About the AO Divergence Indicator

The AO Divergence Forex Indicator is an MT4 tool built on the Awesome Oscillator (AO).

It identifies bullish and bearish divergences naturally, equipping traders with advanced insight into potential trend reversals.

Key Features

- Automatically detects both classic and hidden divergence

- Supports all Forex pairs and timeframes

- Non‑repainting signals for confidence in real-time trading

- Visual arrows and colored labels on the chart

How It Works

Built on the Awesome Oscillator, the indicator spots divergence when price and AO move in opposing directions:

- Bullish Divergence: Price makes a lower low while AO makes a higher low → potential upside reversal

- Bearish Divergence: Price forms a higher high while AO forms a lower high → potential downside reversal

Free Download

Download the “ao-divergence-indicator.mq4” indicator for MT4

Benefits of Using This Indicator

- Spot early reversal zones before price reaction

- Remove subjectivity from divergence detection

- Works across multiple timeframes and pairs

- Clear, color-coded visuals with alerts

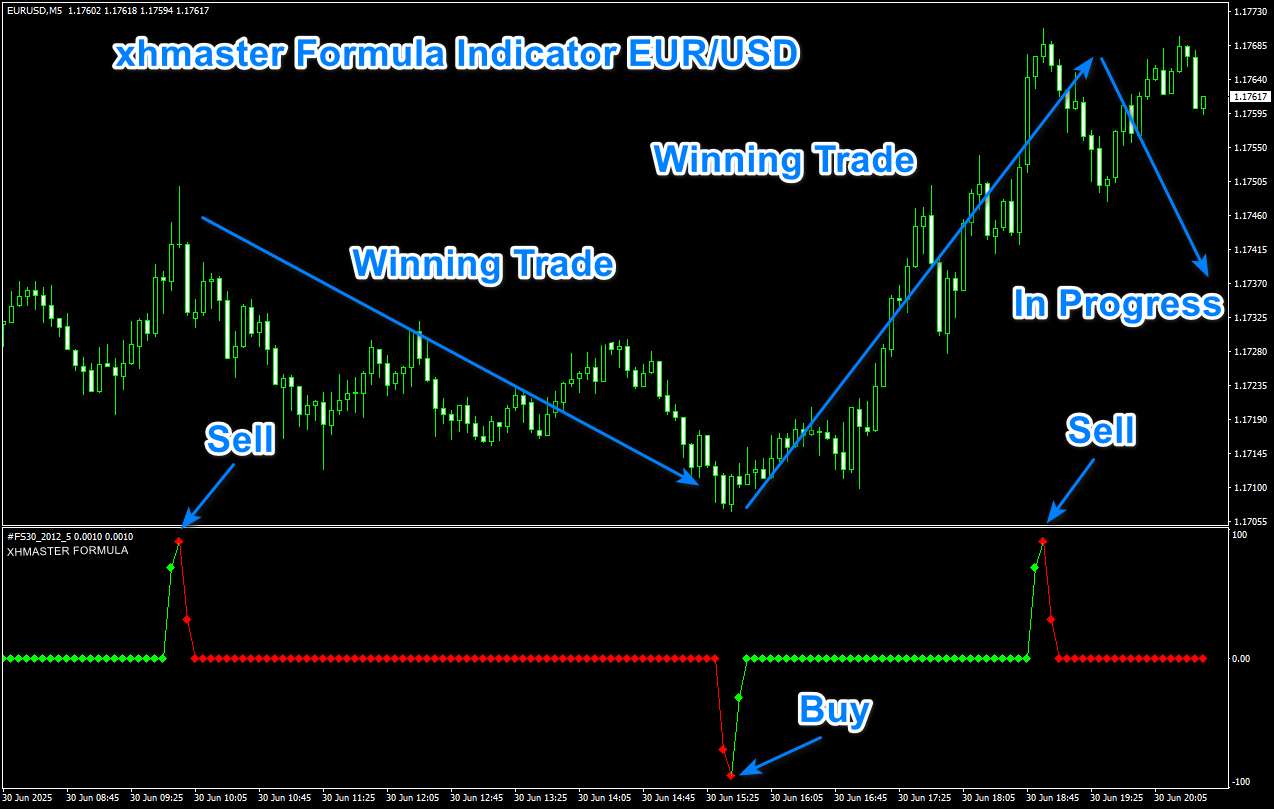

Indicator Example Chart (EUR/USD Daily)

How To Trade Using This Indicator

Entry Strategy

- Execute a long position when the AO Oscillator finds a bullish divergence on the chart above the 0.00 neutral level.

- Execute a short position when the AO Oscillator finds a bearish divergence on the chart below the 0.00 neutral level.

Stop Loss

- For buy signals, place SL just below the recent price swing low

- For sell signals, place SL just above the recent price swing high

Take Profit

- Option A: Use a fixed risk‑reward ratio, e.g., 1:2 or 1:3

- Option B: Close when AO crosses the midline or reverses color

- Option C: Target nearby support/resistance levels or Fibonacci zones

Download Now

Download the “ao-divergence-indicator.mq4” indicator for Metatrader 4

AO Divergence + Waddah Attar Scalping Strategy for MT4

This strategy merges the power of divergence detection with explosive breakout confirmation.

By combining the AO Divergence Forex Indicator and the Waddah Attar Forex Scalping Indicator, traders can spot early trend reversals and then confirm high-momentum entries.

This dual-approach system is well-suited for M5 to M30 charts, ideal for intraday scalping and short-term swing trades.

What Is This Strategy About?

The AO Divergence Indicator identifies bullish or bearish divergence between price and the Awesome Oscillator, often signaling a potential reversal.

The Waddah Attar indicator measures market explosion (momentum breakout) and confirms the strength and direction of the upcoming move.

This strategy waits for a divergence signal and then executes only when the Waddah Attar confirms the breakout strength in the same direction, filtering out weak or fake divergences.

Buy Rules

- Wait for a bullish divergence signal from the AO Divergence Indicator.

- Then, monitor the Waddah Attar Indicator for a strong green bar above the explosion line and a bullish signal.

- Enter a buy trade at the open of the next candle after both signals align.

- Place a stop loss below the recent swing low or last support zone.

- Target 1:1.5 or 1:2 risk-to-reward, or trail stop as Waddah Attar’s momentum continues rising.

Sell Rules

- Wait for a bearish divergence from the AO Divergence Indicator.

- Confirm a strong red bar from the Waddah Attar Indicator above the explosion threshold and showing bearish momentum.

- Enter a sell position at the next candle’s open after confirmation.

- Set stop loss above the recent swing high or resistance.

- Take profit at a fixed level or let the trade run while Waddah Attar bars remain red and strong.

Advantages

- Divergence-based timing: Captures reversals early using a proven oscillator technique.

- Momentum confirmation: Avoids weak signals by requiring a power breakout with Waddah Attar.

- Low-lag execution: Works well on fast charts like M5 and M15.

- Flexible setup: Can be used for scalping or quick intraday swings.

Drawbacks

- False divergence risk: Not all divergence signals lead to reversals; hence, confirmation is vital.

- Lag during consolidation: Waddah Attar may produce fewer signals in ranging markets.

- Needs fast execution: Scalping setup requires fast decision-making and tight risk management.

Final Thoughts

By combining the reversal-detection power of the AO Divergence Forex Indicator with the momentum confirmation of the Waddah Attar Scalping Indicator, this strategy offers a reliable edge for short-term traders.

It captures reversal setups backed by explosive price movement, making it a valuable system for anyone seeking a high-probability trading approach on MT4.

Use during high-volume trading hours for the best results.

Examples, Case Data & Performance

In back‑tests on EUR/USD H1 and GBP/USD H4, the AO Divergence indicator consistently showed reliable reversal setups with approx. 65‑70% win rate when combined with trend filters (e.g., 50 EMA).

It struggles in strong trending moves—hidden divergence filtering helps mitigate false entries.

- Pros: Objective divergence detection, early signals, works well with trend confirmation

- Cons: Can signal too early in strong trends, false positives without confirmation

Indicator Specifications

| Property | Details |

|---|---|

| Name | AO Divergence Forex Indicator |

| Platform | MetaTrader 4 (MT4) |

| Timeframes | All (common: M30, H1, H4) |

| Pairs | All Forex & commodity pairs |

| Signal Type | Green/Red divergence arrows with alerts |

| Inputs |

|

Final Words

The AO Divergence Forex Indicator brings clarity and objectivity to spotting reversal opportunities.

When used alongside trend confirmation tools and risk discipline, it can improve timing and trade accuracy.