About the Choppy Market Index (MT4)

The Choppy Market Index (CMI) for MetaTrader 4 helps you quickly determine whether the price is trending or ranging.

It distills recent price behavior into a single oscillator-style line so you can instantly adjust your tactics—trend-following when the market runs, mean-reversion when it chops.

Use CMI as a market regime filter and as a trade quality gate: only take entries that match the current condition (e.g., pullbacks with moving averages in trends, fades at range extremes in chop).

The result is fewer mismatched trades and more consistent execution.

Key Features

- Regime Detection: Highlights when conditions are choppy (range) vs directional (trend).

- Threshold Bands: Customizable levels to formalize “chop” and “trend” states.

- Color Cues: Optional color change on state shifts for faster recognition.

- Alerts: Popup/sound/email/push when CMI crosses key thresholds.

- Lightweight: Low CPU usage and minimal chart clutter.

- Works Everywhere: Suitable for Forex, indices, gold, and crypto CFDs across M1–D1.

Free Download

Download the “choppy-market-index.ex4” indicator for MT4

Benefits of Using the Indicator

- Right Strategy, Right Market: Avoid trend systems in sideways conditions and vice versa.

- Fewer False Starts: Filter entries when the backdrop is unfavorable.

- Clarity & Discipline: Objective rules reduce emotional decision-making.

- Time-Saving: Alerts notify you of regime changes so you don’t have to babysit charts.

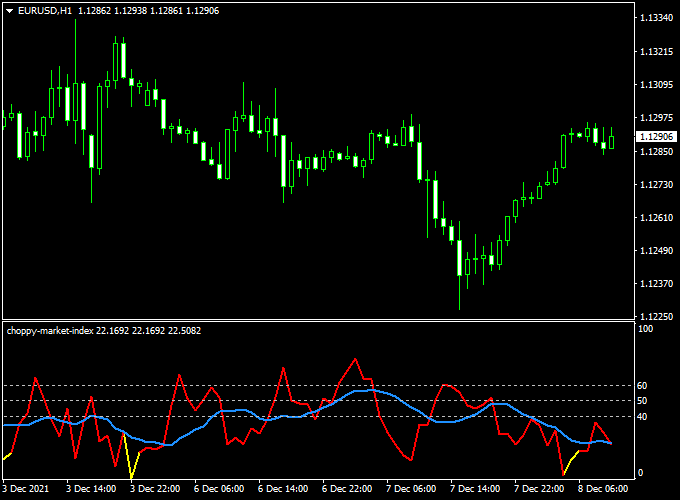

Indicator Example Chart (EUR/USD H1)

The sample below shows CMI holding low while price rotates inside a range, then rising as a breakout evolves into a trend.

How To Trade Using This Indicator

Recommended Confluence

- Trend Tools: EMA 50 & EMA 200 for directional bias and pullback zones.

- Levels: Daily/weekly S&R, session highs/lows, round numbers.

- Session: Focus on London/NY overlap for intraday follow-through.

CMI Regime Guidelines

- Chop Zone (e.g., CMI below Lower Threshold): Favor range strategies—fade extremes, target the middle.

- Transition Zone (between thresholds): Patience or smaller size; wait for confirmation.

- Trend Zone (e.g., CMI above Upper Threshold): Favor trend-following—pullback entries with the slope.

Entry Rules

Buy Setup (Trend-Following)

- Price above EMA 200 and EMA 50 sloping up.

- CMI is in or moving into the Trend Zone.

- Entry: Buy a pullback to EMA 50 or a recent minor support after a higher low.

- Invalidation: If CMI falls back into Chop Zone immediately after entry, be conservative with management.

Sell Setup (Trend-Following)

- Price below EMA 200 and EMA 50 sloping down.

- CMI is in or moving into the Trend Zone.

- Entry: Sell a pullback to EMA 50 or a recent minor resistance after a lower high.

Range Strategy (Mean-Reversion)

- CMI in Chop Zone and price oscillating between clear range highs/lows.

- Entry: Fade at range edges with a confirming rejection candle or micro-structure break.

- Exit: Aim for mid-range or opposite band; avoid holding through news.

Stop Loss & Take Profit

- Stop Loss (SL):

- Trend Buys: below pullback swing low or EMA 50 buffer.

- Trend Sells: above pullback swing high or EMA 50 buffer.

- Range Fades: just outside the range boundary, you’re fading.

- Take Profit (TP):

- Trend: 1.5R–2R base target; trail under/over swing structure for runners.

- Range: partial at mid-range, final near the opposite band; keep R multiples modest (1–1.5R).

- Management: Consider breakeven at 1R; reduce exposure if CMI flips regimes.

Download Now

Download the “choppy-market-index.ex4” indicator for Metatrader 4

Choppy Market Index & Linear Regression Channel Breakout MT4 Strategy: Navigating Market Conditions

This strategy combines the Choppy Market Index Forex Indicator with the Linear Regression Channel Breakout Indicator to identify optimal trading conditions and breakout opportunities.

The Choppy Market Index helps determine whether the market is trending or choppy, while the Linear Regression Channel Breakout Indicator identifies potential breakout points within the channel.

Buy and Sell Rules

Buy Setup

- Wait for the Choppy Market Index to indicate a trending market (values below 50).

- Ensure the price breaks above the upper band of the Linear Regression Channel (yellow arrow).

- Enter a buy trade at the close of the breakout candle.

- Place a stop loss below the lower band of the Linear Regression Channel.

- Set take profit at a risk-reward ratio of 1:2 or near the next significant resistance level.

Sell Setup

- Wait for the Choppy Market Index to indicate a trending market (values below 50).

- Ensure the price breaks below the lower band of the Linear Regression Channel (magenta arrow).

- Enter a sell trade at the close of the breakout candle.

- Place a stop loss above the upper band of the Linear Regression Channel.

- Set take profit at a risk-reward ratio of 1:2 or near the next significant support level.

Trader Case Studies

Here are some examples of traders who applied this strategy on different pairs and timeframes with positive results.

Sofia M – Argentina

Sofia M, a swing trader from Argentina, used this strategy on the AUD/USD and NZD/USD pairs over 21 days. She managed to capture +295 pips by carefully entering breakouts confirmed by low choppiness in the market.

Kofi A – Ghana

Kofi A, a day trader from Ghana, applied this strategy on the USD/JPY and EUR/USD pairs using a 15-minute chart. Over 28 days, he realized +260 pips by avoiding choppy periods and focusing on clear breakouts.

Disclaimer: These case studies are for educational purposes only. Trading results will vary depending on market conditions, risk management, and individual discipline.

Advantages of This Strategy

- Combines market condition analysis with breakout detection for improved trade accuracy.

- Works well across multiple timeframes and currency pairs.

- Helps avoid trading during uncertain or choppy markets.

- Clear entry and exit rules reduce emotional decision-making.

Drawbacks and Considerations

- Requires patience and discipline to wait for the right market conditions.

- Can produce fewer trade signals during extended sideways markets.

- Stop losses must be carefully managed to avoid being stopped out prematurely.

- Frequent monitoring is needed on shorter timeframes.

Strategy Conclusion and Tips

This strategy offers a systematic approach by combining choppiness measurement with breakout confirmation.

Traders should always confirm that both indicators align before entering a trade to maximize winning potential.

Proper risk management, including setting stop losses and realistic take profit levels, is essential.

Begin with demo trading to understand how the indicators behave in different market environments.

Indicator Specifications

| Platform | MetaTrader 4 (MT4) |

|---|---|

| Markets | Forex, Indices, Metals, Crypto (CFD) |

| Timeframes | M1–D1 (popular: M5–H1 intraday, H1–H4 swing) |

| Purpose | Detect choppy vs trending conditions (market regime) |

| Display | Oscillator line with optional color/zone fills |

| Alerts | Popup, Sound, Email, Push (on threshold crosses) |

| Inputs |

|

FAQ

Does the Choppy Market Index repaint?

Values update in real time, but readings based on closed candles should remain fixed. Alerts typically trigger on confirmed crosses.

What pairs and sessions work best?

Major FX pairs (EURUSD, GBPUSD, USDJPY) and XAUUSD. For intraday trading, London and NY often overlap to provide the cleanest trends.

Can I use it alone?

You can for basic filtering, but results improve when combined with EMAs and clear support/resistance or price action triggers.

How should I set thresholds?

Start with symmetrical bands (e.g., 40/60) and adjust per symbol/timeframe after forward-testing to balance sensitivity vs stability.

Best timeframe for beginners?

M15–H1 provides a good balance between signal quality and frequency before trying faster charts.

Final Words

The Choppy Market Index is a simple but powerful regime filter. Let it guide your choice between pullback-trend plays and range fades, and you’ll likely cut many avoidable losses.

Forward-test it on a demo, record your trades, and refine thresholds before going live.