About the Shaff MACD Forex Indicator

The Shaff MACD Forex Indicator for MT4 is a practical solution for traders who find standard oscillators too slow or prone to false signals.

This version refines the relationship between price averages to deliver a more stable and readable output.

The Shaff MACD indicator for Metatrader 4 provides directional trend trading signals that can be applied to any currency pair with ease.

It effectively bridges the gap between momentum tracking and trend identification, allowing you to see the strength behind a move as it develops.

The indicator pops up in a separate MT4 chart window as a buy/sell histogram and additional signal lines, providing a dual-layered approach to market analysis.

Free Download

Download the “Shaff MACD.ex4” indicator for MT4

Key Features

- It utilizes a color-coded histogram to provide instant visual confirmation of trend shifts.

- The indicator features additional signal lines to help identify momentum crossovers.

- The system is designed to filter out market noise during periods of low-volume consolidation.

- It works effectively on all timeframes, from the 1-minute chart up to the monthly view.

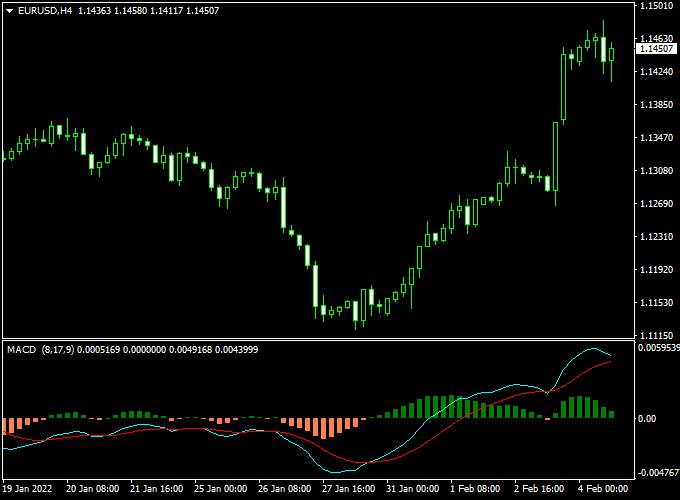

Indicator Chart

The Shaff MACD indicator chart features a dedicated window below the main price candles.

It displays vertical histogram bars that shift between green and orange to indicate the prevailing market sentiment.

When the bars are green and rising, it suggests bullish strength; when they turn orange and fall, it indicates bearish dominance.

Traders can use the height of the bars to gauge the intensity of the current trend.

Guide to Trade with the Shaff MACD Forex Indicator

Trading with this tool involves monitoring the histogram for the very first sign of a color change to catch a new trend early.

Buy Rules

- Monitor the indicator window and wait for the bars to shift from orange to green.

- Open a buy order as soon as the first green histogram bar gets printed on the chart.

- Verify the signal by ensuring the price is bouncing off a support level on the main chart.

- Check that the signal lines are trending upward to support the bullish histogram.

Sell Rules

- Watch the histogram bars for a transition from green to orange.

- Open a sell order as soon as the first orange histogram bar gets printed on the chart.

- Confirm the entry by identifying a bearish rejection at a recent price peak.

- Ensure the broader market trend aligns with the bearish signal for a higher success rate.

Stop Loss

- Secure your buy position by placing the stop loss slightly below the recent swing low.

- Protect your sell trade by positioning the stop loss just above the latest swing high.

- Keep your risk levels tight to account for potential market reversals.

- Always follow a disciplined risk management plan to preserve your trading equity.

Take Profit

- Exit the trade the moment the histogram flips back to the opposite color.

- Alternatively, target a fixed risk-to-reward ratio that fits your personal strategy.

- Consider closing the position when the price reaches a major horizontal level.

- You can also trail your stop loss to lock in profits as the trend continues.

Forex Day Trading Strategy for MT4: Shaff MACD + SuperTrend NRP Indicator

This strategy uses the Shaff MACD Forex Indicator MT4 and the SuperTrend NRP Forex Indicator MT4.

The Shaff MACD shows momentum changes via histogram colours (green for buy, orange for sell).

The SuperTrend NRP displays a coloured trend line (green for bullish trend, orange for bearish trend).

By combining momentum reversal signals with trend confirmation, you get a clear day-trading framework.

Best used on intraday time frames like M5, M15, or M30.

Suitable for traders who can monitor the screen and execute quickly, capturing short to medium intraday swings in major pairs such as EURUSD, USDJPY, and GBPUSD.

You need discipline to stick with the rules and manage risk carefully.

Buy Entry Rules

- Wait for the SuperTrend NRP line to turn green, indicating a bullish trend.

- Then watch for the first green histogram bar on the Shaff MACD.

- Enter a buy order at the close of that first green bar.

- Set a stop loss just below a recent swing low (around 10–15 pips on M15) or below the SuperTrend line.

- Target a take profit equal to 1.5–2× your risk (for example, if risk is 15 pips, target 22–30 pips) or trail the stop when momentum continues.

Sell Entry Rules

- Wait for the SuperTrend NRP line to turn orange, indicating a bearish trend.

- Then watch for the first orange histogram bar on the Shaff MACD.

- Enter a sell order at the close of that first orange bar.

- Set a stop loss just above a recent swing high (about 10–15 pips on M15) or above the SuperTrend line.

- Target a take profit of 1.5–2× your risk, or trail the stop if price keeps moving with momentum.

Advantages

- A clear combination: momentum reversal (Shaff MACD) plus trend confirmation (SuperTrend NRP) gives high-probability setups.

- Well-suited for intraday trading where you need quick and defined signals rather than long-term holds.

- Rules are simple to follow, reducing subjectivity and keeping your trading disciplined.

- Works particularly well on trending moves when a new trend is forming or when momentum picks up.

Drawbacks

- You must be available to monitor the trades and act quickly — it is not suited for set-and-forget trading.

- Spreads and slippage can erode profitability on small take profit targets, especially during low-liquidity hours.

Case Study 1: EURUSD M15 – Morning London Session

At 08:15 GMT, the SuperTrend NRP line on EURUSD turned green, signalling the start of a bullish trend.

At 08:20, the first green histogram bar appeared on the Shaff MACD.

A buy was placed at 1.1120 with a 12-pip stop just below the recent swing low.

Price climbed steadily and by 10:00 it reached 1.1150, delivering a 30-pip profit.

The trend confirmation plus momentum entry captured a strong early move in the session.

Case Study 2: USDJPY M5 – New York Open

At 14:30 EST, USDJPY on the M5 chart showed the SuperTrend line flip to orange, indicating a trend reversal to bearish.

The first orange histogram on the Shaff MACD was then printed.

A sell was taken at 149.50 with a 15-pip stop.

The pair dropped to 149.10 within 35 minutes, yielding a 40-pip profit.

Strategy Tips

- Prefer trading during major session open times (London, New York) when the market has higher volume and stronger moves.

- Avoid trading during quiet periods (late Asian session) when signals may trigger, but momentum is weak and movement is flat.

- Use pairs that have tight spreads and good liquidity, so your small TP/SL targets are viable.

- Backtest the strategy on different pairs and time frames to identify which ones you handle best and which give the most reliable results.

Download Now

Download the “Shaff MACD.ex4” indicator for Metatrader 4

FAQ

How does this indicator differ from the standard MT4 MACD?

The Shaff MACD uses a modified smoothing algorithm that aims to reduce the “lag” found in the default version.

While the standard MACD might wait for a significant move before signaling, the Shaff version is designed to detect the momentum shift earlier.

This allows for better entry prices and helps you avoid entering a trend right before it begins to exhaust itself.

Can I use the signal lines for additional confirmation?

Yes, the signal lines act as a secondary filter.

Some traders wait for the signal lines to cross over in addition to the histogram color change.

For example, a buy signal is considered stronger if the green histogram appears while the signal lines are also crossing upward.

This dual confirmation helps filter out minor fluctuations in choppy markets.

Is the Shaff MACD suitable for day trading gold?

Absolutely, the indicator is very effective on volatile assets like Gold.

Because Gold often moves in strong, fast cycles, the Shaff MACD can capture these momentum bursts efficiently.

It helps you stay in the trade during the high-volume London and New York sessions while giving you a clear exit signal when the momentum starts to fade.

Summary

The Shaff MACD for MT4 is an effective momentum tool that assists in determining the appropriate timing for market entries.

By offering a clearer view of trend transitions, it helps you stay focused on high-probability opportunities rather than chasing random price spikes.

This tool helps traders maintain a consistent routine by highlighting levels where the market is statistically likely to reverse.

Using this indicator allows you to filter high-risk trades and focus on high-conviction momentum shifts.