The Future Price Prediction indicator for MT4 is a buy/sell technical price oscillator that predicts future currency prices very well.

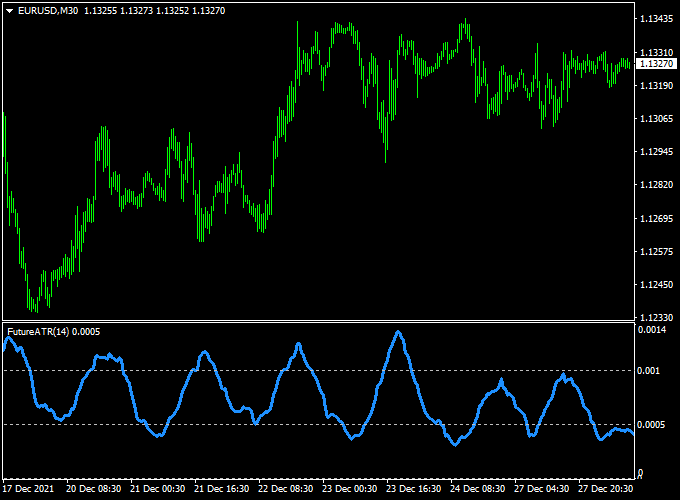

The indicator pops up a separate MT4 chart window as a blue colored signal line that oscillates above and below the 0.001 overbought and 0.0005 oversold threshold levels.

Buy & Sell Trade Example

- A buy signal occurs as soon as the blue signal line rises above the 0.001 threshold level.

- A sell signal occurs as soon as the blue signal line falls below the 0.0005 threshold level.

For scalping and day trading, the indicator tends to work best during the London and American trading sessions.

The Future Price Prediction indicator can be used for both trade entry and exit, or as an additional confirmation filter for other strategies and systems.

The indicator works equally well on all currency pairs (majors, minors, and exotics) and shows promising results when used correctly.

Free Download

Download the “Future Prediction.ex4” indicator for MT4

Indicator Chart (EUR/USD M30)

The example chart below displays the Future Prediction mt4 indicator in action on the trading chart.

Tips:

Feel free to use your own favorite trade entry, stop loss and take profit method to trade with the Future Prediction indicator.

As always, trade in agreement with the overall trend and practice on a demo account first until you fully understand this indicator.

Please note that even the best trading indicator cannot yield a 100% win rate over long periods.

Indicator Specifications & Inputs:

Trading Platform: Developed for Metatrader 4 (MT4)

Currency pairs: Works for any pair

Time frames: Works for any time frame

Trade Style: Works for scalping, day trading and swing trading

Input Parameters: Variable (inputs tab), color settings & style

Indicator type: Oscillator

Does the indicator repaint? No.

Future Price Prediction + 2 EMAs Colored Crossover MT4 Strategy

This MT4 strategy merges the Future Price Prediction Indicator with the 2 EMAs Colored Crossover System Indicator.

By combining predictive momentum from the first indicator with trend direction from the second, traders can identify higher-probability entries.

This strategy is suitable for 15-minute, 30-minute, and 1-hour charts and works well for both day traders and swing traders seeking clear signals.

The Future Price Prediction Indicator plots a blue line in a subchart.

A buy signal appears when the line crosses back above the 0.005 level, while a sell signal appears when the line crosses back below the 0.001 level.

The 2 EMAs Colored Crossover System Indicator confirms the trend.

Two green EMA lines indicate a bullish trend, while two red EMA lines show a bearish trend.

Using these indicators together allows traders to filter out false signals and trade with the prevailing market bias.

Buy Entry Rules

- Wait for the Future Price Prediction Indicator blue line to cross back above the 0.005 level in the subchart.

- Confirm that the 2 EMAs Colored Crossover System Indicator is showing two green EMA lines (bullish trend).

- Place a buy order on the next candle close after both conditions align.

- Set a stop loss just below the recent swing low or nearest support level.

- Take profit at the next resistance level or at least twice your risk.

Sell Entry Rules

- Wait for the Future Price Prediction Indicator blue line to cross back below the 0.001 level in the subchart.

- Confirm that the 2 EMAs Colored Crossover System Indicator is showing two red EMA lines (bearish trend).

- Place a sell order on the next candle close after both conditions align.

- Set a stop loss just above the recent swing high or nearest resistance level.

- Take profit at the next support level or at least twice your risk.

Advantages

- Combines predictive momentum with trend confirmation for stronger signals.

- Applicable to multiple timeframes and currency pairs.

- Flexible stop-loss and take-profit placement based on recent highs/lows.

Drawbacks

- False signals may appear in highly volatile or news-driven markets.

- Requires waiting for both conditions to align, which may limit the frequency of trades.

- Signals can lag slightly during swift price movements.

Case Study 1: AUD/USD 30-Minute Chart

On the AUD/USD 30-minute chart, the blue line of the Future Price Prediction Indicator crossed above 0.005.

The 2 EMAs Colored Crossover System showed two green EMA lines.

A buy trade was entered at 0.6470 with a stop loss at 0.6445.

The price rose steadily to 0.6530, capturing a 60-pip gain at the next resistance level.

This shows how combining predictive and trend-based signals can improve trade quality.

Case Study 2: USD/CHF 1-Hour Chart

On the USD/CHF 1-hour chart, the blue line of the Future Price Prediction Indicator crossed below 0.001.

The 2 EMAs Colored Crossover System displayed two red EMA lines.

A sell order was opened at 0.9005 with a stop loss at 0.9055.

The pair dropped to 0.8885 within several hours, resulting in a 120-pip profit near the next support zone.

This example demonstrates how the strategy can be effective in bearish trends as well.

Strategy Tips

- Test the strategy on a demo account to familiarize yourself with the signals.

- Use higher timeframes like H1 for stronger confirmation and fewer false moves.

- Combine this setup with support and resistance levels for more reliable targets.

- Avoid entering trades during major economic news releases to reduce whipsaw risks.

Download Now

Download the “Future Prediction.ex4” indicator for Metatrader 4