlight important market turning points by identifying local highs and lows on the price chart.

These points often act as natural support and resistance levels, making them useful for both breakout and reversal strategies.

After attaching the indicator to a chart, large bullet-style markers appear directly on the price.

These markers indicate areas where price has previously stalled or reversed, helping traders understand where strong reactions may occur again.

The ZZ Semafor indicator can be applied to any currency pair and across all time frames, from short-term scalping charts to higher time frame swing trading setups.

For best results, traders often confirm signals with price action or additional technical tools.

Free Download

Download the “ZZ_SEMAFOR_02.ex4″ indicator

Key Features

- Marks local highs as resistance levels.

- Marks local lows as support levels.

- Useful for breakout and reversal strategies.

- Displays signals directly on the price chart.

- Suitable for scalping, day trading, and swing trading.

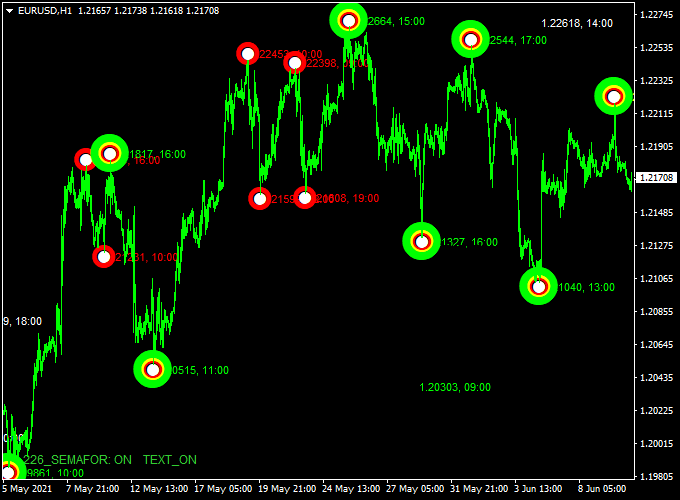

Indicator Chart

The chart displays the ZZ Semafor indicator plotted on the price chart with large bullet markers.

These markers highlight key support and resistance zones, allowing traders to monitor potential breakout points or reversal areas.

Guide to Trade with ZZ Semafor

Buy Rules

- Identify a resistance level marked by the ZZ Semafor indicator.

- Wait for the price to close clearly above that resistance.

- Confirm bullish momentum using price action or another indicator.

- Open a buy trade after confirmation.

Sell Rules

- Identify a support level marked by the ZZ Semafor indicator.

- Wait for the price to close clearly below that support.

- Confirm bearish momentum using price action or another indicator.

- Open a sell trade after confirmation.

Stop Loss

- Place the stop loss beyond the most recent pullback area.

- Allow additional room on higher time frames to avoid noise.

Take Profit

- Target the next major support or resistance level.

- Alternatively, trail profits as long as momentum remains strong.

ZZ Semafor + Zero Lag MACD Forex Strategy for MT4

This strategy combines the ZZ Semafor Forex Indicator for MT4 with the Zero Lag MACD Indicator for MT4.

Using these together gives both structural breakouts (Semafor) and momentum confirmation (Zero Lag MACD) across short-term timeframes (M1, M5, M15) for active traders.

This setup works best when you focus on one major currency pair at a time, during active sessions (London or New York).

It is suited for traders who like quick entries and tight timeframes.

The Semafor indicator identifies key support and resistance breakout points, while the Zero Lag MACD provides momentum direction and strength (zero-lag version reduces delay).

With trades on M1, M5, or M15 charts, you’ll aim for modest pip gains and fast resolution.

Buy Entry Rules

- On your chosen timeframe (M1, M5, or M15), wait until the price closes above the latest resistance level marked by the ZZ Semafor indicator.

- Check that the Zero Lag MACD line is above zero, confirming bullish momentum.

- Enter a buy order at the close of the breakout candle or at the open of the next candle.

- Place a stop loss just below the breakout resistance or bar low (for example, 5–10 pips on M5, adjust for timeframe volatility).

- Set a take profit target based on timeframe: M1: 3–6 pips, M5: 8–15 pips, M15: 15–30 pips, or exit when MACD falls back to zero or crosses below zero.

Sell Entry Rules

- On your chosen timeframe, wait until the price closes below the latest support level marked by the ZZ Semafor indicator.

- Check that the Zero Lag MACD line is below zero, confirming bearish momentum.

- Enter a sell order at the close of the breakout candle or at the open of the next candle.

- Set a stop loss just above the breakout support or bar high (for example, 5–10 pips on M5, adjust accordingly).

- Take profit target: M1: 3–6 pips, M5: 8–15 pips, M15: 15–30 pips, or exit when MACD rises back above zero or shows a reversal signal.

Advantages

- Combines structural breakout via ZZ Semafor with momentum confirmation from Zero Lag MACD for stronger entries.

- Zero Lag MACD reduces signal delay compared to the standard MACD, offering quicker reaction.

- Adaptable to very short timeframes (M1, M5, M15) for scalpers and active traders.

- Clear entry rules make it easier to follow and potentially automate or semi-automate in MT4.

- Good for major currency pairs with tight spreads and high liquidity during active sessions.

Drawbacks

- On very short timeframes, the number of false breakouts can increase, especially in choppy markets.

- The ZZ Semafor indicator may shift its high and low points since semafors are derived from ZigZag logic and may repaint or move, so caution is needed.

- Reduced margins on short-term trades mean spreads, slippage, or wrong broker execution can eat profits quickly.

- During low-volatility or quiet sessions, the momentum (MACD) may remain close to zero, and breakouts may fail or produce minimal moves.

Example Case Study 1 – EURUSD M5

During a London session, the ZZ Semafor indicator shows a recent resistance dot at 1.1045.

Price closes above that level at 1.1048.

At that moment, the Zero Lag MACD is reading above zero and trending higher.

A buy trade is opened at 1.1048 with a stop loss at 1.1038 (10 pips) and a target set at 1.1060 (12 pips).

The momentum continues, MACD remains above zero, and price hits the target in about 30 minutes.

A clean breakout plus momentum confirmed the move.

Example Case Study 2 – GBPUSD M1

In the New York session, the ZZ Semafor marks a support level at 1.2750.

Price closes below at 1.2748, and at that time, the Zero Lag MACD is clearly below zero.

A sell trade is executed at 1.2748 with a stop loss at 1.2758 (10 pips) and a target set at 1.2738 (10 pips).

Within a short five minutes, the price moves down to 1.2738, and the target is reached.

Strategy Tips

- Stick to major pairs like EURUSD, GBPUSD, and USDJPY for tighter spreads and more predictable behavior on short timeframes.

- Before entering, double-check that MACD is clearly above or below zero, not just marginal. A weak reading may lead to weak follow-through.

- Avoid trading during major news releases when spikes and false breakouts are common unless you have rapid execution and good risk control.

- Limit the number of trades per session and stop after reaching a profit goal or a loss limit to maintain discipline.

Download Now

Download the “ZZ_SEMAFOR_02.ex4” Metatrader 4 indicator

FAQ

What do the bullet markers represent?

The bullets highlight local highs and lows where price previously reversed or stalled, acting as potential support or resistance.

Is the ZZ Semafor indicator better for breakouts or reversals?

It can be used for both. Breakout traders focus on price closing beyond levels, while reversal traders look for rejection at those zones.

Should this indicator be used alone?

It works best when combined with confirmation tools such as trend filters, momentum indicators, or price action patterns.

Summary

The ZZ Semafor Forex indicator for MT4 helps traders identify important support and resistance levels with ease.

Its visual markers simplify the process of spotting potential breakout and reversal zones.

The indicator adapts well to different trading styles and time frames.

With proper confirmation and risk control, it can enhance trade timing and decision-making.