About the Golden Finger Indicator

The Golden Finger indicator for MT4 is a powerful trading tool that provides complete buy and sell signals for any currency pair.

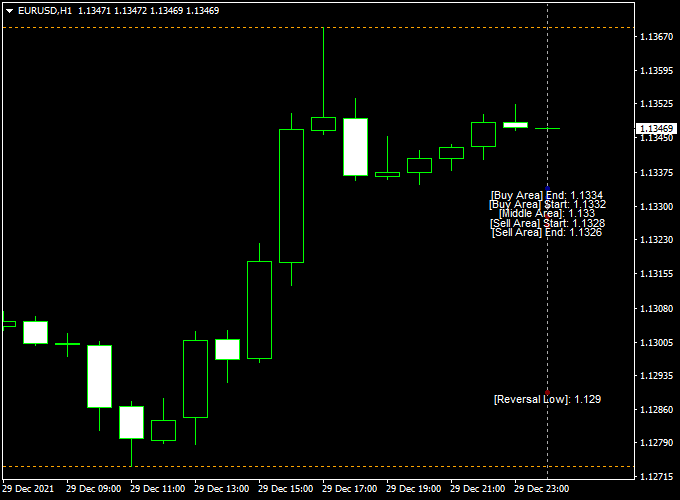

It appears directly on the main chart as a technical dashboard showing recommended buy and sell areas.

This allows traders to identify optimal entry zones without complex calculations.

The indicator is beginner-friendly but also useful for experienced traders seeking precise trade timing.

It can be used for scalping, day trading, or swing trading.

By displaying buy and sell zones clearly, it reduces hesitation and simplifies decision-making.

Free Download

Download the “Golden Finger.ex4” indicator for MT4

Key Features

- The technical dashboard is displayed on the main MT4 chart

- Shows recommended buy and sell areas for precise entries

- Easy to read and beginner-friendly

- Helps confirm trade direction and market conditions

Indicator Chart

The chart example shows the Golden Finger indicator dashboard.

Buy areas indicate zones where upward trades are likely to succeed.

Sell areas highlight zones where downward trades are favored.

Traders can use these areas to enter or exit positions with higher confidence.

Guide to Trade with Golden Finger Indicator

Buy Rules

- Open a buy trade when the price enters the recommended buy area

- Confirm upward momentum with recent price action

- Exit or reverse if the price moves into the sell area

Sell Rules

- Open a sell trade when the price enters the recommended sell area

- Confirm downward momentum with recent price action

- Exit or reverse if the price moves into the buy area

Stop Loss

- For buy trades, place the stop slightly below the buy area

- For sell trades, place the stop slightly above the sell area

Take Profit

- Close the trade when the price reaches the opposite recommended area

- Consider partial profits within the area if momentum slows

- Use trailing stops to lock in gains during strong trends

Practical Tips

- Use higher timeframes to confirm the main trend

- Avoid trading when price moves sideways outside the recommended areas

- Keep proper risk management to avoid large losses

Golden Finger + Waddah Attar Scalping MT4 Strategy

This MT4 scalping strategy combines the Golden Finger Forex System Indicator with the Waddah Attar Forex Scalping Indicator.

Golden Finger highlights recommended buy and sell zones while Waddah Attar shows momentum strength with its histogram.

Combining the two allows scalpers to enter high-probability trades in the direction of market momentum.

This strategy works best on 1-minute to 5-minute charts, ideal for traders looking for quick scalps with tight risk management.

Focus on major currency pairs with low spreads such as EURUSD, GBPUSD, USDJPY, and AUDUSD.

Why this combo works

The Golden Finger zones identify areas of potential reversal or continuation.

The Waddah Attar histogram confirms the market’s momentum in the same direction.

Waiting for the histogram to align with the zone filters out false entries and increases the chance of a successful trade.

Buy Entry Rules

- Price enters a Golden Finger buy zone.

- Waddah Attar’s histogram turns green or shows bullish momentum.

- Enter at the close of the confirming candle.

- Stop loss: place 6–12 pips below the recent swing low or the bottom of the buy zone.

- Take profit: 8–20 pips depending on the timeframe and volatility.

Sell Entry Rules

- Price enters a Golden Finger sell zone.

- Waddah Attar’s histogram turns red or shows bearish momentum.

- Enter at the close of the confirming candle.

- Stop loss: place 6–12 pips above the recent swing high or the top of the sell zone.

- Take profit: 8–20 pips depending on the timeframe and volatility.

Advantages

- Combines zones and momentum for more accurate scalping entries.

- Simple rules are easy to follow, even in fast-paced charts.

- Works well on multiple currency pairs.

- Helps avoid false breakouts and choppy market trades.

Drawbacks

- It can give small losses if the momentum changes quickly.

- Requires tight spreads and fast execution for best results.

- Less effective during major news releases.

- Scalping requires discipline and strict risk management.

Example Case Study 1 — EURUSD, 1-Minute

Timeframe: 1M. Pair: EURUSD. Session: London open.

Price entered a Golden Finger buy zone at 1.1050. Waddah Attar’s histogram turned green.

Entry: 1.1051. Stop loss: 1.1045 (6 pips). Take profit: 1.1061 (10 pips).

Trade closed at target for +10 pips.

Example Case Study 2 — GBPUSD, 5-Minute

Timeframe: 5M. Pair: GBPUSD. Session: New York overlap.

Price entered a Golden Finger sell zone at 1.2720. Waddah Attar’s histogram turned red.

Entry: 1.2718. Stop loss: 1.2728 (10 pips). Take profit: 1.2708 (10 pips).

Trade closed at target for +10 pips.

Strategy Tips

- Use small lot sizes and limit daily risk to a fixed percentage of account equity.

- Avoid trading during major news events.

- Use major pairs with low spreads to reduce slippage.

- Wait for both the Golden Finger zone and Waddah Attar confirmation to align.

- Backtest on different pairs and sessions to understand optimal setups.

Download Now

Download the “Golden Finger.ex4” indicator for Metatrader 4

FAQ

Can Golden Finger be used for swing trading?

Yes. It works on higher timeframes to capture longer-term trends using the buy and sell areas.

How do I know when a trade is safe to enter?

Enter only when the price is inside the recommended area and momentum supports the direction.

Does the indicator work on all MT4 timeframes?

Yes. Lower timeframes suit scalping, while higher timeframes are better for day trading or swing trading.

Can I combine it with other tools?

Yes. Using moving averages, trend indicators, or support/resistance levels can improve signal accuracy.

Summary

The Golden Finger indicator for MT4 provides clear buy and sell zones on a dashboard for precise trade entries.

It simplifies trading decisions and improves timing for scalping, day trading, and swing trading.

The indicator works well with trend-following or momentum tools to enhance trade accuracy.

By combining multiple confirmations, traders can increase the probability of success and better manage risk.