About the No Repaint Forex Signals Indicator

The No Repaint Forex Signals Indicator for MT4 is a short-term oscillator designed to generate stable buy and sell signals that remain unchanged after closing.

It is built for traders who rely on fast execution and disciplined risk management.

The indicator operates in a separate MT4 window, measuring momentum extremes using fixed levels of 1.1 and -1.1.

When price momentum reaches these levels, the indicator prints visual signals directly on the oscillator.

A blue dot signals a potential buy, while a magenta dot signals a potential sell.

Because the logic is non-repainting, traders can trust historical signals when reviewing performance or refining entries.

This indicator is best suited for lower timeframes such as M1, M5, and M15.

It performs well in active market sessions and is ideal for scalping strategies that focus on quick entries, tight stop losses, and controlled profit targets.

Free Download

Download the “Leledc-SsrcForceFinalNoRepaint.mq4” indicator for MT4

Key Features

- Non-repainting buy and sell signals

- Oscillator-based momentum analysis

- Fixed extreme levels at 1.1 and -1.1

- Blue and magenta dots for trade timing

- Optimized for M1–M15 scalping

- Compatible with all MT4 forex pairs

Indicator Chart

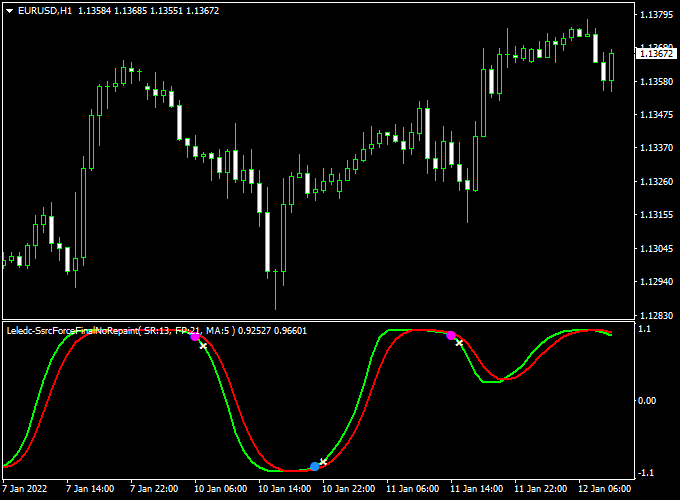

The chart shows the No Repaint Forex Signals Indicator displayed in a separate MT4 window below price.

Blue dots appear near momentum lows, indicating buy setups, while magenta dots appear near momentum highs, indicating sell setups.

The oscillator reacts quickly to short-term price movements during active sessions.

Guide to Trade with No Repaint Forex Signals Indicator

Buy Rules

- Apply the indicator on M1, M5, or M15 charts

- Wait for a blue dot to appear in the oscillator window

- Enter at the open of the next candle

Sell Rules

- Apply the indicator on M1, M5, or M15 charts

- Wait for a magenta dot to appear in the oscillator window

- Enter at the open of the next candle

Stop Loss

- Place the stop loss 2–3 pips beyond the most recent swing

- Keep risk consistent across all trades

Take Profit

- Target 5–20 pips depending on volatility

- Exit earlier if an opposite signal appears

Practical Tips

- Trade during the London and New York sessions only

- Use a higher-timeframe trend filter if needed

No Repaint Forex Signals + HMA Mega Trend Arrows MT4 Strategy

This MT4 day trading strategy combines the precision of the No Repaint Forex Signals Indicator with the trend confirmation of the HMA Mega Trend Arrows Indicator.

It is designed for traders who prefer clear, non-repainting buy and sell entries that align with a strong directional trend.

The combination helps avoid false entries by filtering out weak or sideways movements, making it ideal for day traders and short-term swing traders who focus on accuracy and consistency.

The strategy works best on the M15, M30, and H1 charts for major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

It suits traders who prefer a balanced mix of visual signals and systematic entries without heavy indicator clutter.

How the Strategy Works

The No Repaint Forex Signals Indicator provides the main entry points with clear blue and magenta dots.

A blue dot indicates a potential buy setup, while a magenta dot signals a potential sell setup.

These signals are confirmed using the HMA Mega Trend Arrows Indicator, which defines the prevailing market direction through colored trend lines and arrows.

A green arrow with a green line indicates an uptrend, while a red arrow with a red line indicates a downtrend.

By combining both, traders can align entries with the dominant trend and increase success probability.

Buy Entry Rules

- Wait for a blue dot to appear from the No Repaint Forex Signals Indicator.

- Confirm that the HMA Mega Trend Arrows Indicator shows a green line and green arrow.

- Enter a buy position at the opening of the next candle.

- Set the stop loss just below the recent swing low.

- Set the take profit at 2x the stop loss distance or near the next resistance zone.

Sell Entry Rules

- Wait for a magenta dot to appear from the No Repaint Forex Signals Indicator.

- Confirm that the HMA Mega Trend Arrows Indicator shows a red line and red arrow.

- Enter a sell position at the opening of the next candle.

- Set the stop loss just above the recent swing high.

- Set the take profit at 2x the stop loss distance or near the next support zone.

Advantages

- Non-repainting signals ensure reliable entries that stay fixed once confirmed.

- Combining both indicators filters out false setups in choppy markets.

- Works effectively across multiple pairs and time frames.

- Easy to apply even for beginners with limited chart analysis experience.

Drawbacks

- May produce fewer signals during low volatility sessions.

- Performance can vary in ranging conditions where the trend is unclear.

- Requires discipline to wait for full confirmation before entering trades.

- Short-term traders must monitor charts closely for exits and reversals.

Example Case Study 1: EUR/USD M30

On a recent EUR/USD M30 session, the HMA Mega Trend Arrows turned green with an upward arrow at 1.0750, confirming a bullish direction.

Shortly after, the No Repaint Forex Signals Indicator displayed a blue dot at 1.0760.

A buy entry was placed at the next candle with a stop loss at 1.0735 and a take profit at 1.0810.

The pair reached the target within four hours, capturing a clean 50-pip gain with minimal drawdown.

Example Case Study 2: GBP/JPY H1

During a London session, GBP/JPY formed a red arrow and red line on the HMA Mega Trend Arrows Indicator, signaling a downtrend around 194.80.

Minutes later, a magenta dot appeared on the No Repaint Forex Signals Indicator at 194.60.

A sell trade was executed with a 30-pip stop loss and a 60-pip target.

The price dropped to 194.00 within the session, producing a 60-pip profit while maintaining strong trend momentum.

Strategy Tips

- Avoid trading during overlapping or low liquidity sessions, such as late Fridays.

- Use a trailing stop to lock profits once the trade moves 25 pips in your favor.

- Combine with price action analysis, such as support and resistance levels, for better accuracy.

- Check higher time frames (H4 or D1) to ensure alignment with the dominant trend.

- Backtest the system for at least 3 months on your preferred currency pair before going live.

This day trading approach using the No Repaint Forex Signals Indicator and HMA Mega Trend Arrows Indicator provides a structured, reliable way to capture consistent moves while minimizing false entries.

Traders can adapt the rules to their risk profile and pair preferences, making it a solid strategy foundation for MT4 users seeking clarity and performance.

Download Now

Download the “Leledc-SsrcForceFinalNoRepaint.mq4” indicator for Metatrader 4

FAQ

What makes this indicator non-repainting in live trading?

The signals are generated only after the candle closes. Once a blue or magenta dot is printed, it stays fixed and does not adjust based on future price action.

Can the extreme levels be adjusted?

The default levels at 1.1 and -1.1 are optimized for short-term momentum. Advanced users may experiment with settings, but most traders keep the original values.

Does it work better in trending or ranging markets?

The indicator performs best during active, fast-moving markets. It can still work in ranges, but results improve when volatility is present.

Is this indicator suitable for automated trading?

It is primarily designed for manual trading. However, the fixed signals make it suitable for alert-based or semi-automated execution.

Summary

The No Repaint Forex Signals Indicator for MT4 is built for traders who focus on short-term price movements and fast decision-making.

By using a momentum-based oscillator with fixed extreme levels, it delivers stable buy and sell signals that remain consistent over time.

The indicator is well suited for scalping on lower timeframes and works best when traded during high-liquidity sessions.

While it can be used as a standalone tool, it combines with a simple trend-following indicator to help filter trades and reduce low-quality setups.

With disciplined risk control and realistic targets, this indicator can serve as a reliable component in a short-term trading strategy focused on precision and execution.