About the Laguerre Volume Forex Indicator

The Laguerre Volume Indicator for MT4 provides accurate overbought and oversold market levels for all currency pairs.

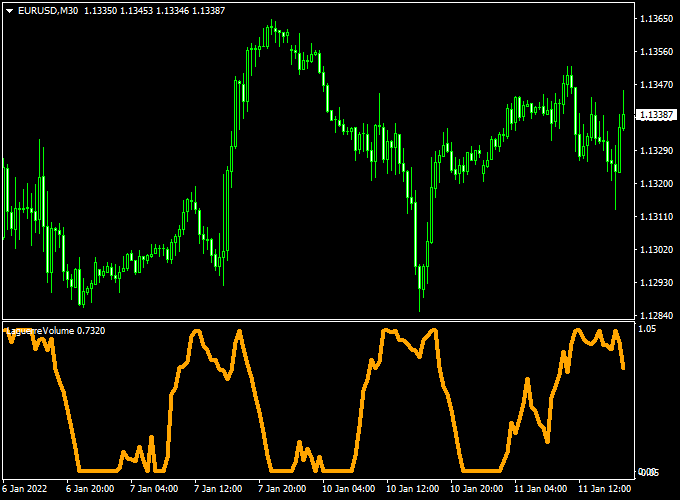

It appears as a yellow line oscillating between 0 and 1.05, helping traders spot high-probability trade opportunities.

A reading near 0 signals an oversold market, suggesting a potential buy in an uptrend, while a reading near 1.05 signals overbought conditions, suggesting a potential sell in a downtrend.

The indicator can be used for trade entries, exits, or as a confirmation filter for other strategies.

It is suitable for intraday trading on M15–H1 charts and can be applied for scalping on M1–M5 charts.

Traders can use the indicator to identify turning points and time entries more effectively.

Free Download

Download the “LaguerreVolume.mq4” indicator for MT4

Key Features

- The yellow line indicates overbought and oversold levels

- 0 reading indicates oversold; 1.05 indicates overbought

- Can be used on all currency pairs

- Suitable for intraday trading and M1–M5 scalping

- Works as a filter for entries and exits in other strategies

- Simple to read and beginner-friendly

- Provides actionable overbought/oversold signals in trending markets

Indicator Chart

The chart shows the Laguerre Volume Indicator on an MT4 chart.

The yellow line oscillates between 0 (oversold) and 1.05 (overbought).

Traders can look for buys near 0 in uptrends and sells near 1.05 in downtrends.

This works well for intraday setups and M1–M5 scalping.

Guide to Trade with Laguerre Volume Indicator

Buy Rules

- Enter a buy when the yellow line approaches 0 in an uptrend

- Confirm the trend with moving averages or trendlines

- Reverse or exit if the line rises above 0.5 in a short-term correction

Sell Rules

- Enter a sell when the yellow line approaches 1.05 in a downtrend

- Confirm the trend with moving averages or trendlines

- Reverse or exit if the line falls below 0.5 in a short-term pullback

Stop Loss

- For buys, place stops below the nearest support or swing low

- For sells, place stops above the nearest resistance or swing high

- Use tighter stops for M1–M5 scalping trades

- Adjust according to market volatility and trend strength

Take Profit

- For buys, target the next resistance level or an overbought reading near 1.05

- For sells, target the next support level or an oversold reading near 0

- Exit fully if the yellow line crosses against your trade

Practical Tips

- Use M1–M5 charts for fast scalping trades

- M15–H1 charts are better for intraday entries

- Combine with trend indicators or moving averages to filter false signals

- Avoid trading during low-volume sessions or major news releases

MT4 Day Trading Strategy Using Laguerre Volume and Silver Trend Indicators

This MT4 day trading strategy combines the Laguerre Volume Forex Indicator MT4 with the Silver Trend Metatrader 4 Forex Indicator to identify high-probability trades during the day.

The Laguerre Volume indicator generates buy signals when it crosses back above 0.05 from below and sell signals when it crosses below 1.05 from above.

The Silver Trend indicator confirms the overall trend, with blue candlesticks for bullish trends and red candlesticks for bearish trends.

This strategy is ideal for M15, M30, and H1 timeframes, perfect for day traders seeking strong trend-based setups.

Buy Entry Rules

- Confirm that the Silver Trend candlesticks are blue, indicating a bullish trend.

- Wait for the Laguerre Volume indicator to cross back above 0.05 from below.

- Enter a buy trade at the close of the confirming candle.

- Set the stop loss below the most recent swing low.

- Set take profit at a risk-reward ratio of 1:2 or close partially at the next resistance level.

Sell Entry Rules

- Confirm that the Silver Trend candlesticks are red, indicating a bearish trend.

- Wait for the Laguerre Volume indicator to cross back below 1.05 from above.

- Enter a sell trade at the close of the confirming candle.

- Set the stop loss above the most recent swing high.

- Set take profit at a risk-reward ratio of 1:2 or close partially at the next support level.

Advantages

- Combines trend confirmation with volume-based signals for high-probability trades.

- Works well on multiple intraday timeframes.

- Clear entry and exit rules make it suitable for disciplined day trading.

- Helps traders avoid counter-trend trades by confirming the main trend.

Drawbacks

- Requires attention to both indicators for confirmation, especially during fast market moves.

- Stop losses must be adjusted properly to avoid early exits during minor retracements.

- Not ideal for extremely short-term scalping.

Case Study 1 – EUR/USD

On the EUR/USD M30 chart, the Silver Trend candlesticks turned blue, indicating an uptrend.

The Laguerre Volume indicator crossed back above 0.05 from below, triggering a buy entry at 1.1050 with a stop loss at 1.1035.

The price moved to 1.1080, reaching the take profit level for a gain of 30 pips within a few hours.

This trade illustrates how trend and volume confirmation together can produce reliable intraday entries.

Case Study 2 – GBP/JPY

On the GBP/JPY H1 chart, the Silver Trend candlesticks turned red, confirming a downtrend.

The Laguerre Volume crossed below 1.05 from above, triggering a sell entry at 178.50 with a stop loss at 179.00.

The trade closed at 177.90, capturing 60 pips in a day.

This example shows how combining trend direction with volume-based signals can produce profitable day trading setups.

Strategy Tips

- Focus on active trading sessions such as London and New York for stronger moves.

- Use currency pairs with higher volatility to maximize intraday opportunities.

- Always wait for both the Laguerre Volume signal and Silver Trend confirmation before entering.

- Adjust stop loss according to recent swing highs/lows to manage risk effectively.

- Partial profit-taking at key levels can help lock gains while allowing the trade to run.

Download Now

Download the “LaguerreVolume.mq4” indicator for Metatrader 4

FAQ

Can I use Laguerre Volume for M1–M5 scalping?

Yes. On M1–M5 charts, the indicator can help identify quick entries near oversold or overbought levels.

Does the yellow line repaint?

No. The line is based on completed calculations and does not change retroactively.

How do I confirm the trend for trades?

Use moving averages, trendlines, or higher timeframe Laguerre Volume readings to confirm the direction before entering.

When is the best time to scalp using this indicator?

The London and New York sessions are ideal due to high volatility and liquidity, which produce faster, more reliable signals.

Summary

The Laguerre Volume Forex Indicator for MT4 shows overbought and oversold levels using a yellow line.

Traders can buy near 0 in uptrends and sell near 1.05 in downtrends. It is suitable for both intraday and M1–M5 scalping trades.

It provides clear entry and exit points and can also act as a filter for other strategies.

Combined with trend confirmation tools, it allows traders to capture high-probability setups efficiently.

Using this indicator helps simplify decision-making, especially for fast-moving scalping trades, while providing reliable guidance for intraday market timing.