About the Keltner Channels Signal Alert Indicator

The Keltner Channels Signal Alert Metatrader 4 forex indicator is a trend-based alert tool built on the Keltner Channels technical indicator.

Its primary role is to identify trend strength and notify traders when market conditions shift.

The indicator plots a three-line channel consisting of a blue, yellow, and purple line.

Price movement outside the channel often signals strong directional momentum, while price within the channel reflects weaker trend conditions.

This enhanced version of the Keltner Channels provides automatic alerts when trend bias changes.

It classifies signals into bullish strong, bullish weak, bearish strong, and bearish weak, helping traders focus on higher-quality trade opportunities.

Free Download

Download the “KeltnerChannels.mq4” MT4 indicator

Key Features

- Keltner Channel-based trend detection.

- Automatic alerts for trend strength changes.

- Strong and weak bullish or bearish signal classification.

- On-chart trade prompts.

- Optional MT4 account information display.

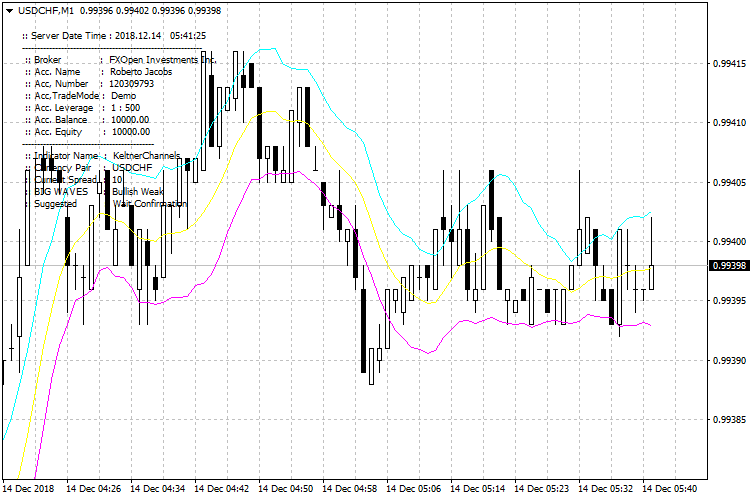

Indicator Chart

The chart shows the Keltner Channels Signal Alert indicator plotted on a price chart.

The Keltner Channel bands highlight volatility and trend direction, while alerts appear when price behavior signals a change in market momentum.

Guide to Trade with Keltner Channels Signal Alert

Buy Rules

- Wait for the indicator to issue a bullish strong alert.

- Confirm that price is moving above the upper Keltner Channel.

- Enter a buy trade after the alert is displayed.

- Prioritize signals aligned with broader market direction.

Sell Rules

- Wait for the indicator to issue a bearish strong alert.

- Confirm that price is moving below the lower Keltner Channel.

- Enter a sell trade after the alert is displayed.

- Focus on signals supported by price momentum.

Stop Loss

- Place the stop loss near the middle Keltner Channel line.

- For buy trades, set the stop slightly below the yellow median line.

- For sell trades, set the stop slightly above the yellow median line.

- Exit the trade if price closes back inside the channel.

Take Profit

- Target extended moves outside the Keltner Channel.

- Use previous highs or lows as profit objectives.

- Secure partial profits when momentum slows.

- Close the position if an opposite alert appears.

MT4 Keltner Channels Signal Alert + Kijun Candles Trend Scalping Strategy

This scalping strategy combines the Keltner Channels Signal Alert MT4 Forex Indicator with the Kijun Candles Trend MT4 Indicator.

The Keltner Channels Signal Alert shows four types of signals in the upper left corner: Bullish Strong, Bullish Weak, Bearish Strong, and Bearish Weak.

Bullish Strong indicates a buy opportunity, while Bearish Strong signals a sell opportunity.

The Kijun Candles Trend confirms the overall trend with blue candles for a bullish trend and red candles for a bearish trend.

This strategy is designed for very short timeframes, M1 and M5, allowing scalpers to quickly enter trades aligned with both momentum and trend direction.

Buy Entry Rules

- Kijun Candles must be blue, indicating a bullish trend.

- Keltner Channels Signal Alert must show a Bullish Strong signal.

- Enter long at the open of the next candle after the Bullish Strong signal appears, while candles remain blue.

- Place a stop loss a few pips below the recent swing low or recent support area.

- Set take profit at 1.5 to 2 times the stop-loss distance, or exit if Kijun Candles turn red or a Bearish Strong signal appears.

Sell Entry Rules

- Kijun Candles must be red, indicating a bearish trend.

- Keltner Channels Signal Alert must show a Bearish Strong signal.

- Enter short at the open of the next candle after the Bearish Strong signal appears while candles remain red.

- Place a stop loss a few pips above the recent swing high or resistance area.

- Set take profit at 1.5 to 2 times the stop-loss distance, or exit if Kijun Candles turn blue or a Bullish Strong signal appears.

Advantages

- Combines momentum-based signals from Keltner Channels with trend confirmation from Kijun Candles.

- Suitable for very short timeframes (M1, M5) for multiple scalping opportunities per session.

- Clear visual signals simplify entry and exit decisions, reducing subjectivity.

- Works across multiple currency pairs with high liquidity.

- It can be used during active market sessions, such as London or New York, for stronger moves.

Drawbacks

- Frequent signals on very short timeframes may produce false entries during choppy or sideways markets.

- Requires constant monitoring due to fast-paced M1 and M5 charts.

- Smaller pip targets mean multiple trades may be necessary to achieve significant profits.

- Over-reliance on signals without context of support/resistance levels may reduce accuracy.

Case Study 1

On EURUSD M1 during the London session, Kijun Candles were blue, indicating a bullish trend.

The Keltner Channels Signal Alert showed a Bullish Strong signal.

The trader entered long at the next candle with a stop loss of 5 pips below the recent swing low and a take profit of 10 pips above.

Within 10 minutes, the price moved up and reached the take profit.

Both indicators remained aligned throughout the trade, resulting in a clean scalp.

Case Study 2

On GBPUSD M5 during the New York session, Kijun Candles were red, showing a bearish trend.

The Keltner Channels Signal Alert displayed a Bearish Strong signal.

The trader entered short at the next candle with a stop loss of 8 pips above the recent swing high and a take profit of 16 pips below.

Price fell steadily over 25 minutes and hit the take profit.

The trend remained aligned with both indicators, validating the setup.

Strategy Tips

- Trade during active market sessions to take advantage of higher volatility and stronger trends.

- Always confirm that both the Keltner Signal and the Kijun Candles align before entering a trade to reduce false signals.

- Keep position sizes small to manage risk since M1 and M5 charts move quickly.

- Consider checking higher timeframes to understand the overall market trend before taking scalp trades.

- Skip trades if signals occur near major support or resistance to avoid whipsaws.

Download Now

Download the “KeltnerChannels.mq4” Metatrader 4 indicator

FAQ

What do strong and weak signals represent?

Strong signals occur when price breaks decisively outside the channel, while weak signals form when price fluctuates near channel boundaries.

What is the difference between bullish strong and bullish weak signals?

Bullish strong signals appear when price pushes decisively outside the channel, while bullish weak signals occur when price moves near the channel edge.

Is this indicator suitable for trending markets?

Yes. It performs best when markets show sustained directional movement.

Does the indicator require manual parameter adjustments?

No. Default settings work effectively, though traders can modify inputs to match their preferred trading style.

Summary

The Keltner Channels Signal Alert MT4 indicator helps traders identify trend strength and momentum using adaptive price channels.

Its alert-based design allows traders to react quickly to changing market conditions.

With clear signal classifications and flexible alert options, the indicator is a practical tool for traders who focus on trend-based opportunities.