The Momentum MT4 forex indicator is often used in forex strategies and systems.

It basically measures and displays the amount of price change over a given time span.

Momentum can be used as a trend-following indicator or as a leading indicator.

This indicator can be used for scalping, day trading, swing trading, and position trading on any currency pair.

Free Download

Download the “Momentum.mq4” MT4 indicator

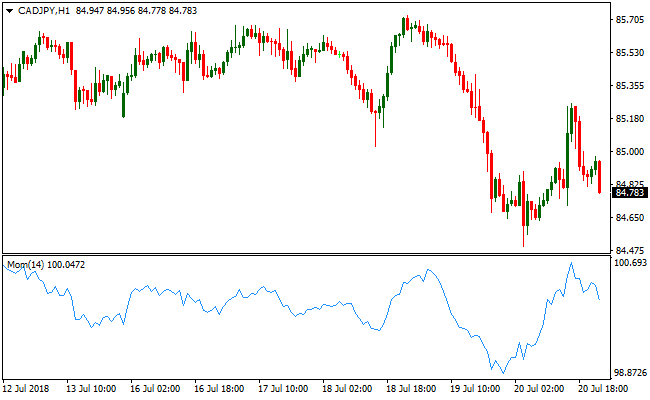

Indicator Chart (CAD/JPY H1)

The CAD/JPY H1 chart below shows the Momentum forex indicator in action.

Basic Trading Signals

Momentum trading signals are simple to interpret and go as follows:

Buy Trade: Go long when the indicator makes a bottom and turns back up.

Sell Trade: Go short when the indicator makes a top and turns back down.

Tip: Add a longer-term moving average to the trading chart and trade in the overall direction of the trend indicated by the longer-term moving average.

Trend up? Only trade Momentum buy trade signals

Trend down? Only trade Momentum sell trade signals

Momentum Indicator and Fisher Forex Scalping Strategy for MT4

This MT4 scalping strategy blends the Momentum MT4 indicator with the Fisher Yur4ik Oscillator MT4 indicator to spot early trend shifts and capture fast moves.

The Momentum indicator signals potential turns when it forms a bottom and then turns upward for buys, or a top and then turns downward for sells.

The Fisher Yur4ik Oscillator shows trend bias with a green histogram above zero for bullish conditions and a red histogram below zero for bearish conditions.

When both indicators agree on direction and timing, this strategy enters short timeframe trades with higher probability setups.

This strategy is built for scalpers using lower timeframes such as M1, M5, and M15.

Buy Entry Rules

- Confirm the Fisher Yur4ik Oscillator histogram is green and above zero, indicating a bullish trend context.

- Wait for the Momentum indicator to form a bottom and turn back upward, signaling renewed upside pressure.

- Enter a buy trade at the close of the candle where both conditions align.

- Place the stop loss below the most recent swing low or a nearby support area.

- Take profit when the Momentum indicator peaks and turns down or when the Fisher histogram turns red.

Sell Entry Rules

- Confirm the Fisher Yur4ik Oscillator histogram is red and below zero, indicating a bearish trend context.

- Wait for the Momentum indicator to form a top and turn back downward, signaling renewed downside pressure.

- Enter a sell trade at the close of the candle where both conditions align.

- Place the stop loss above the most recent swing high or a nearby resistance area.

- Take profit when the Momentum indicator bottoms and turns up or when the Fisher histogram turns green.

Advantages

- Provides early entry opportunities by combining momentum reversals with trend confirmation.

- Works on multiple lower timeframes, offering flexibility for different trading styles.

- Helps traders avoid entering against the overall trend, increasing trade probability.

- Logical stop loss placement based on price action reduces arbitrary risk levels.

Drawbacks

- Scalping requires constant attention and quick reactions to indicator changes.

- Small pip gains per trade mean consistent execution is needed for profitability.

- Lower timeframe noise can sometimes trigger premature entries or exits.

Example Case Study 1

On the M5 USDJPY chart, the Fisher Yur4ik Oscillator histogram was green above zero, indicating a bullish trend context.

The Momentum indicator formed a bottom and began turning up from oversold levels.

A buy trade was entered on the confirming candle close with the stop loss set below the recent swing low.

Price climbed quickly over the next few bars and the trade was closed when the Momentum peaked and started turning downward.

The trade captured 18 pips on this quick M5 reversal.

Example Case Study 2

On the M1 EURGBP chart, the Fisher Yur4ik Oscillator histogram was red below zero, showing a bearish trend context.

The Momentum indicator reached a top and started turning down from overbought conditions.

A sell trade was entered at the close of the confirming candle, with the stop loss placed above the recent minor resistance.

Price moved lower rapidly, and the trade was closed when the Fisher histogram flipped green, signaling a potential trend shift.

This scalping trade captured 12 pips in fast market action.

Strategy Tips

- Trade during the busiest market sessions such as London and New York for better momentum and tighter spreads.

- Avoid entering trades during quiet market hours with low liquidity to reduce false signals.

- Use limit entries or pending orders near Momentum signal points for better price control.

- Do not force trades when indicators do not clearly align; patience improves win rate.

- Manage risk by keeping position sizes small relative to your account to handle rapid scalping swings.

- Combine entries with minor support and resistance areas to improve accuracy and risk/reward.

Download Now

Download the “Momentum.mq4” Metatrader 4 indicator

MT4 Indicator Characteristics

Currency pairs: Any

Platform: Metatrader 4

Type: chart pattern indicator

Customization options: Variable (Momentum Period) Colors, width & Style.

Time frames: 1-Minute, 5-Minutes, 15-Minutes, 30-Minutes, 1-Hour, 4-Hours, 1-Day, 1-Week, 1-Month

Type: Momentum