About the Bigger Time Frames OHLC Indicator

The Bigger Time Frames OHLC Forex Indicator for MT4 displays the Open, High, Low, and Close levels from higher timeframes directly on your current chart.

These levels are essential reference points used by institutional traders, and this indicator helps retail traders see the same structure clearly.

The indicator gives you an idea of where the market is heading and can be used to trade powerful breakouts in trending markets.

The indicator is simple to use, even for newbie traders.

Key Takeaways

- A bullish market occurs when the closing price is higher than the open price.

- A bearish market occurs when the closing price is lower than the open price.

- Pure price action, no lag.

- Simple to use, yet powerful technical indicator

Free Download

Download the “bigger-tf-ohlc-indicator.mq4” indicator for MT4

Main Features

- Plots OHLC levels from higher timeframes (H1, H4, D1, W1)

- Real-time updates with automatic recalculation

- Color-coded lines for easy distinction

- Customizable timeframe selection

- Works on all Forex pairs, indices, and commodities

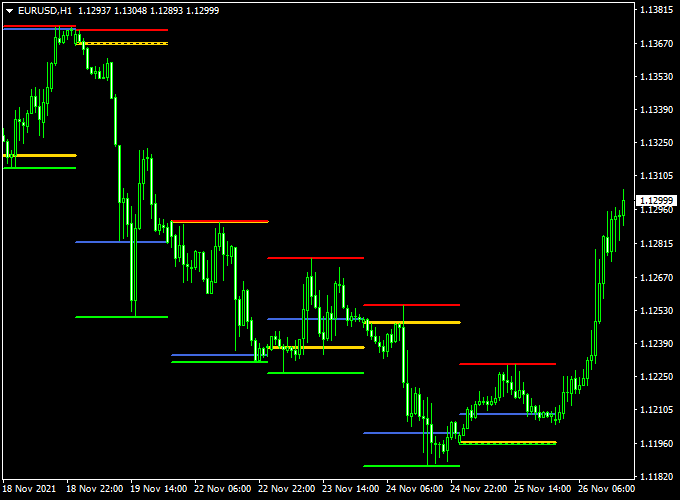

Indicator Example Chart (EUR/USD H1)

The example below shows the indicator plotting the OHLC levels on an H1 chart.

Horizontal lines mark today’s open, high, low, and close. Price respects these levels frequently, making them ideal for trade setups.

How To Trade Using This Indicator

Here’s how to apply it:

- Buy signal: A buy signal occurs whenever the price closes above the previous day’s high price.

- Sell signal: A sell signal occurs whenever the price closes above the previous day’s low price.

- Place a stop loss just beyond the High/Low levels for better protection.

- Use a risk/reward ratio of 1:1.5 or 1:2, or exit manually near the next OHLC level.

Pros

- Highly effective in all market conditions

- Supports precise entry and exit planning

- Great for both breakout and reversal strategies

- Simple visual interface with no lag

Cons

- Traders must understand OHLC behavior to use it optimally

Download Now

Download the “bigger-tf-ohlc-indicator.mq4” indicator for Metatrader 4

High-Probability MT4 Breakout Strategy Using Bigger Time Frames OHLC + Cougar Indicator

This strategy is built for traders who want to catch strong price breakouts with confirmation from higher timeframes.

By combining the Bigger Time Frames OHLC Indicator with the powerful signal-based Cougar Forex Indicator, you can filter out false moves and only take trades when the price breaks out beyond a major high or low supported by momentum.

What Is This Strategy About?

The strategy uses the high and low levels of a higher timeframe (e.g., H4 or Daily) drawn on a lower chart like M15 or H1, provided by the Bigger Time Frames OHLC Indicator.

The Cougar Indicator delivers smart entry signals based on momentum, price action, and volatility.

The combination helps you time breakouts when price pushes past key OHLC levels with strength.

Buy Trade Setup

Conditions:

- Price breaks above the high of the previous higher-timeframe candle (from the OHLC indicator).

- A blue upward arrow appears from the Cougar Indicator, confirming bullish momentum.

Entry:

Open a buy trade at the close of the candle with the Cougar signal after it confirms a breakout above the higher-timeframe high.

Stop Loss:

Place the stop-loss just below the same higher-timeframe high level or the most recent swing low.

Take Profit:

Use a fixed reward/risk of 2:1 or close at the next resistance area. You may also use Cougar’s exit hints for additional confirmation.

Sell Trade Setup

Conditions:

- Price breaks below the low of the previous higher-timeframe candle (from the OHLC indicator).

- A red downward arrow from the Cougar Indicator confirms bearish momentum.

Entry:

Enter a sell trade at the close of the candle where the Cougar signal confirms a breakdown below the key OHLC level.

Stop Loss:

Place the stop just above the higher-timeframe low or the nearest swing high.

Take Profit:

Set your TP based on 2:1 risk/reward, or take partial profits and trail the rest.

Case Study 1

AUD/USD M15 Chart Analysis (20-Day Sample Period):

- Total Signals: 26 trades

- Winning Trades: 17 (65.4%)

- Average Win: +25 pips

- Average Loss: -10 pips

- Net Result: +335 pips over the testing period

Case Study 2

EUR/JPY M30 Chart Analysis (30-Day Sample Period):

- Total Signals: 33 trades

- Winning Trades: 20 (60.6%)

- Average Win: +30 pips

- Average Loss: -16 pips

- Net Result: +392 pips over the testing period

Advantages

- Combines breakout levels with reliable confirmation.

- Prevents premature entries thanks to OHLC filters.

- Works well in trending and volatile markets.

- Visually clear for beginners and advanced traders alike.

Drawbacks

- Not ideal for range-bound or sideways markets.

- May generate fewer trades on low-volatility days.

- Requires discipline to avoid taking trades without full confirmation.

Strategy Conclusion

The combination of the Bigger Time Frames OHLC Indicator and Cougar Forex Indicator offers a disciplined way to trade breakouts with higher accuracy.

By waiting for prices to break major levels and confirming with Cougar signals, traders can improve entry timing and reduce false breakouts.

Indicator Specifications

| Indicator Name | Bigger Time Frames OHLC Indicator |

|---|---|

| Platform | MetaTrader 4 |

| Timeframes | All (can overlay H1, H4, D1, W1, MN1) |

| Currency Pairs | All Forex pairs, indices, metals, and crypto |

| Inputs |

|

| Repaint | No |

Final Words

The Bigger Time Frames OHLC Indicator for MT4 is an essential tool for traders who want to stay aligned with key market levels used by professional traders and institutions.

These OHLC levels act as natural magnets for price, and this indicator puts them right on your current chart.

It’s a must-have for top-down traders who rely on clean structure, support/resistance levels, and strong price reaction zones.

Download it today and upgrade your chart-reading strategy instantly.