About the CCI MTF Oscillator Indicator

The CCI MTF Oscillator indicator for MT4 is designed to follow short-term trends across multiple timeframes.

It oscillates above and below the zero line, signaling bullish conditions above zero and bearish conditions below zero.

This makes it ideal for scalpers seeking quick entries and exits.

For intraday or swing trading, the oscillator should be used in agreement with a longer-term trend-following indicator to trade in the direction of the overall trend.

In an uptrend, traders look for the oscillator to cross above zero for buy opportunities.

In a downtrend, trades are taken when the oscillator crosses below zero for sell opportunities.

The default period is 12 but can be adjusted through the inputs menu to suit different trading styles.

Free Download

Download the “cci-mtf-oscillator.mq4” MT4 indicator

Key Features

- MTF oscillator tracks short-term trends across multiple timeframes.

- Oscillates above and below zero to indicate bullish or bearish momentum.

- Ideal for scalping, day trading, and swing trading with trend confirmation.

- Default period of 12, fully adjustable via inputs.

- Helps traders spot high-probability short-term entries and exits.

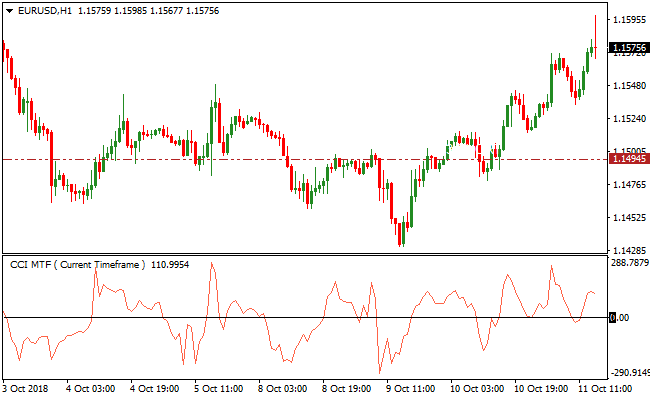

Indicator Chart

The image below shows the CCI MTF Oscillator displayed in a separate window beneath the main price chart.

Bars above the zero line indicate short-term bullish momentum, while bars below the zero line indicate short-term bearish momentum.

Guide to Trade with the CCI MTF Oscillator Indicator

Buy Rules

- For scalping, enter a buy trade when the oscillator crosses above zero from below.

- For trend trading, ensure the overall trend is upward with a longer-term trend indicator.

- Enter trades when the oscillator crosses above zero in the direction of the trend.

- Ignore buy signals if the trend is down or the oscillator shows weak momentum.

Sell Rules

- For scalping, enter a sell trade when the oscillator crosses below zero from above.

- For trend trading, ensure the overall trend is downward with a trend-following indicator.

- Enter trades when the oscillator crosses below zero in the direction of the trend.

- Ignore sell signals if the trend is up or the oscillator shows weak momentum.

Stop Loss

- For buy trades, place the stop-loss below the recent swing low or nearby support.

- For sell trades, place the stop-loss above the recent swing high or nearby resistance.

Take Profit

- Close buy trades if the oscillator falls back below zero.

- Close sell trades if the oscillator rises back above zero.

- Optionally, secure partial profits at key support or resistance levels.

CCI MTF Oscillator + Simple Linear Regression Forex Scalping Strategy

This MT4 strategy combines the CCI MTF Oscillator Indicator with the Simple Linear Regression Indicator to create a fast scalping approach for M1 and M5 charts.

The CCI MTF Oscillator generates buy signals when it crosses back above the zero line from below and sell signals when it crosses below the zero line from above.

The Simple Linear Regression shows trend direction. An upward-sloping regression indicates a bullish trend while a downward-sloping regression indicates a bearish trend.

By combining the oscillator’s quick entries with regression trend confirmation, traders can scalp short-term moves with higher accuracy.

This strategy works best on volatile pairs such as GBP/USD, EUR/JPY, AUD/USD, and USD/JPY.

Buy Entry Rules

- The Simple Linear Regression must slope upward, confirming a bullish trend.

- The CCI MTF Oscillator crosses above zero from below.

- Enter a buy trade at the close of the confirming candle.

- Place a stop loss below the recent swing low or the nearest support level.

- Take profit when the next candle shows a CCI cross back below zero or when price shows early signs of reversal on the regression slope.

Sell Entry Rules

- The Simple Linear Regression must slope downward, confirming a bearish trend.

- The CCI MTF Oscillator crosses below zero from above.

- Enter a sell trade at the close of the confirming candle.

- Place stop loss above the recent swing high or the nearest resistance level.

- Take profit when the next candle shows a CCI cross back above zero or when the regression shows signs of trend exhaustion.

Advantages

- Fast entries suitable for M1 and M5 scalping.

- Trend confirmation reduces counter-trend scalps.

- Clear signals from the CCI MTF Oscillator make timing easier.

- Works well on volatile, liquid pairs with consistent short-term moves.

- Dynamic take profit using oscillator reversal captures quick gains efficiently.

Drawbacks

- Requires constant attention and quick execution on lower timeframes.

- Short-term trades may require monitoring multiple signals per hour.

Example Case Study 1 – GBP/USD M1

During the London session, GBP/USD showed an upward slope on the Simple Linear Regression.

The CCI MTF Oscillator crossed above zero at 1.2572.

A buy order was entered at 1.2572. Stop loss was set at 1.2565 below the recent swing low.

Price moved up quickly and the trade was exited when the next candle closed and the CCI crossed back below zero at 1.2581, capturing 9 pips.

The regression slope remained upward, confirming the trend throughout the trade.

Example Case Study 2 – EUR/JPY M5

EUR/JPY on the M5 chart during the New York session showed a downward-sloping regression.

The CCI MTF Oscillator crossed below zero at 144.50.

A sell trade was placed at 144.50. Stop loss was set at 144.65 above the recent swing high.

Price fell, and the trade was closed when the next candle closed and the CCI crossed back above zero at 144.38, capturing 12 pips.

The regression remained downward, confirming the bearish trend and validating the trade direction.

Strategy Tips

- Focus on pairs with high volatility for better scalping opportunities.

- Use M1 and M5 charts for quick trades, but monitor spreads to avoid excessive slippage.

- Do not trade if the regression slope is flat or ambiguous, even if the CCI crosses zero.

- Use tight stop losses and quick exits based on CCI reversals to protect profits on short-term moves.

Download Now

Download the “cci-mtf-oscillator.mq4” Metatrader 4 indicator

FAQ

Is the CCI MTF Oscillator suitable for scalping?

Yes, the oscillator works very well for scalping as it quickly highlights short-term bullish and bearish momentum through zero-line crosses.

Can it be used for swing or day trading?

Absolutely. For longer-term trades, use the oscillator in combination with a trend-following tool to trade only in the direction of the overall market trend.

How do I adjust the indicator for different currencies or timeframes?

The default period is 12, but you can modify it in the inputs menu to adapt to different currency pairs, timeframes, and trading styles.

How reliable are the zero-line signals?

The zero-line crosses provide clear short-term signals. Accuracy improves when trades are aligned with the trend and momentum is strong.

Summary

The CCI MTF Oscillator is a versatile tool for spotting short-term buy and sell opportunities.

Tracking momentum across multiple timeframes helps traders enter trades when the market shows bullish or bearish strength.

When combined with a trend-following indicator, it enhances trade accuracy, supports disciplined entries and exits, and is effective for scalping, day trading, or swing trading.

It simplifies short-term trend analysis and provides a reliable framework for timing trades.