About the Detrended Synthetic Price Go Oscillator indicator

The Detrended Synthetic Price Go Oscillator indicator for MT4 is a momentum-based trading tool designed to highlight directional price pressure without the noise of longer-term trends.

It operates in a separate window below price and moves above and below a fixed zero line, helping traders quickly identify bullish and bearish conditions.

By removing trend bias, the oscillator focuses on short- to medium-term momentum changes.

Green lines reflect bullish price behavior, while red lines indicate bearish pressure.

This makes it easier to time entries during momentum expansions and to exit trades when conditions begin to shift.

Free Download

Download the “Detrended_Synthetic_Price_goscillators.mq4” MT4 indicator

Key Features

- Oscillates around a fixed zero line for directional bias.

- Uses green and red lines to show bullish and bearish momentum.

- Helps identify momentum shifts and reversals.

- Useful for short-term and medium-term trading.

- Easy to combine with other technical tools.

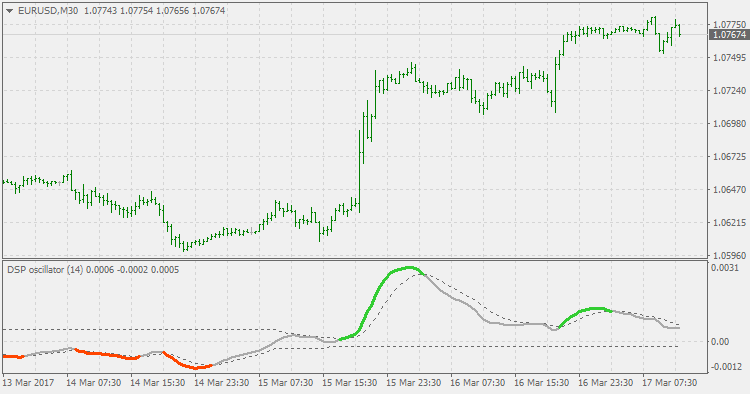

Indicator Chart

The chart shows the Detrended Synthetic Price Go Oscillator plotted beneath price.

Green lines above the zero level highlight periods of upward momentum, while red lines below zero reflect downward pressure.

Traders use these shifts to align entries with momentum and manage exits when the oscillator changes direction.

Guide to Trade with Detrended Synthetic Price Go Oscillator

Buy Rules

- Wait for the oscillator to hold above the zero line.

- Enter a buy trade when a new green line begins.

- Avoid entries during rapid color changes.

- Trade only when momentum remains consistent.

Sell Rules

- Wait for the oscillator to stay below the zero line.

- Enter a sell trade when a new red line forms.

- Avoid trades during unstable momentum phases.

- Focus on sustained downside pressure.

Stop Loss

- Place the stop loss beyond the most recent price swing.

- Limit risk during volatile market conditions.

Take Profit

- Close trades when the oscillator crosses the zero line.

- Take profits when the opposite color appears.

- Use fixed risk-reward targets if preferred.

Detrended Synthetic Price GO Oscillator and Trend Wave Oscillator Indicator Forex Strategy

This MT4 strategy combines momentum confirmation with trend identification using the Detrended Synthetic Price GO Oscillator Indicator and the Trend Wave Oscillator Indicator.

The Detrended Synthetic Price GO Oscillator provides momentum signals with a green line above zero for buys and a red line below zero for sells.

The Trend Wave Oscillator confirms trend direction with aqua dots indicating a buy trend and yellow dots indicating a sell trend.

By combining both indicators, traders can enter trades that align with both momentum and trend, making it effective for M5 and M15 intraday trading.

Buy Entry Rules

- Ensure the Trend Wave Oscillator displays an aqua dot, confirming a bullish trend.

- Check that the Detrended Synthetic Price GO Oscillator is above zero and a green line begins.

- Enter a buy trade at the close of the candle when the green line starts.

- Place a stop loss below the recent swing low or the nearest support level.

- Take profit when the Detrended Synthetic Price GO Oscillator turns red or shows weakening momentum.

Sell Entry Rules

- Ensure the Trend Wave Oscillator displays a yellow dot, confirming a bearish trend.

- Check that the Detrended Synthetic Price GO Oscillator is below zero and a red line begins.

- Enter a sell trade at the close of the candle when the red line starts.

- Place a stop loss above the recent swing high or the nearest resistance level.

- Take profit when the Detrended Synthetic Price GO Oscillator turns green or shows weakening momentum.

Advantages

- Combines momentum and trend indicators for higher probability trades.

- Clear entry and exit signals reduce indecision.

- Works on multiple timeframes for intraday trading.

- Helps avoid trading against the main trend.

- It can be used on a variety of currency pairs without the need for adjustments.

- Useful for both scalping and short-term swing trades.

Drawbacks

- Exits based on oscillator color change may lag during sudden reversals.

- Requires active monitoring on M5 and M15 charts.

- Trade frequency may be lower if both momentum and trend conditions are strict.

Example Case Study 1

On NZDUSD M5, the Trend Wave Oscillator displayed an aqua dot, confirming an upward trend.

The Detrended Synthetic Price GO Oscillator rose above zero and started a green line.

A buy trade was entered at candle close with a stop loss below the swing low.

Price moved steadily upward, and the trade was closed when the GO Oscillator turned red, capturing a 22 pip gain.

Example Case Study 2

On USDCAD M15, a yellow dot appeared on the Trend Wave Oscillator, signaling a bearish trend.

The Detrended Synthetic Price GO Oscillator dropped below zero and drew a red line.

A sell trade was opened at the close of the candle with a stop loss above the recent swing high.

Price declined and the trade was closed when the GO Oscillator turned green, resulting in a 39 pip profit.

Strategy Tips

- Combine signals from multiple timeframes to confirm trend strength before entering trades.

- Monitor recent price swings to avoid entering trades too close to support or resistance extremes.

- Use smaller position sizes when market volatility is high to protect your account.

- Consider waiting for a pullback toward the trend direction for better risk/reward entries.

- Track the duration of previous oscillator signals to anticipate potential reversals.

- Focus on trading during active market sessions to improve signal reliability.

- Keep an eye on higher timeframe trends to avoid trading against long-term momentum.

- Maintain a consistent trading routine to improve discipline and execution speed.

- Use alerts for the oscillator color changes to never miss entry or exit signals.

- Periodically review past trades to refine your setup and optimize entry timing.

Download Now

Download the “Detrended_Synthetic_Price_goscillators.mq4” Metatrader 4 indicator

FAQ

What does the zero line indicate?

The zero line separates bullish and bearish momentum, helping traders decide whether to focus on buy or sell setups.

Can this oscillator be used alone?

It can be traded on its own, but combining it with price action or trend tools can improve signal quality.

Summary

The Detrended Synthetic Price Go Oscillator offers a practical way to trade momentum without relying on trend-following overlays.

Its zero-line behavior and color changes help traders recognize directional pressure and manage entries and exits with confidence.

Adaptable across timeframes and trading styles, it provides a flexible solution for traders who prefer oscillator-driven decision-making.