About the Momentum Reversal Forex Indicator

The Momentum Reversal Forex Indicator for MT4 is a momentum-based tool designed to identify potential trend reversals across all currency pairs and timeframes.

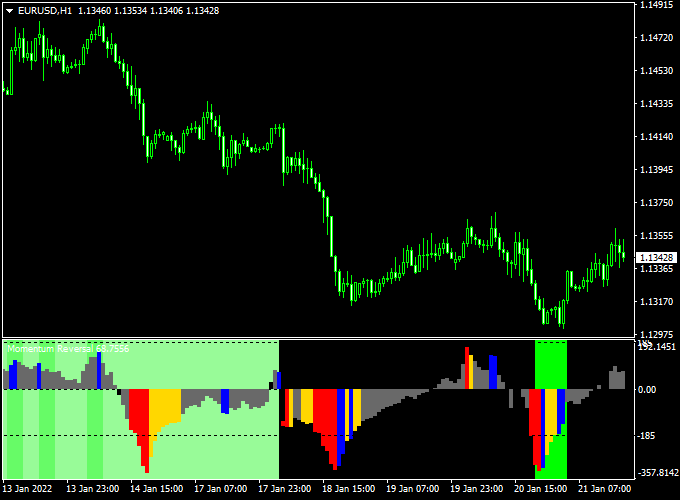

The indicator is displayed as a colored trend bar histogram in a separate MetaTrader 4 window.

Its position relative to the zero line helps traders determine shifts in market momentum.

Instead of following price direction, the indicator focuses on changes in momentum strength.

This allows traders to spot early signs of trend exhaustion before price fully reverses.

When histogram bars cross above or below the zero level, it signals a possible change in market direction.

These signals can be used for both early entries and confirmation trades.

Its simplicity and adaptability make it a useful addition to momentum and trend-following strategies.

Free Download

Download the “momentum-reversal-detector.mq4” indicator for MT4

Key Features

- Momentum-based histogram designed to detect trend reversals.

- Zero line crossover signals for buy and sell decisions.

- Colored trend bars for quick momentum interpretation.

- Effective for early entries and reversal confirmation.

- Can be combined with trend filters and price action.

Indicator Chart

The histogram bars change direction and cross the zero level, highlighting potential buy and sell signals as momentum shifts.

Guide to Trade with the Momentum Reversal Forex Indicator

Buy Rules

- Wait for the first histogram bar to cross above the 0.00 level.

- Confirm that bullish momentum is starting to build.

- Enter a buy trade at the close of the signal bar.

Sell Rules

- Wait for the first histogram bar to cross below the 0.00 level.

- Confirm that bearish momentum is increasing.

- Enter a sell trade at the close of the signal bar.

Stop Loss

- Place the stop loss beyond the most recent swing high or swing low.

- Use a fixed pip stop for lower timeframes if needed.

- Adjust position size to maintain consistent risk.

Take Profit

- Target the next major support or resistance zone.

- Close the trade when opposite momentum signals appear.

Practical Tips

- Use the indicator during active market sessions for better signals.

- Combine zero line crossovers with trend direction analysis.

- Stick to consistent timeframes for reliable results.

- Confirm signals with price behavior near key levels.

Momentum Reversal + 1-2-3 Reversal Points Forex Day Trading Strategy

This day-trading strategy combines the Momentum Reversal Forex Indicator MT4 and the 1-2-3 Reversal Points Pattern Indicator MT4 to catch high-probability intraday reversal moves.

The first indicator is a histogram that crosses above zero for a buy signal, and below zero for a sell signal.

The second indicator marks reversal structure with arrows (blue for bullish, red for bearish).

Trading on lower time-frames (such as 5-minute or 15-minute charts) for major FX pairs, this strategy is designed for traders who prefer identified reversal points rather than riding long trends.

It works best in liquid sessions (London, New York) and is suitable for intermediate day traders comfortable with quick decision-making and strict risk control.

Buy Entry Rules

- The Momentum Reversal histogram must cross above zero and stay above for at least one completed bar.

- The 1-2-3 Reversal Points Indicator must generate a blue arrow, indicating a bullish reversal pattern has formed.

- Confirm price is not deeply extended: ideally, price retraced to a recent support or session low before the signal.

- Enter a buy once both conditions align, and the next candle closes above the reversal high point identified by the blue arrow.

- Stop loss: place below the recent swing low (or the low of the reversal arrow bar) by 8-15 pips, depending on the pair and volatility.

- Take profit: aim for 12-25 pips, or a 1:1.5 or 1:2 risk-reward ratio.

- Alternatively, exit when the histogram approaches a strong overbought region or shows signs of crossing back below zero.

Sell Entry Rules

- The Momentum Reversal histogram must cross below zero and remain below for at least one completed bar.

- The 1-2-3 Reversal Points Indicator must generate a red arrow, marking a bearish reversal structure.

- Confirm price is near recent resistance or session high before the signal, limiting risk on entry.

- Enter a sell once both conditions align and the next candle closes below the reversal low point indicated by the red arrow.

- Stop loss: place above the recent swing high (or the high of the red arrow bar) by 8-15 pips, depending on volatility and pair.

- Take profit: target 12-25 pips or a risk-reward of 1:1.5 to 1:2.

- Exit early if the histogram nears zero or begins to cross back above (for shorts) / below (for longs).

Advantages

- Clear signal alignment between momentum and pattern reversal increases the probability of success.

- Works well for intraday scalpers and day traders seeking defined exit targets and shorter holding times.

- Applies to multiple currency pairs and under 15-minute timeframes, offering frequent setups.

- Combines a structural reversal pattern (1-2-3) and a momentum shift, reducing choppy or false entries.

Drawbacks

- Reversal setups tend to be fewer than trend-following ones, so patience is required.

- In range-bound or low-volatility periods, signals may trigger, but the price may lack follow-through.

- Requires quick decision-making and tight risk control, as momentum can fade fast.

- Not always suitable around major news events where reversals may be sudden and erratic.

Example Case Study 1 – EUR/JPY (15-min Chart)

During the London session, EUR/JPY pulled back into a recent support zone near 141.45.

The Momentum Reversal histogram crossed above zero and stayed positive for one full bar.

Shortly afterward, the 1-2-3 Reversal Points Indicator plotted a blue arrow, marking the low of the 1-2-3 pattern at 141.43.

A buy was entered at 141.50, stop loss placed at 141.35 (15 pips risk), and take profit set at 141.80 (30 pips target: 1:2 reward).

The move reached the target within 40 minutes, giving +30 pips.

Example Case Study 2 – AUD/USD (5-min Chart)

In the New York afternoon session, AUD/USD rose into resistance around 0.6705, and then the histogram of Momentum Reversal crossed below zero.

The 1-2-3 Reversal Points Indicator gave a red arrow at 0.6707.

A short trade was triggered at 0.6700, stop loss set at 0.6715 (15 pips), and take profit at 0.6685 (target 15 pips for 1:1 risk-reward).

The move ran for ~20 minutes and closed at 0.6683, netting +17 pips.

Strategy Tips

- Use major currency pairs with good liquidity (EUR/USD, GBP/USD, USD/JPY, AUD/USD, EUR/JPY) to ensure tighter spreads and reliable momentum.

- Avoid trading during major economic news release times when whipsaws are common; wait for the market to settle and momentum signals to form.

- Confirm that the reversal arrow (1-2-3 pattern) aligns with a structural point, such as recent support/resistance or intra-day high/low, to increase edge.

- Adjust your lot size so that the risk of stop loss (8-15 pips) remains within your risk management rules (e.g., 1-2% of account per trade).

- If the Momentum Reversal histogram crosses above zero but no reversal arrow is generated, skip the trade — you need both tools to align for higher probability.

- Track how many trades you take and the win/loss ratio. Day-trading reversals can give fewer trades but better defined risk-reward. Consistency is key.

Download Now

Download the “momentum-reversal-detector.mq4” indicator for Metatrader 4

FAQ

What makes the Momentum Reversal indicator different?

It focuses on momentum shifts rather than price direction, helping traders identify reversals earlier than traditional trend indicators.

Does the histogram repaint signals?

No, the indicator does not repaint. Once a bar closes, the signal remains fixed.

Which timeframe works best with this indicator?

The indicator works well on all timeframes, but M15 to H1 are popular choices for balanced signal frequency.

Can this indicator be used for trend trading?

Yes, zero line crossovers can also be used to confirm trend continuation when aligned with higher timeframe bias.

Summary

The Momentum Reversal Forex Indicator for MT4 is a reliable tool for identifying momentum shifts and potential trend reversals.

Its histogram-based design and zero line signals make it easy to interpret during live market conditions.

The indicator offers flexibility across trading styles and pairs well with disciplined risk management.

Combining the Momentum Reversal Indicator MT4 with the 1-2-3 Reversal Points Pattern Indicator MT4 helps pinpoint reliable market turning points.

The strategy supports disciplined entries with controlled risk.

Use it with discipline, good risk control, and patience for optimal results.