About the Keltner ATR Band Forex Indicator

The Keltner ATR Band Forex Indicator for Metatrader 4 is a versatile tool designed to help traders identify market trends and potential entry or exit points.

It uses Average True Range (ATR) calculations to plot dynamic channels that adapt to market volatility.

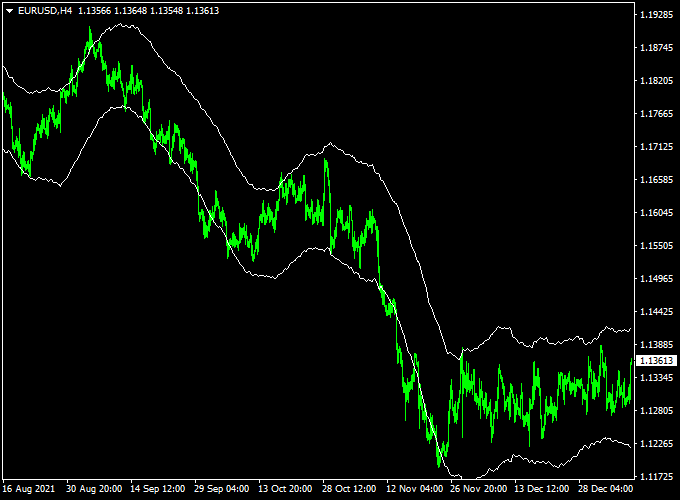

The indicator is displayed on the main MT4 chart as a white trend-following channel.

When the channel rises, it indicates a bullish trend, while a falling channel suggests a bearish trend.

Traders can use this information to align trades with the prevailing market direction.

Free Download

Download the “Keltner_ATR_Band+mt4.mq4” indicator for MT4

Key Features

- Dynamic trend-following channels based on ATR

- Indicates bullish and bearish market trends

- Can be used as a standalone system or trend filter

- Adapts to changing market volatility

- Helps identify potential trade entry and exit points

Indicator Chart

The chart shows the Keltner ATR Band Forex Indicator as a white channel surrounding price action.

Rising channels indicate upward trends, while declining channels signal downward trends.

This visualization helps traders align their trades with the overall market momentum.

Guide to Trade with Keltner ATR Band Forex Indicator

Buy Rules

- Enter a buy trade when the price stays above the upper half of the rising channel.

- Confirm that the channel slope is positive to ensure the trend is strong.

Sell Rules

- Enter a sell trade when the price remains below the lower half of the declining channel.

- Ensure that the channel slope is negative to confirm the bearish trend.

Stop Loss

- For buy trades, place the stop loss just below the lower boundary of the Keltner channel or below the nearest swing low.

- For sell trades, place the stop loss just above the upper boundary of the channel or above the nearest swing high.

- Use ATR-based stops to adjust for market volatility dynamically.

Take Profit

- Set targets at the next swing high (buy) or swing low (sell).

- Use a trailing stop along the channel to capture larger moves.

Practical Tips

- Use higher timeframes to determine the primary trend before trading shorter timeframes.

- Combine the Keltner ATR Band with momentum or breakout indicators for higher-probability trades.

- Monitor channel slope: steeper slopes generally indicate stronger trends and higher potential gains.

Keltner ATR Band + Cycle Identifier Day Trading Strategy for MT4

This day trading strategy combines the trend-filtering power of the Keltner ATR Band with the entry timing of the Cycle Identifier indicator.

Use the Keltner bands to identify the dominant intraday trend.

When the bands slope up, the trend is bullish. When they slope down, the trend is bearish.

Use the Cycle Identifier bars on a lower timeframe for precise entries: a green cycle bar signals a buy entry and a red bar signals a sell entry.

The setup works because it aligns momentum and volatility with specific cycle-based triggers.

Trend direction from the Keltner bands reduces countertrend trades. Cycle bars capture short bursts of momentum inside the trend.

This makes the system reliable for day trading, where you want clear bias and fast, repeatable entries.

Buy Entry Rules

- Confirm the Keltner ATR Bands are sloping up. Prefer a clear upward slope for at least three candles.

- Wait for a green Cycle Identifier bar to appear.

- Enter a market buy at the close of the bar that printed the green cycle signal.

- Place a stop loss below the recent swing low or below the lower Keltner band on the entry timeframe.

- On M15, use a stop of roughly 10–25 pips on majors, adjusted for volatility.

- Set initial take profit at 1:1.5 to 1:2 risk-to-reward.

- For H1 trend with M15 entries, target 25–60 pips depending on pair and momentum.

- If price moves quickly, move stop to break even after capturing 50% of the planned target and then trail below recent pullbacks.

- Avoid entries if the Keltner bands flatten or if a major economic release is due within the next 30 minutes.

Sell Entry Rules

- Confirm the Keltner ATR Bands are sloping down for at least three candles.

- Wait for a red Cycle Identifier bar to appear.

- Enter a market sell at the close of the bar that printed the red cycle signal.

- Place a stop loss above the recent swing high or above the upper Keltner band on the entry timeframe.

- On M15, use a stop of roughly 10–25 pips on majors, adjusted for volatility.

- Set initial take profit at 1:1.5 to 1:2 risk-to-reward.

- Typical TP is 25–60 pips for H1 trend confirmations.

- Move stop to break even after capturing half the target and trail to lock profits as the move continues.

- Do not enter sells when the bands are sloping up or when the price is testing a major support zone without clear follow-through.

Advantages

- Combines trend and cycle signals to reduce false entries.

- Flexible across pairs and intraday timeframes.

- Clear stop and target rules make position sizing straightforward.

- Short trade duration limits overnight and gap risk.

Drawbacks

- Choppy markets produce false cycle bars despite a sloping band, so expect whipsaws.

- Requires active monitoring and quick execution for best results.

- Spread and slippage can eat profit on smaller targets; use major pairs and active sessions.

- Large news events can invalidate the band slope and cause larger losses.

Example Case Study 1 — EUR/USD, H1 trend / M15 entry

On H1, the Keltner bands sloped up for several hours. The green Cycle Identifier bar is printed at 1.1000.

The trader entered at 1.1000 and placed a stop loss at 1.0980, 20 pips below the entry.

The target was set to 1.1030 for a 30 pip take profit.

Price moved in favor and hit the TP for +30 pips.

Example Case Study 2 — GBP/USD, M30 trend / M5 entry

The M30 Keltner bands showed a clear downward slope. A red Cycle Identifier bar printed at 1.2700.

The trader sold at 1.2700 with a stop at 1.2718, 18 pips above entry.

Target was 1.2674 for 26 pips. Price fell quickly, then retraced.

The trader trailed the stop once 13 pips were in favor and exited at 1.2680, locking 20 pips when a counter-move began.

Strategy Tips

- Backtest the method on a demo and collect stats per pair and timeframe.

- Prefer major pairs during the London and New York sessions for best liquidity.

- Adjust stops by current ATR to match real-time volatility rather than fixed pips.

- Avoid trading into high-impact news. Remove open positions if a scheduled event creates unpredictable moves.

- Use fixed fractional risk and never risk more than a small percentage of equity per trade.

- Keep a trading journal and review losing trades to refine entry timing and stop placement.

Download Now

Download the “Keltner_ATR_Band+mt4.mq4” indicator for Metatrader 4

FAQ

How does the Keltner ATR Band indicate trend strength?

The slope of the channel shows trend momentum. A steep upward slope signals a strong bullish trend, while a steep downward slope indicates a strong bearish trend.

Can I use this indicator on lower timeframes?

Yes, it works on all timeframes, but lower timeframes may produce more false signals during sideways markets. Higher timeframes provide more reliable trend direction.

How can it be combined with other indicators?

It pairs well with momentum, MACD, or breakout indicators to confirm entries and filter trades, improving accuracy in both trending and volatile markets.

How should I manage risk using the Keltner ATR Band?

Traders can set stop losses near the channel boundaries and adjust position size according to ATR-measured volatility. Trailing stops along the channel help lock in profits during strong trends.

Summary

The Keltner ATR Band Forex Indicator for MT4 provides a clear visualization of market trends and volatility using dynamic ATR-based channels.

It helps traders identify potential entry and exit points while aligning with the prevailing trend.

Flexible enough for standalone use or as a confirmation filter, this indicator supports multiple trading styles.

By combining channel slope, ATR-based stops, and trend analysis, traders can improve trade accuracy, optimize risk management, and capture larger moves in trending markets.