About the Power of USD Indicator

The Power of USD indicator for MT4 is a real-time currency strength tool that measures the relative performance of the U.S. Dollar against other major currencies.

It helps traders identify whether the USD is gaining or losing strength, making pair selection more objective.

Once attached to the chart, the indicator plots a strength line that fluctuates around the neutral 0.00 level.

This level acts as a clear dividing line between bullish and bearish USD conditions.

The indicator is designed to guide traders toward trading strong currencies against weak ones.

It works across all Forex pairs that include the U.S. Dollar and can be combined with technical or price action analysis for confirmation.

Free Download

Download the “Power_of_USD.ex4” Metatrader 4 indicator

Key Features

- Measures U.S. Dollar strength in real time.

- Uses the 0.00 level as a strength threshold.

- Helps identify strong vs weak currency combinations.

- Works on any USD-related Forex pair.

- Compatible with all time frames.

- Best used with confirmation tools.

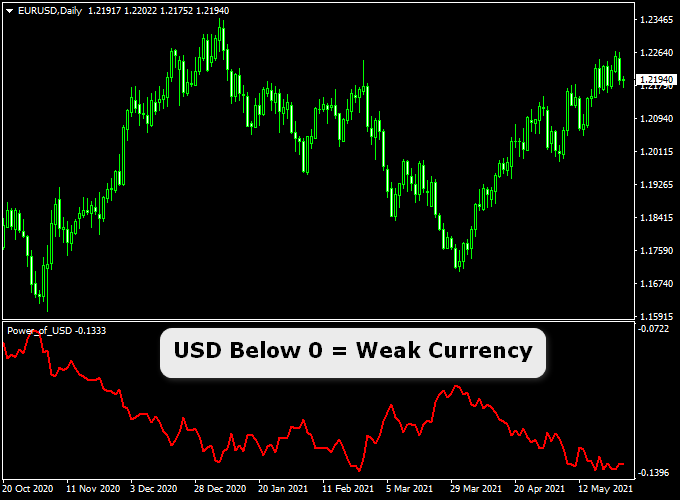

Indicator Chart

The Power of USD indicator appears in a separate window below the price chart.

Movements above or below the zero line clearly show when the U.S. Dollar is gaining or losing relative strength.

Guide to Trade with the Power of USD Indicator

Buy Rules

- Wait for the Power of USD line to cross above the 0.00 level

- Confirm that the counter currency is weak

- Open a buy trade on the selected USD pair

Sell Rules

- Wait for the Power of USD line to cross below the 0.00 level

- Confirm that the counter currency is strong

- Open a sell trade on the selected USD pair

Stop Loss

- Place the stop loss beyond recent support or resistance

- Use wider stops on higher time frames if needed

Take Profit

- Target a reward-to-risk ratio of at least 2.5

- Alternatively, exit when strength momentum weakens

Power of USD Indicator + Zero Lag Moving Average Forex Day Trading Strategy

This day-trading strategy uses the Power of USD U.S. Dollar Forex Indicator for MT4 and the Zero Lag Moving Average Indicator MT4.

The first tool tracks the relative strength of the USD.

The second tool uses a moving average line that adapts faster than traditional MAs:

When the price is above the red Zero Lag MA, the bias is bullish; when below, the bias is bearish.

This combination filters for strong directional moves and helps you day-trade with clarity.

Use on M15 or H1 time frames, in active sessions, ideally on pairs such as USDCHF, USDCAD, NZDUSD.

Buy Entry Rules

- The Power of USD indicator crosses upward through the 0.00 level, indicating USD strength.

- The counter-currency shows relative weakness in the strength meter, or you confirm that the pair is USD vs a weak currency.

- Price is above the red Zero Lag Moving Average, confirming a bullish trend or momentum.

- Enter the buy trade at the market (or at the break of a recent high) once the above conditions align.

- Set stop loss a few pips below the red Zero Lag MA or a recent swing low (for example, 20-25 pips depending on pair volatility).

- Set take profit target of 40-60 pips (or more if volatility supports) or trail the trade while price remains above the MA and the Power of USD stays above zero.

Sell Entry Rules

- The Power of USD indicator crosses downward through the 0.00 level, indicating USD weakness.

- The counter-currency is relatively strong (for example, EURUSD when EUR is strong and USD is weak, or NZDUSD when NZD is strong and USD is weak).

- Price is below the red Zero Lag Moving Average, confirming a bearish trend or momentum.

- Enter the sell trade at the market (or at the break of a recent low) once conditions align.

- Set stop loss a few pips above the red Zero Lag MA or the recent swing high (20-25 pips or adjusted to pair volatility).

- Set take profit target 40-60 pips (or more) or trail while the price remains below the MA and the Power of USD remains below zero.

Advantages

- Combines currency strength (Power of USD) with trend/momentum filter (Zero Lag MA) to improve trade probability.

- Clear rules and visuals: zero-line cross plus price-relative-to-MA give clean entries.

- A day-trading setup means you are in and out within the same session, reducing overnight risk.

- Works well on major USD pairs where one currency clearly dominates the other.

Drawbacks

- In choppy or range-bound markets, the Power of USD may cross zero frequently and the MA may flip bias often, leading to false signals.

- Requires the counter‐currency to show clear weakness or strength; if both currencies are balanced, the signal is weak.

- Spread and cost matter: for day trades, transaction cost can eat profits unless you pick pairs with tight spreads and good liquidity.

- The Zero Lag MA reduces lag but still may lag in extremely fast reversals; you may enter slightly late.

Case Study 1: USDCHF H1 Setup

During a US session hour, the Power of USD indicator crossed above 0.00, indicating USD strength.

At the same time, CHF was showing weakness in broader currency strength tools.

On the USDCHF H1 chart, the price moved above the red Zero Lag MA and held above it.

Entry was placed at 0.9050 with a stop loss at 0.9030 (20 pips).

Price moved up to 0.9110 over the next 3 hours, delivering a 60-pip profit before a minor retracement triggered a move back to the MA and exit.

Case Study 2: NZDUSD H1 Setup

In the early London session, the Power of USD crossed downward through 0.00, indicating USD weakness, while NZD strength was evident.

On the NZDUSD H1 chart price was trading below the red Zero Lag MA.

A sell trade was entered at 0.6200 with a stop loss at 0.6225 (25 pips).

Over the next couple of hours price fell to 0.6140, giving a 60-pip profit.

The price then moved close to the MA, and the signal to exit was taken.

Strategy Tips

- Use the strategy on major pairs with USD involvement (e.g., USDCHF, USDCAD, NZDUSD) where currency strength shifts are meaningful.

- Watch session times with good volatility (London open, New York open) to improve the probability of meaningful moves.

- Check the economic calendar: avoid entering just before major news releases that may distort strength indicators or cause sharp reversals.

- Use a higher-time-frame check (H4) to ensure the major trend supports your day trade direction for added confluence.

Download Now

Download the “Power_of_USD.ex4” MT4 indicator

FAQ

What does the zero line represent?

The zero line separates strong and weak USD conditions.

Values above indicate strength, while values below indicate weakness.

Is this indicator suitable for beginners?

Yes. The strength-based logic is easy to understand and removes much of the guesswork from pair selection.

Can it be used without other indicators?

It can be traded alone, but combining it with technical confirmation often improves accuracy.

Does it repaint or lag?

The indicator updates in real time and reflects current market conditions without repainting past data.

Summary

The Power of USD Forex Indicator for MT4 provides a clear view of U.S. Dollar strength using a simple zero-line framework.

It helps traders align trades by pairing strong currencies against weaker ones.

The indicator works across all USD pairs and time frames.

When combined with confirmation and risk control, it supports structured and consistent trading decisions.