DTOSC Signal is a free mt4 (Metatrader 4) indicator and can be categorized as an overbought & oversold technical signals oscillator.

The indicator appears in a separate MT4 chart window as an oscillator that consists of two signal lines that follow the trend.

DTOSC can be used in multiple ways.

Trade Example

- Go long as soon as the blue colored signal line crosses above the red colored signal line.

- Go short as soon as the red colored signal line crosses above the blue colored signal line.

The DTOSC indicator can be used for both trade entry and exit, or as an additional confirmation filter for other strategies and systems.

The indicator works equally well on all currency pairs (majors, minors and exotic) and shows promising results if used correctly.

Free Download

Download the “dtosc-indicator.ex4” indicator for MT4

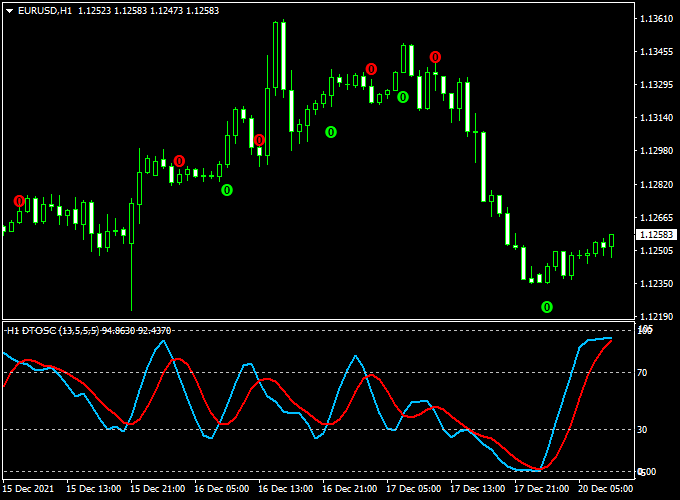

Indicator Example Chart (EUR/USD H1)

The example chart below displays the DTOSC mt4 indicator in action on the trading chart.

Tips:

Feel free to use your own favorite trade entry, stop loss and take profit strategy to trade with the DTOSC Forex indicator.

As always, trade in agreement with the overall trend and practice on a demo account first until you fully understand this indicator.

Please note that even the best trading indicator cannot yield a 100% win rate over long periods.

Indicator Specifications & Inputs:

Trading Platform: Developed for Metatrader 4 (MT4)

Currency pairs: Works for any pair

Time frames: Works for any time frame

Trade Style: Works for scalping, day trading and swing trading

Input Parameters: Variable (inputs tab), color settings & style

Indicator type: Oscillator with signals

Does the indicator repaint? No.

DTOSC Signal + Zero Lag MA MT4 Strategy

Introduction

This strategy blends the DTOSC Signal Forex Indicator with a Zero Lag Moving Average in MT4.

DTOSC is an overbought/oversold oscillator that outputs signal line crossovers.

The Zero Lag MA filters for trend and reduce lag so that you trade with momentum more sharply.

Use this on 5-minute, 15-minute, or 30-minute charts for intraday moves. It is best for traders who want a mix of momentum signals and trend confirmation.

Buy Entry Rules

- Price must be above the Zero Lag Moving Average line (i.e., the trend is bullish).

- DTOSC’s blue signal line must cross above its red signal line (bullish crossover).

- Enter long at the close of the candle where the crossover is confirmed while the price remains above the Zero Lag MA.

- Stop Loss: Place stop below the recent swing low or a certain number of pips under entry (e.g., 10–30 pips depending on timeframe).

- Take Profit: Target 1.5×–2× risk or exit when DTOSC shows a bearish crossover or price closes below Zero Lag MA.

Sell Entry Rules

- Price must be below the Zero Lag Moving Average line (trend is bearish).

- DTOSC’s red signal line must cross above its blue signal line (bearish crossover).

- Enter short at the close of the candle, confirming that crossover while price is below Zero Lag MA.

- Stop Loss: Place stop above the recent swing high or a defined pip distance above entry.

- Take Profit: Target 1.5×–2× risk or exit when DTOSC gives a bullish crossover or price moves above the Zero Lag MA.

Advantages

- Combines momentum oscillator signals (DTOSC) with a smoother trend filter.

- Zero Lag MA helps reduce lag compared with standard moving averages.

- Clear entry and exit cues reduce indecision.

- Applicable across multiple intraday timeframes.

Drawbacks

- Zero Lag MA settings must be tuned; incorrect periods can lead to whipsaws.

- DTOSC crossovers in range markets may generate false signals.

- Lag in strong reversals — signals might come a little late.

Example Case Studies

Case Study 1 — EURUSD on 15m

On the EURUSD 15-minute chart, the price was trending above the Zero Lag MA line.

The DTOSC blue line crossed above the red line at 1.1205. A long entry was taken at 1.1207.

The stop was set 20 pips below at 1.1187.

Price moved up steadily and hit the 1.5× target (~30 pips) at 1.1237 before the DTOSC gave a bearish crossover, at which point the position was closed.

Case Case Study 2 — GBPJPY on 5m

On GBPJPY 5-minute, the price was below the Zero Lag MA. DTOSC’s red line crossed above blue at 153.45, confirming bearish momentum.

A short was entered at 153.43 with a stop placed 15 pips above.

The trade slid downward, achieving ~22 pips before a bullish DTOSC crossover triggered exit.

Strategy Tips

- Always check a higher timeframe trend (e.g., H1) before taking signals on lower timeframes.

- Avoid entering right before major news releases — volatility can spike and false crossovers may occur.

- Tweak the period setting of Zero Lag MA per instrument (e.g., 20, 50, or custom) to best align with volatility.

- Backtest the combination of DTOSC period settings and Zero Lag MA across major pairs to find reliable configurations.

By combining the DTOSC Signal with a well-parametrized Zero Lag Moving Average, you get a balanced momentum + trend filter system on MT4.

Refine parameters and follow strict risk control to improve performance across pairs and sessions.

Download Now

Download the “dtosc-indicator.ex4” indicator for Metatrader 4