About the All Volume Average Forex Indicator

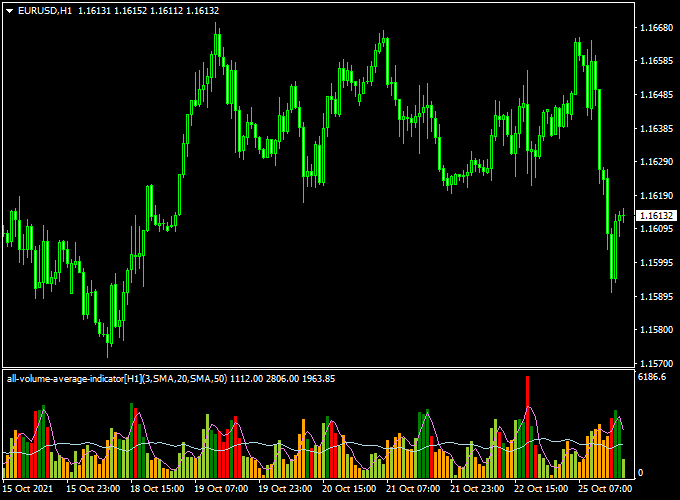

The All Volume Average Indicator for MT4 is a smart tool that helps you measure and visualize market activity using average volume levels.

It offers a dynamic way to detect when the market is heating up or cooling down, allowing traders to time entries and exits more effectively by watching for volume surges.

Unlike traditional volume bars, this indicator overlays an average line and gives a visual cue when the current volume crosses above or falls below the average, giving you a powerful edge in spotting breakout conditions, fakeouts, or trend continuation.

Key Features of the Indicator

- Plots real-time volume along with a dynamic average volume line

- Highlights when the current volume exceeds the average (breakout potential)

- Color-coded bars:

Green for above-average,

Red for below-average - Works on all timeframes and currency pairs

- Non-repainting and lightweight on MT4

How It Works

The indicator tracks the tick volume of each candle and calculates the average over a customizable number of periods.

When the current volume exceeds this moving average, the volume bar turns green, signaling a possible increase in market participation and volatility.

If it’s below average, it displays a red bar, suggesting consolidation or low activity.

This volume filter can help you avoid entering trades during low volume periods and stay aligned with smart money activity during strong moves.

Free Download

Download the “all-volume-average-indicator.mq4” indicator for MT4

Why Use the All Volume Average Indicator?

- Detect breakout setups by confirming rising volume

- Avoid low-volume traps and false breakouts

- Enhance your entry/exit timing with volume confirmation

- Works well with trend and reversal systems

Indicator Example Chart (EUR/USD H1)

How to Trade Using This Indicator

You can use the All Volume Average indicator as a confirmation layer in your strategy. Here’s a basic approach:

- Entry Point: Wait for a price breakout from a support/resistance zone. Enter only if the volume bar turns green (above average), confirming momentum.

- Stop Loss: Use a technical stop below the breakout candle (for longs) or above (for shorts).

- Take Profit: Use a 1:2 or 1:3 risk-to-reward ratio, or exit when volume drops off (bar turns red) after a strong move.

Download Now

Download the “all-volume-average-indicator.mq4” indicator for Metatrader 4

All Volume Average + Winning MACD Arbitrage Cloud Strategy for MT4

This strategy merges the volume analysis of the All Volume Average Forex Indicator with the cloud-based momentum tracking of the Winning MACD Arbitrage Cloud Indicator.

By combining real-time volume dynamics with trend and momentum cloud signals, traders can filter high-probability trades where price movement is supported by strong participation.

This strategy is effective on M15 to H1 charts across major forex pairs.

What Is This Strategy About?

The All Volume Average Indicator compares current volume to its historical average, providing a clear picture of whether the market is showing strength or weakness in participation.

The Winning MACD Arbitrage Cloud Indicator visualizes MACD momentum and trend conditions using a dynamic cloud structure that shifts color based on buy or sell conditions.

By aligning volume confirmation with MACD cloud shifts, this strategy aims to enter strong, validated moves while avoiding low-volume traps.

Buy Rules

Conditions:

- The Winning MACD Arbitrage Cloud turns green, signaling a bullish MACD momentum shift.

- The All Volume Average shows volume above its average level, indicating strong market participation.

Entry:

Open a buy trade when both the MACD Cloud is bullish and volume is elevated above average.

Stop Loss:

Place a stop loss below the recent swing low or the base of the MACD cloud.

Take Profit:

Use a 1:2 or 1:3 risk-to-reward ratio, or exit when the MACD Cloud turns neutral/red.

Sell Rules

Conditions:

- The MACD Cloud turns red, indicating bearish momentum.

- The All Volume Average displays above-average volume, confirming strong bearish interest.

Entry:

Initiate a sell trade when both the MACD Cloud turns red and the volume is above average.

Stop Loss:

Set stop loss above the recent swing high or cloud top.

Take Profit:

Close the trade at a set R:R target or when the cloud flips to bullish.

Advantages

- Combines momentum and volume for strong signal confirmation.

- Filters out weak or fake signals in low-volume conditions.

- Visually clear with dynamic cloud coloring and volume bars.

- Useful for trend-following and breakout strategies.

Drawbacks

- Volume on MT4 is tick-based and not true exchange volume.

- MACD cloud signals may lag slightly during fast reversals.

- Fewer trade setups during flat or low-volume sessions.

Conclusion

The All Volume Average + Winning MACD Arbitrage Cloud Strategy provides a reliable and visually clear approach for trading momentum moves with volume confirmation.

The All Volume Average Indicator ensures participation is present, while the Winning MACD Arbitrage Cloud identifies trend direction and strength.

Together, they form a robust framework for making disciplined, data-backed trading decisions.

Example Scenario

During the London session, the price breaks out of an Asian range on EURUSD.

You notice the volume bar has turned green and is clearly above the average line. This confirms the strength behind the move.

You enter long with a tight SL and ride the breakout for 30-50 pips.

Pros and Cons

| Pros | Cons |

|---|---|

| Clear visual of volume strength and weakness | Volume in MT4 is based on tick data (not real contracts) |

| Great for timing breakouts and reversals | Needs combination with price action for best results |

Indicator Specifications

| Indicator Name | All Volume Average Forex Indicator |

|---|---|

| Platform | MetaTrader 4 (MT4) |

| Indicator Type | Volume Analysis |

| Repainting | No |

| Inputs |

|

Final Words

The All Volume Average Indicator for MT4 is a simple but highly effective way to add volume confirmation to your trades.

It helps validate breakouts, avoid false signals, and stay in sync with market activity.