The RSI vs Bollinger Bands forex MT4 indicator is a buy/sell arrows indicator based on BB and RSI.

The indicator tracks channel breakouts with the help of the RSI indicator and then draws buy and sell signals directly on the chart.

The indicator has a lot of options for customization.

Scalpers, day traders, swing traders and position traders can benefit from this indicator.

Free Download

Download the “RSI_vs_BB.mq4” MT4 indicator

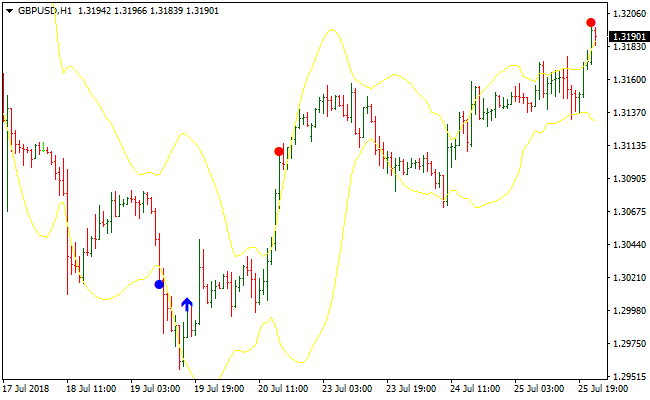

Indicator Chart (GBP/USD H1)

The GBP/USD H1 chart below displays the RSI vs Bollinger Bands forex indicator in action.

Basic Trading Signals

Trading signals from this indicator are simple to interpret and go as follows:

Buy Trade: Open buy trade when the indicator displays a blue arrow

Sell Trade: Open sell trade when the indicator displays a red arrow

RSI vs Bollinger Bands and Cycle Identifier Signals Forex Strategy MT4

This MT4 forex strategy combines the trend clarity from the RSI vs Bollinger Bands Metatrader 4 Forex Indicator with the timing precision of the Cycle Identifier Signals Metatrader 4 Forex Indicator.

The first indicator lets you identify the direction of the market by reading the trend slope and relative volatility.

When the trend is upsloping, the bias is bullish, and when it is downward sloping, the bias is bearish.

The Cycle Identifier adds signal bars that appear as green below the zero level for buy signals and red above the zero level for sell signals, helping confirm entry timing within those trends.

This strategy is ideal for traders who want to enter in the direction of dominant price movement while using cycles to fine-tune entries.

It works well on M15, M30, and H1 timeframes where trend moves and cycle swings are more defined.

Major currency pairs such as EURUSD, GBPUSD, and USDCHF often produce clearer setups with this method during active session hours.

Buy Entry Rules

- The RSI vs Bollinger Bands indicator must show an upsloping trend, indicating bullish bias.

- A green cycle bar must appear below the zero level, signaling buy momentum.

- Enter a buy trade at the close of the candle with the green cycle bar once price respects recent support.

- Place the stop loss below the nearest swing low or below recent Bollinger Band support.

- Set take profit at a preselected pip target or at the next resistance level from a higher timeframe.

Sell Entry Rules

- The RSI vs Bollinger Bands indicator must show a downward sloping trend, indicating bearish bias.

- A red cycle bar must appear above the zero level, signaling sell momentum.

- Enter a sell trade at the close of the candle with the red cycle bar once price respects recent resistance.

- Place the stop loss above the nearest swing high or above recent Bollinger Band resistance.

- Set take profit at a preselected pip target or at the next support level from a higher timeframe.

Advantages

- Combines clear trend direction with precise cycle timing for better entry quality.

- Green and red cycle bars give obvious entry cues without guesswork.

- Helps avoid countertrend trades by only taking setups that align with the trend slope.

- Works on multiple forex pairs and common day trading timeframes.

Drawbacks

- In choppy or low volatility markets, cycle signals can be frequent and less reliable.

- Trend slope may flatten before you get a cycle confirmation, leading to fewer setups.

- Slippage and spread expansion during news events can reduce profit potential.

- Requires practice to read the trend slope accurately and wait for quality cycle confirmations.

- May underperform during extended sideways ranges where neither trend nor cycles align cleanly.

Case Study 1

On EURUSD M30 during the European session, the RSI vs Bollinger Bands indicator showed a clear upsloping trend, indicating that bullish momentum was dominant.

After a small pullback into support, a green cycle bar formed below zero, signaling a buy opportunity.

A buy trade was entered at the close of the confirmation candle.

Price continued upward for a 22-pip move before reaching a preselected resistance target, resulting in a profitable setup.

The stop loss remained below the recent swing low for controlled risk.

Case Study 2

On GBPUSD H1 during the London to New York overlap, the trend displayed by the RSI vs Bollinger Bands indicator turned downward.

After a mild retracement toward resistance, a red cycle bar appeared above zero, signaling a sell entry.

A sell trade was taken on the close of that candle.

Price extended lower for 18 pips before hitting a support zone identified on a higher timeframe.

The stop loss was placed above the recent swing high to protect the trade in case of a reversal.

Strategy Tips

- Only take buy signals when the trend is clearly upsloping and sell signals when it is clearly downward sloping.

- Wait for cycle bars to appear at natural support or resistance areas for higher probability entries.

- Avoid trading during major economic releases to reduce the risk of fake signals and whipsaws.

- Use higher timeframe swing levels to inform your take profit targets and trailing stop adjustments.

- Keep consistent risk per trade to manage your equity and avoid large drawdowns.

- If the trend slope and cycle signals conflict, stay out until both align to reduce low-quality entries.

Download Now

Download the “RSI_vs_BB.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern indicator

Customization options: Variable (RSI Period, RSI Up Level, RSI Down Level, BB Period, BB Deviation, alerts) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Semaphore